IRS 13844 Fill Out Tax Template OnlineUS 2022

What is the IRS Form 13844?

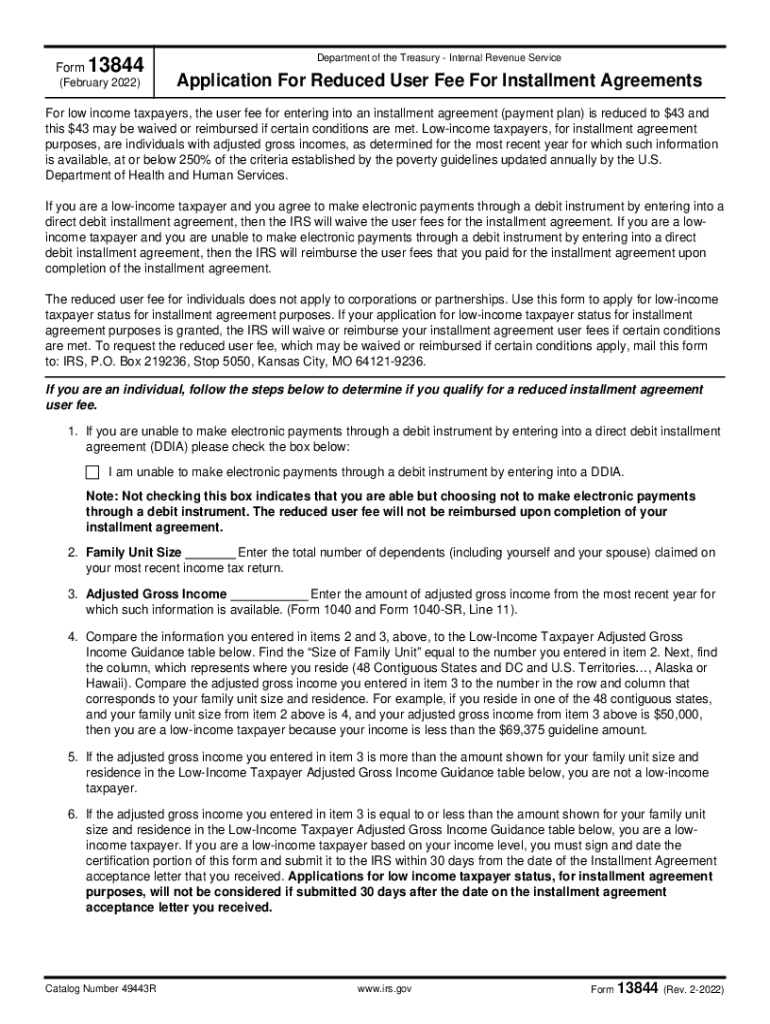

The IRS Form 13844 is an application used by taxpayers to request a reduced user fee for installment agreements. This form is particularly relevant for individuals who are unable to pay their tax liabilities in full and seek to establish a payment plan with the IRS. By completing this form, taxpayers can potentially lower the fees associated with setting up an installment agreement, making it easier to manage their tax obligations.

Key Elements of the IRS Form 13844

Understanding the key elements of the IRS Form 13844 is essential for successful completion. The form typically requires the following information:

- Personal Information: Taxpayer’s name, address, and Social Security number.

- Tax Information: Details regarding the tax year(s) for which the installment agreement is being requested.

- Financial Information: Information about income, expenses, and assets to demonstrate the need for a reduced fee.

- Signature: The taxpayer must sign and date the form to validate the application.

Steps to Complete the IRS Form 13844

Completing the IRS Form 13844 involves several straightforward steps:

- Gather Required Information: Collect all necessary personal and financial information before starting the form.

- Fill Out the Form: Carefully complete each section of the form, ensuring accuracy and completeness.

- Review Your Application: Double-check all entries for errors or omissions.

- Submit the Form: Send the completed form to the appropriate IRS address as indicated in the instructions.

Legal Use of the IRS Form 13844

The IRS Form 13844 is legally binding when properly filled out and submitted. It is essential to comply with all IRS regulations regarding the form to ensure that the request for a reduced user fee is valid. The form must be signed by the taxpayer, and any false information can lead to penalties or denial of the request.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial when submitting the IRS Form 13844. Generally, the form should be submitted as soon as the taxpayer determines the need for an installment agreement. Timely submission can help avoid additional penalties and interest on outstanding tax liabilities. It is advisable to check the IRS website for any specific deadlines related to the current tax year.

Eligibility Criteria

To qualify for a reduced user fee using the IRS Form 13844, taxpayers must meet certain eligibility criteria. These may include:

- Having a balance due that qualifies for an installment agreement.

- Demonstrating financial hardship through the information provided on the form.

- Filing all required tax returns before applying for the reduced fee.

Quick guide on how to complete irs 13844 2020 2022 fill out tax template onlineus

Effortlessly Prepare IRS 13844 Fill Out Tax Template OnlineUS on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers a superb eco-conscious alternative to traditional printed and signed papers, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage IRS 13844 Fill Out Tax Template OnlineUS on any device using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to alter and eSign IRS 13844 Fill Out Tax Template OnlineUS with ease

- Locate IRS 13844 Fill Out Tax Template OnlineUS and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to share your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your digital management needs in just a few clicks from any device you prefer. Modify and eSign IRS 13844 Fill Out Tax Template OnlineUS while ensuring seamless communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 13844 2020 2022 fill out tax template onlineus

Create this form in 5 minutes!

How to create an eSignature for the irs 13844 2020 2022 fill out tax template onlineus

The way to generate an e-signature for your PDF in the online mode

The way to generate an e-signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an e-signature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The best way to generate an e-signature for a PDF document on Android OS

People also ask

-

What is form 13844?

Form 13844 is an official document used for various administrative purposes, including tax-related filings. It is essential for ensuring compliance in specific scenarios and can be easily completed and submitted using the airSlate SignNow platform.

-

How can airSlate SignNow help me with form 13844?

airSlate SignNow provides a user-friendly platform that enables you to complete, sign, and securely send form 13844. With its intuitive interface, you can streamline your process, minimize errors, and ensure that your documentation is handled efficiently.

-

Is there a cost to use airSlate SignNow for form 13844?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Each plan includes features that can facilitate the completion and management of form 13844, ensuring that you receive great value for your investment.

-

What features does airSlate SignNow offer for form 13844?

airSlate SignNow includes features like electronic signatures, document templates, and secure cloud storage, all of which are beneficial for managing form 13844. These tools help streamline the signing process and ensure documents are stored safely.

-

Can I integrate airSlate SignNow with other applications for form 13844?

Yes, airSlate SignNow offers integrations with numerous applications, allowing you to seamlessly manage form 13844 alongside other tools. This integration capability enhances productivity and ensures that you can keep all your documents organized.

-

What are the benefits of using airSlate SignNow for form 13844?

Using airSlate SignNow for form 13844 helps reduce processing time and eliminate paperwork hassles. With its electronic signature feature, you can quickly get approvals and send forms without the delays associated with traditional methods.

-

Is airSlate SignNow secure for handling form 13844?

Absolutely, airSlate SignNow employs robust security measures to protect your data. When managing sensitive documents like form 13844, encryption and secure access ensure that your information remains confidential and safe.

Get more for IRS 13844 Fill Out Tax Template OnlineUS

Find out other IRS 13844 Fill Out Tax Template OnlineUS

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy