Form 11 C Rev December IRS Gov 2017-2026

What is the Form 11 C Rev December IRS gov

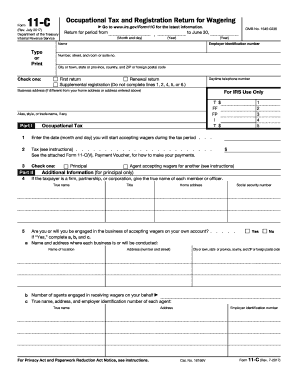

The Form 11 C, officially known as the Occupational Tax and Registration Return, is a document required by the Internal Revenue Service (IRS) for individuals and businesses engaged in certain occupations. This form is primarily used to report and pay occupational taxes, which are levied on specific professions, such as wagering businesses and other regulated activities. The form must be completed accurately to ensure compliance with federal tax regulations.

Steps to complete the Form 11 C Rev December IRS gov

Completing the Form 11 C involves several key steps to ensure that all necessary information is accurately reported. Begin by gathering relevant information about your business or occupation, including your legal name, address, and Employer Identification Number (EIN). Next, fill out the sections that detail your specific occupation and the applicable tax rates. Ensure that you calculate the total tax due correctly. Once completed, review the form for accuracy before submission.

How to obtain the Form 11 C Rev December IRS gov

The Form 11 C can be obtained directly from the IRS website. It is available as a downloadable PDF, which can be printed and filled out by hand or completed digitally. Additionally, you may request a copy through your local IRS office or by contacting the IRS directly for assistance. Ensure you have the most recent version of the form to comply with current tax regulations.

Legal use of the Form 11 C Rev December IRS gov

The legal use of the Form 11 C is essential for compliance with U.S. tax laws. This form must be filed by individuals and businesses that fall under the specific occupational tax requirements set forth by the IRS. Failing to file this form or providing inaccurate information can lead to penalties and interest on unpaid taxes. It is crucial to understand the legal implications of the information provided on this form to avoid any potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 11 C are typically aligned with the tax year, and it is important to submit the form by the due date to avoid penalties. Generally, the form must be filed annually, and the deadline is usually set for April 15 of the following year. However, if that date falls on a weekend or holiday, the deadline may be extended. Keeping track of these important dates is essential for maintaining compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file the Form 11 C or submitting it late can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the duration of the delay. Additionally, interest may accrue on unpaid taxes, further increasing the total amount due. It is crucial to adhere to filing requirements to avoid these financial repercussions.

Quick guide on how to complete form 11 c rev december 2017 irsgov

Manage Form 11 C Rev December IRS gov effortlessly on any device

Digital document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Form 11 C Rev December IRS gov on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 11 C Rev December IRS gov easily

- Find Form 11 C Rev December IRS gov and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Form 11 C Rev December IRS gov to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 11 c rev december 2017 irsgov

Create this form in 5 minutes!

How to create an eSignature for the form 11 c rev december 2017 irsgov

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the pricing structure for the airSlate SignNow 11 c.?

The airSlate SignNow 11 c. offers flexible pricing plans to accommodate businesses of all sizes. You can choose from monthly or annual subscriptions, with options that provide additional features for enterprises. Each plan is designed to be cost-effective, ensuring you get the best value for your investment.

-

What features does the airSlate SignNow 11 c. include?

The airSlate SignNow 11 c. includes a variety of features such as document templates, team collaboration, and secure e-signatures. It also offers customizable workflows which streamline document management processes. These features make it easy for businesses to enhance productivity while ensuring compliance.

-

How can the airSlate SignNow 11 c. benefit my business?

The airSlate SignNow 11 c. empowers your business by simplifying the signing process. With its user-friendly interface, you can quickly send and eSign documents, which speeds up transactions. This efficiency leads to improved customer satisfaction and can help close deals faster.

-

Is airSlate SignNow 11 c. secure for sensitive documents?

Absolutely, the airSlate SignNow 11 c. prioritizes security with top-notch encryption and authentication features. This ensures that all your sensitive documents are protected throughout the signing process. You can also track the status of documents for added peace of mind.

-

Can I integrate airSlate SignNow 11 c. with other software?

Yes, the airSlate SignNow 11 c. seamlessly integrates with various applications such as CRM, ERP, and cloud storage solutions. This integration allows you to enhance your existing workflows without disruption. By connecting your software tools, you streamline the document management process even further.

-

What support options are available for airSlate SignNow 11 c. users?

Users of the airSlate SignNow 11 c. can access multiple support options, including 24/7 customer service and a comprehensive knowledge base. Our dedicated support team is always ready to assist you with any inquiries. Additionally, the knowledge base provides helpful tutorials and tips to maximize your experience.

-

Is there a mobile app for airSlate SignNow 11 c.?

Yes, airSlate SignNow 11 c. offers a mobile app that allows users to send and eSign documents from anywhere. This mobile access ensures you can manage your documents on the go, making it perfect for busy professionals. With the app, you can easily stay connected and streamline your workflow.

Get more for Form 11 C Rev December IRS gov

- Observation application form

- Application deadline is april 12 2019 or until all openings are filled form

- Guide to application georgetown university school of form

- Marksman security application form

- Employment application indiana university bloomington form

- Transient student form

- 2020 21 schol app pg 1 for 1st yr students working form

- Bac competition form

Find out other Form 11 C Rev December IRS gov

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile