Claim by Unregistered Farmer for Refund of Value Added Tax 2020-2026

What is the claim by unregistered farmer for refund of value added tax

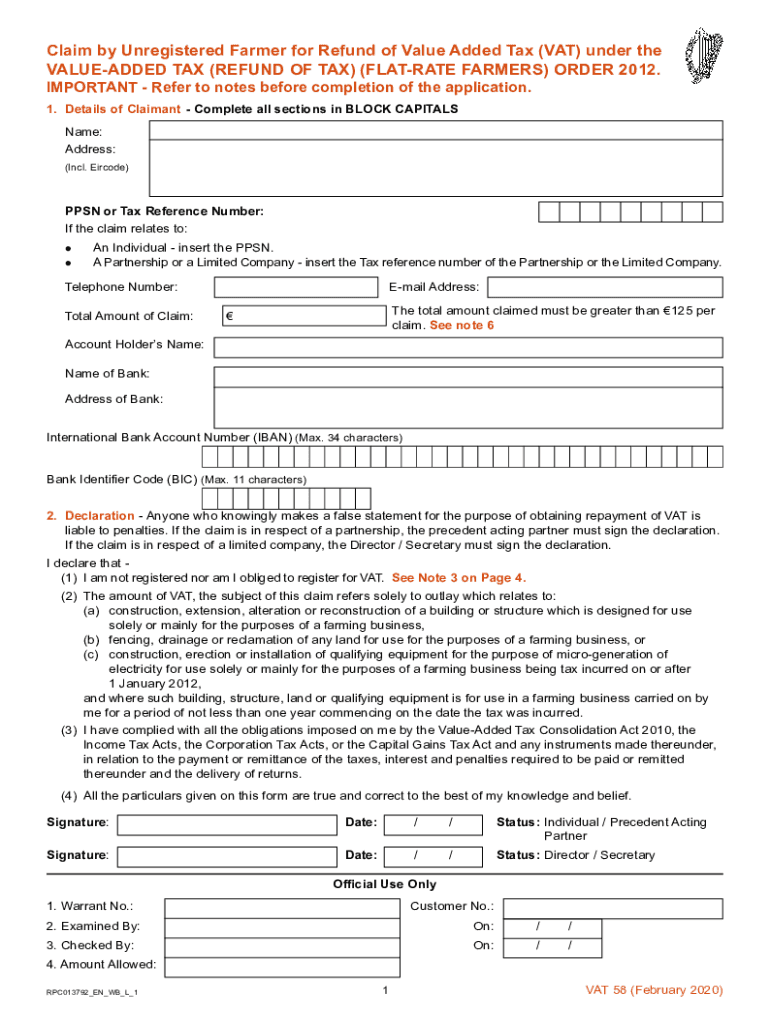

The claim by unregistered farmers for a refund of value added tax (VAT) allows individuals who are not registered for VAT to recover certain taxes paid on their business-related purchases. This process is essential for farmers who operate under specific thresholds and do not charge VAT on their sales. The VAT 58 form is typically used for this purpose, enabling farmers to reclaim taxes that can help improve their financial situation.

Steps to complete the claim by unregistered farmer for refund of value added tax

Completing the VAT 58 claim form involves several critical steps to ensure accuracy and compliance. First, gather all necessary documentation, including receipts and invoices related to purchases made for farming activities. Next, accurately fill out the VAT 58 form, providing details such as the total amount of VAT paid and the nature of the purchases. After completing the form, review it for any errors before submission. Finally, submit the form along with supporting documents to the appropriate tax authority, ensuring that all deadlines are met to avoid penalties.

Required documents

To successfully file a claim for a VAT refund, unregistered farmers must prepare specific documents. These typically include:

- Receipts for all purchases made that include VAT.

- A completed VAT 58 form detailing the claim.

- Any additional documentation that supports the claim, such as invoices or proof of payments.

Having these documents organized and ready will facilitate a smoother submission process and help avoid delays in processing the refund.

Eligibility criteria

Eligibility for claiming a VAT refund as an unregistered farmer depends on several factors. Farmers must operate below the VAT registration threshold and should not be charging VAT on their sales. Additionally, the purchases for which they are claiming a refund must be directly related to their farming activities. It's important to ensure that all criteria are met to qualify for the refund, as failure to do so may result in a rejected claim.

Form submission methods

The VAT 58 form can typically be submitted through various methods, depending on the guidelines set by the tax authority. Common submission methods include:

- Online submission through the tax authority's website.

- Mailing a physical copy of the completed form and supporting documents.

- In-person submission at designated tax offices.

Choosing the appropriate submission method can help ensure that the claim is processed efficiently and in a timely manner.

IRS guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the filing of VAT claims for unregistered farmers. It is essential to refer to these guidelines to understand the requirements and procedures involved. Farmers should ensure that they are familiar with IRS regulations to avoid any compliance issues that could affect their claim. This includes adhering to deadlines and maintaining accurate records of all transactions related to the claim.

Quick guide on how to complete claim by unregistered farmer for refund of value added tax

Effortlessly Manage Claim By Unregistered Farmer For Refund Of Value Added Tax on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Claim By Unregistered Farmer For Refund Of Value Added Tax on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign Claim By Unregistered Farmer For Refund Of Value Added Tax with Ease

- Locate Claim By Unregistered Farmer For Refund Of Value Added Tax and click Get Form to begin.

- Leverage the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Select your delivery method for the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mismanaged documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Claim By Unregistered Farmer For Refund Of Value Added Tax to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim by unregistered farmer for refund of value added tax

Create this form in 5 minutes!

How to create an eSignature for the claim by unregistered farmer for refund of value added tax

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is unregistered farmers VAT reclaim?

Unregistered farmers VAT reclaim refers to the process by which farmers who are not registered for VAT can reclaim VAT on eligible business expenses. This allows farmers to enhance their cash flow and reduce overall costs. Understanding the unregistered farmers VAT reclaim process is essential for maximizing financial efficiency.

-

How can airSlate SignNow assist with unregistered farmers VAT reclaim?

airSlate SignNow provides an efficient platform for managing and eSigning documents related to unregistered farmers VAT reclaim. Our user-friendly interface allows farmers to quickly submit necessary documentation, ensuring a smooth reclaim process. Additionally, our solution minimizes administrative burdens, allowing farmers to focus on their core business.

-

Are there any fees involved in using airSlate SignNow for VAT reclaim?

airSlate SignNow operates on a cost-effective pricing model, making it accessible for farmers seeking to handle unregistered farmers VAT reclaim. While there may be a subscription fee, our transparent pricing structure helps you understand what you’re paying for without hidden costs. This enables farmers to budget effectively while gaining access to our valuable services.

-

What features does airSlate SignNow offer for VAT-related documents?

airSlate SignNow offers a variety of features tailored for managing VAT-related documents, including templates for unregistered farmers VAT reclaim forms, secure eSignature capabilities, and document tracking. These features all streamline the process, ensuring that documents are properly submitted and signed in a timely manner. It enhances accuracy and compliance in VAT management.

-

Can airSlate SignNow integrate with other accounting software for VAT reclaim?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, enhancing the unregistered farmers VAT reclaim process. This integration allows for automatic updates of financial records, ensuring accuracy and efficiency. By combining document management with your accounting system, farmers can simplify their financial operations.

-

What benefits do unregistered farmers gain from VAT reclaim?

Unregistered farmers benefit signNowly from unregistered farmers VAT reclaim, as it allows them to recover essential costs related to their farming operations. This reclaim can boost cash flow, helping farmers invest in equipment, supplies, or improvements. By utilizing airSlate SignNow, the reclaim process becomes easier and more streamlined.

-

Is the airSlate SignNow platform user-friendly for new users?

Absolutely! The airSlate SignNow platform is designed with ease of use in mind, making it accessible for all users, including those new to unregistered farmers VAT reclaim. The intuitive interface and guided processes ensure that even non-tech-savvy individuals can effectively manage their document needs. This reduces the barrier to entry for farmers and helps them reclaim VAT effortlessly.

Get more for Claim By Unregistered Farmer For Refund Of Value Added Tax

- Pipeline easement montana university system form

- Affidavit of common law marriage montana state university form

- The homestead act secretary of the commonwealth of massachusetts form

- Probate in montanamontanalawhelporgfree legal forms info

- Applicant for personal representative form

- Agreement between owner and contractor for form

- North carolina disclaimer of interest formsdeedscom

- Basic probate and estate administration in georgia form

Find out other Claim By Unregistered Farmer For Refund Of Value Added Tax

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later