I Believe that I Am Entitled to Exemption from 2019-2026

Understanding the Tax Exempt Status

The tax exempt status refers to the ability of certain organizations or individuals to be exempt from paying federal income tax. This status is often granted to non-profit organizations, religious institutions, and educational entities. To qualify, applicants must demonstrate that their activities align with the criteria set by the Internal Revenue Service (IRS). Understanding the specific requirements for tax exemption is crucial for ensuring compliance and maintaining this status.

Eligibility Criteria for Tax Exemption

To be eligible for tax exempt status, an organization must meet specific criteria outlined by the IRS. Generally, this includes:

- Being organized and operated exclusively for charitable, educational, religious, or scientific purposes.

- Not engaging in substantial activities that benefit private interests.

- Not participating in political campaigns or substantial lobbying activities.

Organizations seeking tax exemption must provide detailed information about their structure, governance, and activities to demonstrate compliance with these criteria.

Steps to Apply for Tax Exempt Status

The application process for tax exemption involves several key steps:

- Determine the appropriate IRS form to file, typically Form 1023 for 501(c)(3) organizations.

- Gather necessary documentation, including financial statements, bylaws, and a detailed description of activities.

- Complete the application form accurately, ensuring all required information is included.

- Submit the application along with the required fee to the IRS.

After submission, the IRS will review the application, which may take several months. Organizations may be contacted for additional information during this process.

Required Documents for Tax Exemption Application

When applying for tax exempt status, organizations must prepare and submit several important documents, including:

- Articles of Incorporation or Organization.

- Bylaws that govern the organization.

- A detailed description of the organization’s activities and programs.

- Financial statements for the past three years, if applicable.

These documents help the IRS assess whether the organization meets the criteria for tax exemption.

Filing Deadlines for Tax Exemption Applications

Organizations should be aware of important filing deadlines when applying for tax exempt status. Generally, applications should be submitted within 27 months of the organization’s formation to ensure retroactive tax exempt status from the date of incorporation. Missing this deadline may result in the loss of potential tax benefits.

IRS Guidelines for Maintaining Tax Exempt Status

After obtaining tax exempt status, organizations must adhere to IRS guidelines to maintain their exemption. This includes:

- Filing annual information returns, such as Form 990, to report financial activities.

- Ensuring that activities remain in compliance with the exempt purposes outlined in the application.

- Maintaining proper records and documentation to support ongoing eligibility.

Failure to comply with these guidelines can result in the revocation of tax exempt status.

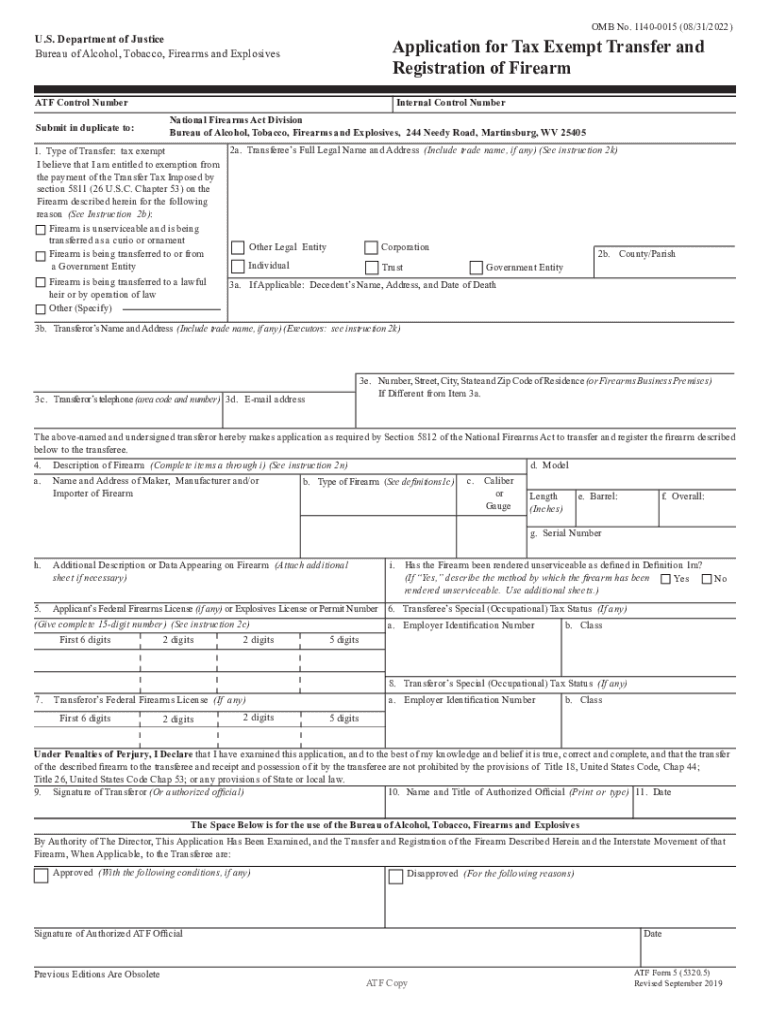

Quick guide on how to complete i believe that i am entitled to exemption from

Effortlessly Prepare I Believe That I Am Entitled To Exemption From on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to swiftly create, modify, and eSign your documents without any delays. Manage I Believe That I Am Entitled To Exemption From on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related activity today.

How to Modify and eSign I Believe That I Am Entitled To Exemption From Seamlessly

- Find I Believe That I Am Entitled To Exemption From and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting searches for forms, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Adjust and eSign I Believe That I Am Entitled To Exemption From to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct i believe that i am entitled to exemption from

Create this form in 5 minutes!

How to create an eSignature for the i believe that i am entitled to exemption from

How to make an eSignature for your PDF file online

How to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What does tax exempt mean in the context of airSlate SignNow?

In the context of airSlate SignNow, 'tax exempt' refers to the ability of certain organizations, such as nonprofits and government entities, to avoid paying sales tax on electronic signatures and document management services. Our platform offers options tailored for tax-exempt entities, ensuring compliance and ease of use.

-

How does airSlate SignNow support tax-exempt organizations?

airSlate SignNow provides specialized features to support tax-exempt organizations by simplifying document processes and ensuring that all your transactions align with tax exemption rules. This minimizes the risk of tax-related issues while enhancing your operational efficiency.

-

Are there any special pricing packages for tax-exempt entities?

Yes, airSlate SignNow offers competitive pricing packages for tax-exempt organizations, allowing them to leverage our powerful document signing and management tools at a reduced cost. We aim to make it financially viable for nonprofits and government organizations to adopt our solutions.

-

Can I integrate airSlate SignNow with other tools for tax-exempt documentation?

Absolutely! airSlate SignNow offers seamless integrations with a variety of tools that are essential for managing tax-exempt documentation. This includes popular accounting, CRM, and document management systems, ensuring you can streamline all processes.

-

What benefits does airSlate SignNow provide for managing tax-exempt documents?

With airSlate SignNow, managing tax-exempt documents becomes simpler and more efficient. You’ll benefit from quicker turnaround times, enhanced security, and a user-friendly interface designed to ease the complexities often involved in tax-exempt paperwork.

-

Is there customer support available for tax-exempt organizations using airSlate SignNow?

Yes, airSlate SignNow offers dedicated customer support for tax-exempt organizations. Whether you require assistance with account setup or navigating the specific features that cater to your needs, our expert team is ready to help.

-

How can I ensure compliance while using airSlate SignNow for tax-exempt transactions?

Using airSlate SignNow for tax-exempt transactions involves adhering to best practices in eSignature compliance. Our platform is designed to meet regulatory standards, and we encourage users to familiarize themselves with specific guidelines pertaining to their tax-exempt status.

Get more for I Believe That I Am Entitled To Exemption From

- Officer reporting form

- Vdocumentsnetmcps systemwide safety programsmcps systemwide safety programs department of facilities form

- Wwwsdcityedu docs nursingapplicationapplicant name application to the associate of science form

- Pdf new graduate student health forms checklist

- Food drug administration animal form

- Reimbursement for travel form swarthmore college

- Swimming pool rental agreement fill and sign printable template form

- Wwwunitedconcordiacomdocsinddisableddisabled dependent certification form united concordia

Find out other I Believe That I Am Entitled To Exemption From

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy