Publications and Forms Missouri Department of Labor MO 2019-2026

Understanding the Missouri Quarterly Contribution and Wage Report

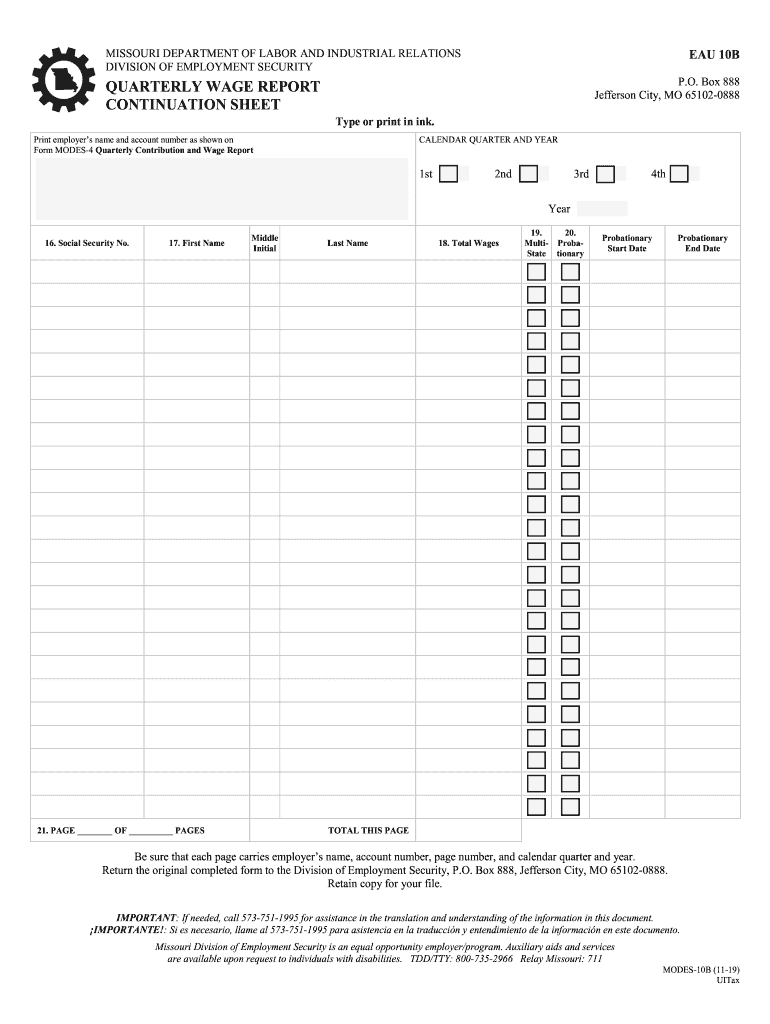

The Missouri quarterly contribution and wage report, often referred to as the modes 10b form, is a critical document for employers in the state. This report is used to report wages paid to employees and contributions owed to the Missouri Division of Employment Security. It ensures compliance with state unemployment insurance laws and helps maintain accurate records for both employers and employees.

Steps to Complete the Missouri Quarterly Contribution and Wage Report

Completing the modes 10b form involves several key steps:

- Gather Required Information: Collect employee wage data, including names, Social Security numbers, and total wages for the quarter.

- Calculate Contributions: Determine the unemployment insurance contributions based on the total wages reported.

- Fill Out the Form: Accurately enter all required information into the modes 10b form, ensuring all data is correct.

- Review for Accuracy: Double-check all entries to avoid errors that could lead to penalties.

- Submit the Form: File the completed report electronically or by mail, adhering to submission deadlines.

Filing Deadlines for the Quarterly Wage Report

It is essential to be aware of filing deadlines to avoid penalties. The Missouri quarterly contribution and wage report must be submitted by the last day of the month following the end of each quarter. For example:

- For the first quarter (January to March), the deadline is April 30.

- For the second quarter (April to June), the deadline is July 31.

- For the third quarter (July to September), the deadline is October 31.

- For the fourth quarter (October to December), the deadline is January 31 of the following year.

Legal Use of the Missouri Quarterly Contribution and Wage Report

The modes 10b form is legally binding and must be filled out accurately to comply with state laws. Employers are required to report wages and contributions to ensure employees receive proper unemployment benefits. Failing to submit this report or submitting inaccurate information can result in penalties, including fines and increased contribution rates.

Form Submission Methods

Employers can submit the Missouri quarterly contribution and wage report through various methods:

- Online Submission: Utilizing the Missouri Department of Labor’s online portal for electronic filing.

- Mail: Sending a physical copy of the completed report to the appropriate department.

- In-Person: Delivering the report directly to a local office of the Missouri Division of Employment Security.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the quarterly contribution and wage report can lead to significant penalties. These may include:

- Fines for late submissions.

- Increased unemployment insurance contribution rates.

- Legal action for continued non-compliance.

Quick guide on how to complete publications and forms missouri department of labor mo

Complete Publications And Forms Missouri Department Of Labor MO effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Handle Publications And Forms Missouri Department Of Labor MO on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The optimal method to edit and eSign Publications And Forms Missouri Department Of Labor MO without stress

- Find Publications And Forms Missouri Department Of Labor MO and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information carefully and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Publications And Forms Missouri Department Of Labor MO and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publications and forms missouri department of labor mo

Create this form in 5 minutes!

How to create an eSignature for the publications and forms missouri department of labor mo

The best way to make an eSignature for a PDF in the online mode

The best way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What are the mo quarterly contribution and wage report instructions?

The mo quarterly contribution and wage report instructions provide detailed guidance on how to complete and submit your wage reports and contributions for employees in Missouri. These instructions cover essential aspects such as reporting deadlines, required information, and submission methods to ensure compliance with state regulations.

-

How can airSlate SignNow help with mo quarterly contribution and wage report instructions?

airSlate SignNow simplifies the process of obtaining and managing mo quarterly contribution and wage report instructions. With our easy-to-use eSignature capabilities, you can securely sign and send necessary documents, making the reporting process faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for mo quarterly contribution and wage report instructions?

airSlate SignNow offers a cost-effective solution for businesses needing assistance with mo quarterly contribution and wage report instructions. Our pricing plans are designed to accommodate various business sizes and needs, ensuring you only pay for the features that benefit you.

-

What features does airSlate SignNow offer to support my compliance with mo quarterly contribution and wage report instructions?

airSlate SignNow provides robust features such as document templates, secure eSignature capabilities, and tracking options to support your compliance efforts with mo quarterly contribution and wage report instructions. These tools ensure that your reports are completed accurately and submitted on time.

-

Can I integrate airSlate SignNow with other software for mo quarterly contribution and wage report instructions?

Yes, airSlate SignNow offers integrations with various software applications that enhance your workflow while managing mo quarterly contribution and wage report instructions. This capability allows you to connect with payroll systems, accounting software, and more for streamlined reporting.

-

How does airSlate SignNow ensure the security of my documents related to mo quarterly contribution and wage report instructions?

airSlate SignNow prioritizes the security of your documents by implementing industry-standard encryption and secure storage solutions. When managing mo quarterly contribution and wage report instructions, you can trust that your sensitive information is protected against unauthorized access.

-

What benefits will my business gain by using airSlate SignNow for mo quarterly contribution and wage report instructions?

By using airSlate SignNow for your mo quarterly contribution and wage report instructions, your business can enjoy improved efficiency, reduced administrative burden, and faster document processing. This allows you to focus on core business activities while staying compliant with Missouri regulations.

Get more for Publications And Forms Missouri Department Of Labor MO

- Ju athlete info foothills physical therapy center form

- Work history form

- Employment application tease salon teasesalon form

- Alarm registration form danbury connecticut

- Official form 106sum

- Maecd 2651f donn es lappui de la demande de paiement pour travaux achev s form

- Cosigner agreement dated addendum to rental agreement form

- Randall gear property management form

Find out other Publications And Forms Missouri Department Of Labor MO

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement