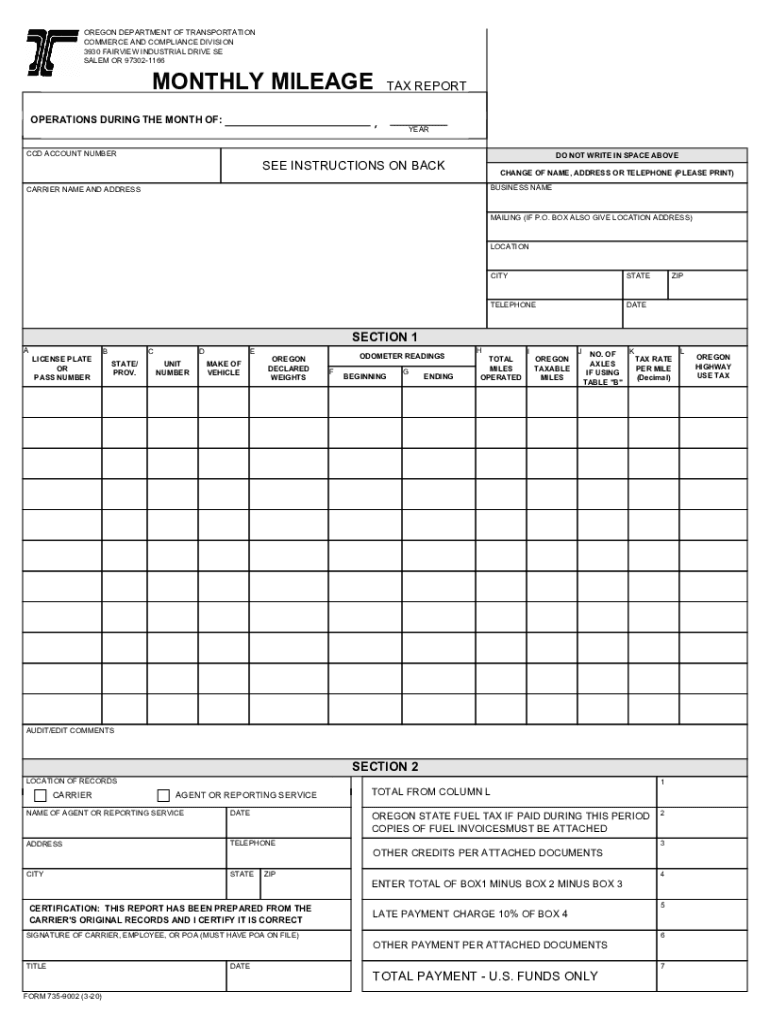

MONTHLY MILEAGE TAX REPORT Oregon Gov Form

What is the monthly mileage tax report in Oregon?

The monthly mileage tax report in Oregon is a form used by businesses and individuals to report the miles driven for business purposes. This report is essential for calculating the appropriate tax obligations related to vehicle usage. It is particularly relevant for those who operate vehicles for commercial purposes, ensuring compliance with state regulations. The report typically includes details such as the total miles driven, the purpose of the trips, and any applicable deductions.

Steps to complete the monthly mileage tax report in Oregon

Completing the monthly mileage tax report involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including odometer readings and trip logs. Next, accurately record the total miles driven for business purposes during the reporting period. Be sure to differentiate between personal and business miles. After filling in the required information, review the form for any errors before submission. Finally, submit the report through the designated method, whether online or via mail.

Legal use of the monthly mileage tax report in Oregon

The monthly mileage tax report serves a legal purpose in documenting vehicle usage for tax calculations. For the report to be considered valid, it must be completed accurately and submitted within the required deadlines. Compliance with state laws regarding mileage reporting is crucial, as inaccuracies can lead to penalties. The report is also important for maintaining transparency with tax authorities, ensuring that all business-related vehicle expenses are accounted for correctly.

State-specific rules for the monthly mileage tax report in Oregon

Oregon has specific rules governing the completion and submission of the monthly mileage tax report. These rules may include guidelines on what constitutes business mileage, how to document trips, and the frequency of reporting. It is essential for taxpayers to familiarize themselves with these regulations to avoid non-compliance. Additionally, the state may have specific requirements for record-keeping, such as maintaining detailed logs of trips and expenses related to vehicle use.

Form submission methods for the monthly mileage tax report in Oregon

The monthly mileage tax report can be submitted through various methods, providing flexibility for users. Common submission methods include online filing through the Oregon Department of Transportation website, mailing a paper form, or submitting it in person at designated offices. Each method has its own set of guidelines and deadlines, so it is important to choose the one that best suits your needs while ensuring timely submission.

Examples of using the monthly mileage tax report in Oregon

There are various scenarios in which the monthly mileage tax report is utilized. For instance, a self-employed individual may use the report to track business-related travel expenses for tax deductions. Similarly, companies with a fleet of vehicles need to report mileage to calculate fuel taxes accurately. Each example highlights the importance of maintaining accurate records and adhering to reporting requirements to ensure compliance and maximize potential deductions.

Quick guide on how to complete monthly mileage tax report oregongov

Complete MONTHLY MILEAGE TAX REPORT Oregon gov effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage MONTHLY MILEAGE TAX REPORT Oregon gov on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven operation today.

How to alter and eSign MONTHLY MILEAGE TAX REPORT Oregon gov without any hassle

- Obtain MONTHLY MILEAGE TAX REPORT Oregon gov and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Craft your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign MONTHLY MILEAGE TAX REPORT Oregon gov and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Oregon monthly mileage printable and how can it benefit my business?

An Oregon monthly mileage printable is a convenient tool that allows businesses to track their mileage accurately for expense reporting and tax purposes. By using this printable, businesses can streamline their mileage tracking process, ensuring compliance and maximizing potential deductions. This feature is particularly beneficial for small businesses and freelancers who need to report travel expenses.

-

How do I access the Oregon monthly mileage printable in airSlate SignNow?

You can easily access the Oregon monthly mileage printable within the airSlate SignNow platform. Simply navigate to the form templates section and select the mileage tracker. This printable can be customized as per your business needs, ensuring you capture all necessary data for accurate mileage recording.

-

Is there a cost associated with using the Oregon monthly mileage printable?

The Oregon monthly mileage printable is included in the airSlate SignNow subscription plans, making it a cost-effective solution for businesses. Depending on your chosen plan, you can enjoy unlimited access to the printable along with other document management features. Check our pricing page for more information on subscription options.

-

Can I integrate the Oregon monthly mileage printable with other tools I use?

Yes, airSlate SignNow allows integration with various tools such as Google Drive, Dropbox, and CRM systems. This means you can seamlessly incorporate the Oregon monthly mileage printable into your existing workflow, enhancing productivity and organization. Integration helps in keeping all your documents and data synchronized across platforms.

-

What features does the Oregon monthly mileage printable offer?

The Oregon monthly mileage printable includes fields for start and end odometer readings, purpose of travel, date of travel, and total miles driven. It provides a clear and concise way to document your travels for business purposes. This feature helps in ensuring all necessary details are captured accurately to support expense claims.

-

How does the Oregon monthly mileage printable improve accuracy in mileage reporting?

Using the Oregon monthly mileage printable ensures that all mileage details are documented in a structured format, reducing the chances of errors. By regularly updating and maintaining this printable, businesses can achieve higher accuracy in their mileage reporting. This improved accuracy can signNowly benefit tax deductions and expense approvals.

-

What are the benefits of using airSlate SignNow for my mileage tracking needs?

AirSlate SignNow offers a user-friendly interface that simplifies document management, including mileage tracking. The ability to easily generate and manage the Oregon monthly mileage printable means reduced time spent on administrative tasks. Additionally, you benefit from eSigning capabilities, making it quick to finalize and submit your mileage reports.

Get more for MONTHLY MILEAGE TAX REPORT Oregon gov

Find out other MONTHLY MILEAGE TAX REPORT Oregon gov

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document