Vat 58 2019

What is the VAT 58 claim form?

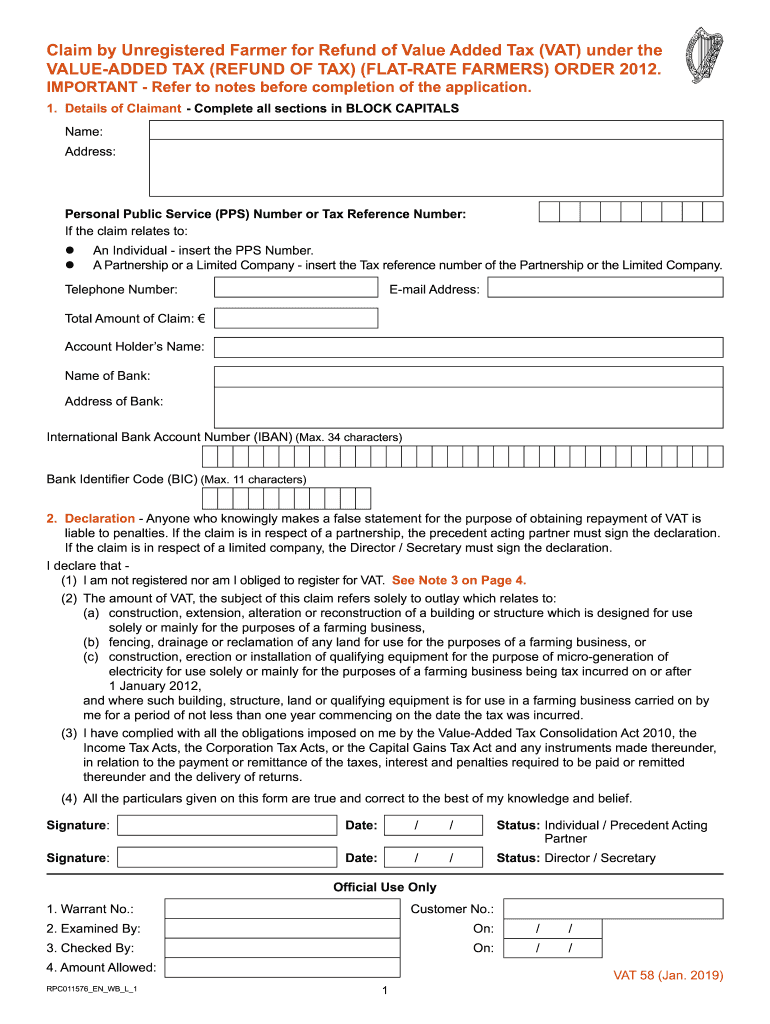

The VAT 58 claim form is a specific document used by unregistered farmers in the United States to reclaim value-added tax (VAT) on eligible purchases. This form is essential for farmers who do not have VAT registration but have incurred VAT on goods and services related to their farming activities. By submitting the VAT 58 claim form, farmers can recover VAT costs, thereby improving their financial position and supporting their agricultural operations.

How to obtain the VAT 58 claim form

Farmers can obtain the VAT 58 claim form through various channels. The most straightforward method is to visit the official website of the relevant tax authority, where the form is typically available for download. Additionally, local tax offices may provide printed copies of the form. It is important for farmers to ensure they are using the most current version of the form to avoid any issues during submission.

Steps to complete the VAT 58 claim form

Completing the VAT 58 claim form involves several important steps:

- Gather necessary documentation, including receipts and invoices that show VAT paid on purchases.

- Fill out the form accurately, ensuring all required fields are completed, including personal information and details of the purchases.

- Calculate the total VAT amount being claimed, based on the documentation provided.

- Review the form for accuracy and completeness before submission.

- Submit the form through the preferred method, whether online, by mail, or in person, depending on local regulations.

Legal use of the VAT 58 claim form

The legal use of the VAT 58 claim form is governed by tax regulations that specify how unregistered farmers can reclaim VAT. It is crucial for farmers to comply with these regulations to ensure their claims are valid. This includes maintaining accurate records of all transactions and ensuring that the claimed VAT relates directly to farming activities. Non-compliance can lead to penalties or rejection of the claim.

Eligibility criteria for the VAT 58 claim form

To be eligible to use the VAT 58 claim form, individuals must meet specific criteria. Primarily, the claimant must be an unregistered farmer who has incurred VAT on purchases related to their farming operations. Additionally, the purchases must be for goods or services that are eligible for VAT reclaim under current tax laws. It is advisable for farmers to review the eligibility criteria carefully before submitting their claims.

Required documents for the VAT 58 claim form

When completing the VAT 58 claim form, several documents are required to support the claim:

- Receipts or invoices that detail the VAT paid on eligible purchases.

- Proof of identity, such as a driver's license or tax identification number.

- Any additional documentation that may be requested by the tax authority, such as proof of farming activities.

Form submission methods for the VAT 58 claim

The VAT 58 claim form can typically be submitted through various methods, depending on the regulations of the local tax authority. Common submission options include:

- Online submission through the tax authority's official website, which may offer a streamlined process.

- Mailing the completed form to the designated tax office, ensuring it is sent with adequate postage and tracking.

- In-person submission at local tax offices, where farmers can receive immediate confirmation of receipt.

Quick guide on how to complete vat 58

Effortlessly Prepare Vat 58 on Any Device

The management of online documents has gained traction among businesses and individuals alike. It offers an excellent environmentally-friendly substitute to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Vat 58 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Easily Modify and eSign Vat 58

- Obtain Vat 58 and click Get Form to initiate the process.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review the information and click the Done button to finalize your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns regarding lost or misplaced files, tedious form searching, or errors necessitating reprints of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Vat 58 to guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vat 58

Create this form in 5 minutes!

How to create an eSignature for the vat 58

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is a VAT 58 claim form?

The VAT 58 claim form is an official document used by businesses to reclaim Value Added Tax (VAT) paid on specific purchases. It serves as a formal request to recover the VAT, ensuring that businesses can benefit from tax relief. Understanding how to complete the VAT 58 claim form correctly is crucial to streamline the reimbursement process.

-

How can airSlate SignNow help with VAT 58 claim form submissions?

AirSlate SignNow offers an intuitive platform that simplifies the process of completing and eSigning the VAT 58 claim form. With features like templates and easy document management, users can efficiently fill out the form and submit it for approval. This streamlines the entire claims process and reduces the hassle of paperwork.

-

Are there any costs associated with using airSlate SignNow for VAT 58 claim forms?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs, making it a cost-effective solution for managing VAT 58 claim forms. The pricing structure is transparent, with details available on our website. Businesses can choose a plan that best fits their budget and requirements for eSigning documents.

-

What features does airSlate SignNow offer for VAT 58 claim form preparation?

AirSlate SignNow offers features such as customizable templates, document collaboration, and secure eSigning to enhance the preparation of VAT 58 claim forms. These features enable teams to work together efficiently, making the completion of claim forms faster and more accurate. Additionally, users can track the status of their forms for peace of mind.

-

Can I integrate airSlate SignNow with other software for VAT 58 claim processing?

Absolutely! airSlate SignNow offers integrations with various business applications that facilitate seamless processing of VAT 58 claim forms. By linking with accounting software or document management systems, users can streamline their workflow. This ensures that all necessary data for the VAT claim is easily accessible and manageable.

-

What benefits does eSigning the VAT 58 claim form bring?

eSigning the VAT 58 claim form provides several benefits, including faster processing times and enhanced security. With airSlate SignNow, businesses can sign documents electronically, which speeds up the approval process signNowly. Moreover, eSigning reduces the risk of lost paperwork, ensuring that all claims are documented and filed correctly.

-

Is support available for users of airSlate SignNow when filling out VAT 58 claim forms?

Yes, airSlate SignNow offers customer support to assist users with any questions or issues related to filling out VAT 58 claim forms. Users can access help through various channels, including live chat, email, and an extensive knowledge base. Our support team is dedicated to ensuring that your experience is smooth and hassle-free.

Get more for Vat 58

- Changing your name after divorce wifeorg form

- For the minor children form

- The above entitled matter having been submitted to this court for an order appointing form

- Order for change of surnames form

- Voice over ip telephones and voicemailtemple its form

- Affirmation name change form

- Promissory note example vue interior design form

- Free nevada secured promissory note template word form

Find out other Vat 58

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement