Annual Ohio Wine Tax Return for B2a Andor S Permit Holders Tax Ohio 2009

What is the Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio

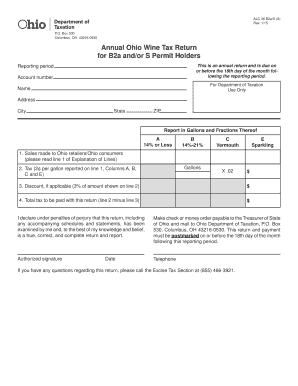

The Annual Ohio Wine Tax Return for B2A and/or S permit holders is a specific tax document required by the Ohio Department of Taxation. This form is essential for businesses engaged in the production and sale of wine within the state. It allows permit holders to report their wine production, sales, and any applicable taxes owed. Understanding this form is crucial for compliance with state tax regulations and ensuring that all financial obligations are met accurately.

Steps to Complete the Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio

Filling out the Annual Ohio Wine Tax Return involves several key steps:

- Gather necessary documentation, including sales records, production data, and previous tax returns.

- Complete the form by accurately entering all required information, such as the total gallons of wine produced and sold.

- Calculate the total tax owed based on the applicable rates for your specific wine type.

- Review the completed form for accuracy and ensure all sections are filled out correctly.

- Submit the form by the designated deadline, either electronically or via mail, as per state guidelines.

Legal Use of the Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio

The legal use of the Annual Ohio Wine Tax Return is governed by state tax laws. This form must be completed accurately to ensure compliance with Ohio's tax regulations. Failure to submit the form or providing incorrect information can lead to penalties, including fines or audits. It is essential for permit holders to understand their legal responsibilities and maintain accurate records to support their tax filings.

Filing Deadlines / Important Dates

It is important for B2A and/or S permit holders to be aware of the filing deadlines for the Annual Ohio Wine Tax Return. Typically, the return is due on the last day of the month following the end of the tax year. For example, if your tax year ends on December thirty-first, the return would be due by January thirty-first of the following year. Keeping track of these dates helps ensure timely compliance and avoids potential penalties.

Required Documents

To complete the Annual Ohio Wine Tax Return, several documents are required:

- Sales records detailing all wine sales throughout the year.

- Production records indicating the total gallons of wine produced.

- Previous tax returns for reference and consistency.

- Any additional documentation that supports the figures reported on the return.

Form Submission Methods (Online / Mail / In-Person)

The Annual Ohio Wine Tax Return can be submitted through various methods. Permit holders may choose to file online through the Ohio Department of Taxation's website, which often provides a more streamlined process. Alternatively, the form can be mailed directly to the appropriate tax office. In-person submissions may also be possible at designated tax offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete annual ohio wine tax return for b2a andor s permit holders tax ohio

Prepare Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Manage Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio with ease

- Obtain Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive data using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Decide how you wish to send your form—via email, text message (SMS), or shareable link, or download it to your computer.

Eliminate concerns of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your preference. Edit and eSign Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct annual ohio wine tax return for b2a andor s permit holders tax ohio

Create this form in 5 minutes!

How to create an eSignature for the annual ohio wine tax return for b2a andor s permit holders tax ohio

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is the Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio?

The Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio is a required filing for businesses holding these specific permits. It ensures compliance with state regulations regarding the taxation of wine sales and production. Proper submission is essential to avoid penalties and maintain good standing with the Ohio Department of Taxation.

-

How does airSlate SignNow assist with the Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio?

airSlate SignNow offers a streamlined process to help B2a And S permit holders eSign and send their Annual Ohio Wine Tax Return. Our platform ensures that all documents are securely signed and can be easily stored for future reference. Using our solution can simplify the complexities of compliance and tax preparation.

-

What are the costs associated with filing the Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio using airSlate SignNow?

The costs of using airSlate SignNow for your Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio are efficient and competitive. Pricing packages vary based on features and usage needs, but our affordable plans are designed to be cost-effective for businesses. You can choose a plan that fits your specific requirements, ensuring value for your investment.

-

What features does airSlate SignNow provide for managing tax returns?

airSlate SignNow offers features such as document templates, real-time collaboration, and secure eSigning tailored for filing the Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio. These tools enhance efficiency and compliance, allowing users to prepare and submit their forms accurately. The platform also integrates with existing systems for seamless functionality.

-

Can I integrate airSlate SignNow with my accounting software for the Annual Ohio Wine Tax Return?

Yes, airSlate SignNow can integrate with various accounting software, making it easier to manage your finances alongside filing the Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio. This integration ensures that all financial data is accurately reflected in your tax filings. By connecting your accounts, you can save time and minimize errors.

-

What are the benefits of using airSlate SignNow for the Annual Ohio Wine Tax Return?

Using airSlate SignNow for the Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio offers numerous benefits, including time savings and enhanced accuracy. Our platform simplifies the eSigning process, ensuring that all documents are handled electronically, which speeds up filing. Additionally, our secure system protects sensitive information, promoting peace of mind for businesses.

-

Is airSlate SignNow user-friendly for filing the Annual Ohio Wine Tax Return?

Absolutely! airSlate SignNow is designed to be user-friendly, allowing users to easily navigate through the filing process for the Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio. With intuitive features and accessible support, anyone can efficiently complete their tax documentation without prior technical expertise.

Get more for Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio

- Sapd property room form

- Hitech customs declaration formpdf hitech courier

- Centurylink com returnmodem form

- Harris county department of education records management form

- Print form save form clear all fields

- Navmed 671028 naval forms online

- Au human services centrelink online form

- Consent to disclose medical information tigrinya australian

Find out other Annual Ohio Wine Tax Return For B2a Andor S Permit Holders Tax Ohio

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement