Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return or Claim for Refund 2022

Understanding Form 944 X Rev February

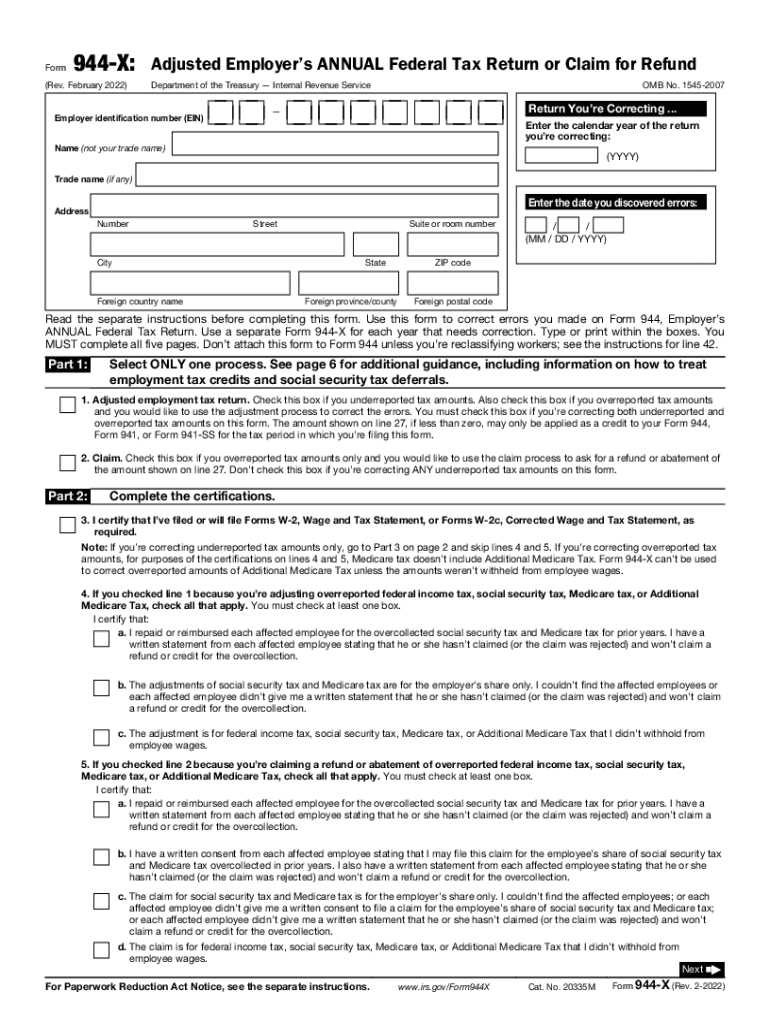

The Form 944 X Rev February is an adjusted employer's annual federal tax return or claim for refund. This form is specifically designed for employers who need to correct errors made on their original Form 944 submissions. It allows businesses to report adjustments to their tax liability and request refunds for overpayments. Understanding this form is crucial for maintaining compliance with IRS regulations and ensuring accurate tax reporting.

Steps to Complete Form 944 X Rev February

Completing the Form 944 X requires careful attention to detail. Here are the essential steps:

- Obtain the most recent version of the Form 944 X from the IRS website or through authorized channels.

- Review your original Form 944 to identify the specific errors that need correction.

- Fill out the Form 944 X, ensuring that all relevant sections are completed accurately.

- Provide a clear explanation of the adjustments being made in the designated section.

- Sign and date the form before submission.

Double-check all entries to avoid further errors, as accuracy is vital for compliance.

Legal Use of Form 944 X Rev February

The legal use of Form 944 X is governed by IRS regulations. Employers must use this form to correct any inaccuracies on their original Form 944 filings. Submitting this form ensures that the IRS has accurate information regarding an employer's tax obligations. It is essential for maintaining compliance and avoiding potential penalties associated with incorrect filings.

Filing Deadlines for Form 944 X Rev February

Filing deadlines for the Form 944 X are critical to ensure timely processing and compliance. Generally, the form must be filed within three years from the date the original Form 944 was filed or within two years from the date the tax was paid, whichever is later. Adhering to these deadlines helps avoid penalties and ensures that any adjustments are processed efficiently.

Form Submission Methods

Employers can submit the Form 944 X through various methods:

- Online: Utilize the IRS e-file system for electronic submission.

- Mail: Send the completed form to the appropriate IRS address listed in the form instructions.

- In-Person: Visit a local IRS office for assistance with form submission.

Choosing the right submission method can impact the processing time and ease of communication with the IRS.

Key Elements of Form 944 X Rev February

Understanding the key elements of Form 944 X is essential for accurate completion. Important sections include:

- Employer Identification Number (EIN): Required for identification purposes.

- Tax Year: Specify the tax year for which the adjustments are being made.

- Corrected Amounts: Clearly indicate the original amounts and the corrected figures.

- Reason for Adjustment: Provide a detailed explanation for the changes being reported.

Each of these elements plays a crucial role in ensuring the form is processed correctly by the IRS.

Quick guide on how to complete form 944 x rev february 2022 adjusted employers annual federal tax return or claim for refund

Effortlessly Prepare Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund on Any Device

Online document management has become increasingly favored by companies and individuals alike. It offers an exceptional eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly and without hassle. Manage Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

Easily Edit and Electronically Sign Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

- Obtain Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes necessitating the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 944 x rev february 2022 adjusted employers annual federal tax return or claim for refund

Create this form in 5 minutes!

How to create an eSignature for the form 944 x rev february 2022 adjusted employers annual federal tax return or claim for refund

The way to generate an e-signature for your PDF file online

The way to generate an e-signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

The best way to generate an e-signature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The best way to generate an e-signature for a PDF document on Android devices

People also ask

-

What is Form 944 and why is it important?

Form 944 is an annual tax return form used by small employers to report Federal Insurance Contributions Act (FICA) taxes. It's important because it simplifies tax reporting for businesses with a low payroll. By using Form 944, employers can align their filing schedules with their business needs while ensuring compliance with federal tax regulations.

-

How can airSlate SignNow assist with Form 944?

airSlate SignNow provides a seamless way to send and eSign Form 944, making the process efficient and paperless. With our platform, you can easily prepare, send for signatures, and store Form 944 securely. This enhances compliance and ensures that your staff can easily access their tax documents at any time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to various business needs, ensuring you can find a plan that suits your requirements for managing documents like Form 944. Options include monthly and annual subscriptions, with discounts for long-term commitments. This makes it a cost-effective solution for businesses of all sizes.

-

Does airSlate SignNow integrate with other software for Form 944 processing?

Yes, airSlate SignNow integrates with numerous platforms, including accounting and payroll software, to streamline the management of Form 944. By integrating with tools you already use, you can ensure that your tax filings are efficient and synchronized with your financial systems. This further simplifies the process of document management and increases productivity.

-

What are the benefits of using airSlate SignNow for Form 944?

Using airSlate SignNow for Form 944 offers numerous benefits, including enhanced security, increased speed of processing, and improved compliance. Our platform allows for real-time tracking of document status, ensuring that you stay informed about the signing process. Moreover, you can easily store your signed Form 944 securely within our system.

-

Is it easy to get started with airSlate SignNow for Form 944?

Getting started with airSlate SignNow for Form 944 is simple and user-friendly. Sign up for a free trial to explore our features and start sending your forms for eSignature right away. Our intuitive interface requires minimal training, allowing you to focus more on your business operations rather than document management.

-

How secure is airSlate SignNow when handling Form 944?

airSlate SignNow prioritizes security when it comes to handling Form 944 and other sensitive documents. Our platform employs industry-leading encryption and compliance features to ensure your data is protected. With our secure storage and audit trails, you can trust that your signed forms are safe and compliant with regulatory standards.

Get more for Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

Find out other Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors