Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version 2022

What is the Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version

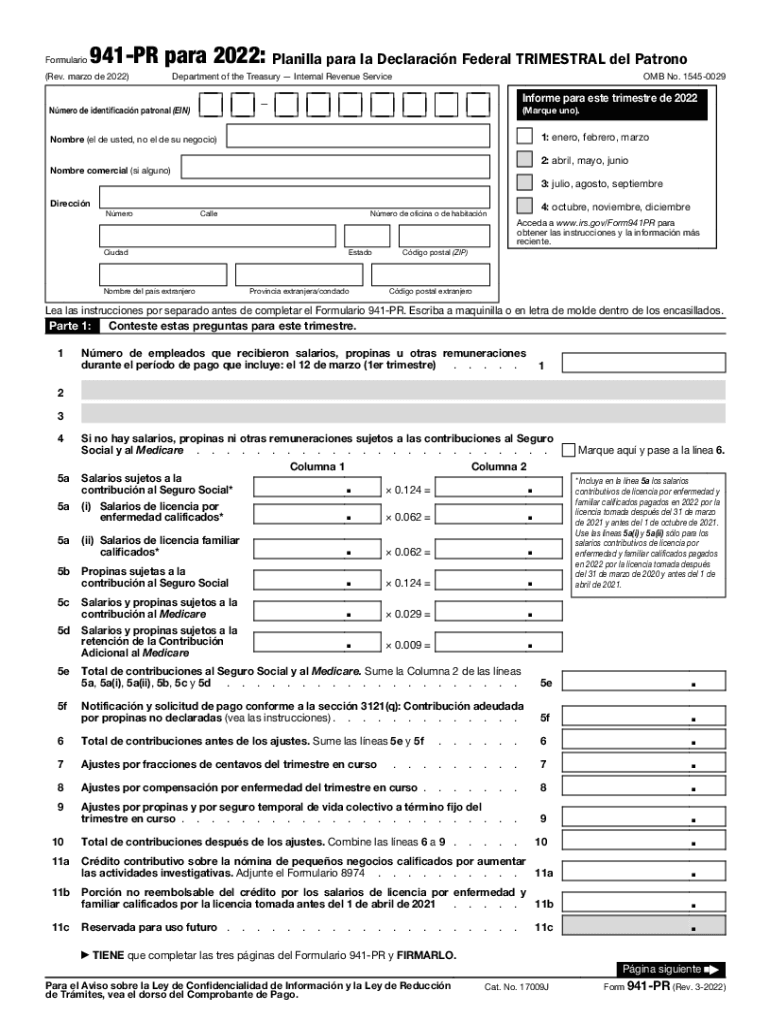

The Form 941 PR Rev March is a specialized version of the Employer's Quarterly Federal Tax Return designed specifically for employers operating in Puerto Rico. This form is essential for reporting income taxes withheld from employees, as well as the employer's share of Social Security and Medicare taxes. It is crucial for compliance with federal tax regulations and ensures that employers fulfill their tax obligations accurately. The form must be filed quarterly, reflecting the employer's payroll activities for the specified quarter.

How to use the Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version

Using the Form 941 PR involves several steps to ensure accurate reporting. First, employers must gather all relevant payroll information, including wages paid, taxes withheld, and any adjustments for prior quarters. Next, they will fill out the form with this data, ensuring that all entries are accurate and complete. Once completed, the form can be submitted electronically or via mail, depending on the employer's preference. It's important to retain a copy of the submitted form for record-keeping and future reference.

Steps to complete the Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version

Completing the Form 941 PR requires careful attention to detail. Here are the steps to follow:

- Gather all necessary payroll records for the quarter, including total wages, tips, and other compensation.

- Calculate the total taxes withheld from employees, including federal income tax and Social Security and Medicare taxes.

- Complete each section of the form, ensuring that all figures are accurate and reflect the payroll data.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the deadline, either electronically or by mail.

Legal use of the Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version

The legal use of the Form 941 PR is governed by federal tax laws, which require employers to report and remit payroll taxes accurately. Filing this form is not only a legal obligation but also a critical component of maintaining compliance with the Internal Revenue Service (IRS) regulations. Failure to file the form correctly or on time can result in penalties, interest, and potential legal repercussions for the employer.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Form 941 PR. The form is due on the last day of the month following the end of each quarter. For example, the deadlines for the 2020 tax year are as follows:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

It is essential for employers to mark these dates on their calendars to avoid late filing penalties.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form 941 PR can lead to significant penalties. The IRS imposes fines for late submissions, which can accumulate quickly. Additionally, inaccuracies in the reported information may result in further penalties and interest charges. Employers are encouraged to ensure that their filings are accurate and timely to avoid these financial repercussions.

Quick guide on how to complete form 941 pr rev march 2022 employers quarterly federal tax return puerto rican version

Complete Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the required form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version on any device with the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to modify and eSign Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version with ease

- Find Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version and click Get Form to begin.

- Utilize the tools provided to finish your document.

- Emphasize important sections of the documents or blackout sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 pr rev march 2022 employers quarterly federal tax return puerto rican version

Create this form in 5 minutes!

How to create an eSignature for the form 941 pr rev march 2022 employers quarterly federal tax return puerto rican version

The way to generate an e-signature for a PDF document in the online mode

The way to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The best way to generate an e-signature from your mobile device

The way to create an e-signature for a PDF document on iOS devices

The best way to generate an e-signature for a PDF file on Android devices

People also ask

-

What is a formulario 941?

The formulario 941 is a quarterly tax form used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Using airSlate SignNow, businesses can easily complete and submit their formulario 941 electronically, ensuring compliance and accuracy with minimal effort.

-

How can airSlate SignNow help with formulario 941 compliance?

airSlate SignNow streamlines the process of preparing and signing your formulario 941 by providing intuitive tools for document editing and electronic signatures. This not only saves time but also minimizes the risk of errors, ensuring that your quarterly tax filings are compliant with IRS regulations.

-

What are the pricing options for using airSlate SignNow for formulario 941 preparation?

airSlate SignNow offers flexible pricing plans to cater to businesses of all sizes. With cost-effective tiers, users can access features specifically designed for efficient formulario 941 preparation and e-signing, making it affordable for everyone from freelancers to larger organizations.

-

Can I integrate airSlate SignNow with other accounting software for formulario 941?

Yes, airSlate SignNow supports integration with various accounting software solutions. This allows for seamless data transfer when preparing your formulario 941, ensuring that all necessary financial information is accurately reflected without manual entry.

-

What are the key features of airSlate SignNow for handling the formulario 941?

Key features of airSlate SignNow include customizable templates, secure electronic signatures, and real-time document tracking. These tools make the process of managing your formulario 941 not only efficient but also secure, providing peace of mind for businesses handling sensitive tax information.

-

Is airSlate SignNow suitable for businesses of all sizes when filing formulario 941?

Absolutely! airSlate SignNow is designed to support businesses of all sizes, whether you're a sole proprietor or a large enterprise. Its user-friendly interface and scalable solutions make it a perfect fit for efficiently managing formulario 941 filings for any organization.

-

How can I ensure my formulario 941 documents are secure with airSlate SignNow?

airSlate SignNow prioritizes document security with advanced encryption and secure cloud storage. This ensures that your formulario 941 and other sensitive documents are protected from unauthorized access while still being easily accessible for authorized users.

Get more for Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version

Find out other Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document