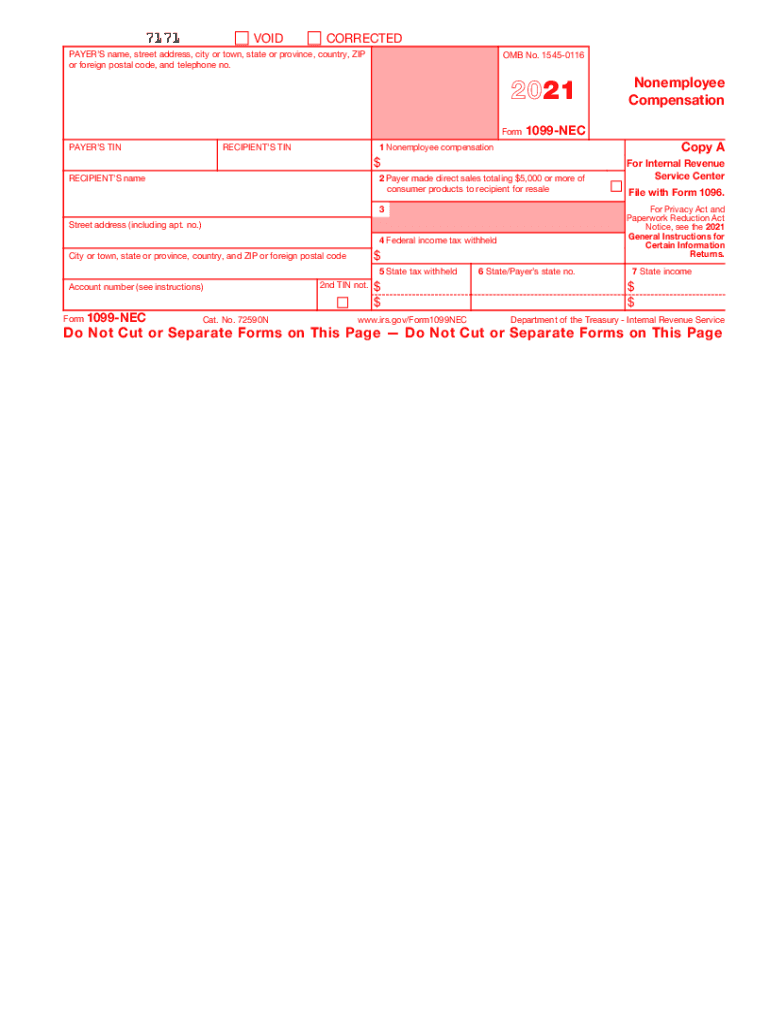

1099 Nec Form 2021

What is the 1099 NEC Form

The 1099 NEC form is a tax document used in the United States to report non-employee compensation. It is primarily utilized by businesses to report payments made to independent contractors, freelancers, and other non-employees. This form became distinct in 2020, separating non-employee compensation reporting from the 1099 MISC form. The 1099 NEC is essential for ensuring that all income is accurately reported to the IRS, helping to maintain compliance with tax regulations.

How to use the 1099 NEC Form

To use the 1099 NEC form, businesses must first gather the necessary information about the payee, including their name, address, and taxpayer identification number (TIN). Once this information is collected, the payer fills out the form, detailing the total amount paid to the contractor during the tax year. After completing the form, it must be provided to the payee by January thirty-first of the following year. Additionally, the payer must submit the form to the IRS, either electronically or by mail, to ensure proper reporting of the income.

Steps to complete the 1099 NEC Form

Completing the 1099 NEC form involves several key steps:

- Gather the payee's information, including their name, address, and TIN.

- Indicate the total amount paid to the contractor in Box 1 of the form.

- Fill out the payer's information, including the business name, address, and TIN.

- Review the form for accuracy to prevent errors that could lead to penalties.

- Provide a copy of the completed form to the payee by January thirty-first.

- Submit the form to the IRS by the deadline, which is typically January thirty-first for paper submissions and March thirty-first for electronic submissions.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 NEC form are crucial for compliance. The form must be provided to the payee by January thirty-first of the year following the tax year in which payments were made. Additionally, the form must be submitted to the IRS by the same date if filing by paper. If submitting electronically, the deadline extends to March thirty-first. It is important to adhere to these deadlines to avoid potential penalties.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the 1099 NEC form. These guidelines include instructions on how to fill out the form accurately, the requirements for reporting payments, and the necessary steps for submitting the form. It is essential for businesses to familiarize themselves with these guidelines to ensure compliance and avoid any issues with the IRS. The IRS also emphasizes the importance of accurate reporting to maintain the integrity of tax records.

Penalties for Non-Compliance

Failure to comply with the requirements of the 1099 NEC form can result in significant penalties. The IRS imposes fines for late filings, incorrect information, and failure to provide the form to payees. Penalties can vary based on how late the form is filed and whether the error is corrected. It is crucial for businesses to ensure timely and accurate submissions to avoid these financial repercussions and maintain good standing with tax authorities.

Quick guide on how to complete 1099 nec form 2021

Accomplish 1099 Nec Form effortlessly on any device

Online document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, edit, and electronically sign your documents swiftly without delays. Manage 1099 Nec Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign 1099 Nec Form without effort

- Find 1099 Nec Form and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere moments and possesses the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Stop worrying about lost or misplaced documents, the hassle of form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and electronically sign 1099 Nec Form to ensure excellent communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 nec form 2021

Create this form in 5 minutes!

People also ask

-

What is 1099 preparation software?

1099 preparation software is a specialized tool designed to help businesses efficiently prepare, file, and distribute 1099 forms to contractors and freelancers. By automating the process, this software minimizes errors and saves valuable time during tax season, making it an essential component for financial management.

-

How does airSlate SignNow's 1099 preparation software simplify the filing process?

airSlate SignNow's 1099 preparation software streamlines the filing process by providing intuitive templates and easy integration with your accounting systems. This helps users to automatically generate the necessary 1099 forms, ensuring accuracy and compliance while reducing the administrative burden associated with tax preparation.

-

What features should I look for in 1099 preparation software?

Key features to look for in 1099 preparation software include automated form generation, e-signature capabilities, data import from other applications, and secure document storage. These functionalities enhance efficiency, ease of use, and ensure compliance with IRS regulations during tax reporting.

-

Is airSlate SignNow’s 1099 preparation software suitable for small businesses?

Yes, airSlate SignNow’s 1099 preparation software is highly suitable for small businesses. Its cost-effective solution ensures that small business owners can manage contractor filings without incurring heavy expenses, while the user-friendly interface allows for easy navigation even for those with limited accounting experience.

-

What are the benefits of using 1099 preparation software?

Using 1099 preparation software offers several benefits, including time efficiency, accuracy in form preparation, and reduction of penalties due to filing errors. Moreover, it allows for easy organization and access to historical filing data, making future tax preparations more streamlined and manageable.

-

Can airSlate SignNow's 1099 preparation software integrate with existing accounting tools?

Absolutely! airSlate SignNow's 1099 preparation software seamlessly integrates with various accounting tools and financial systems. This integration enhances data accuracy and allows for a more comprehensive financial management experience, simplifying data transfer and reducing the potential for errors.

-

What is the pricing model for airSlate SignNow's 1099 preparation software?

airSlate SignNow offers a competitive pricing model for its 1099 preparation software, typically based on a subscription plan. This pricing structure allows businesses of all sizes to access essential features without breaking the budget, ensuring you only pay for the resources you need.

Get more for 1099 Nec Form

- Housing counseling intake assessment form catholic charities

- C16 notice to case management form 3 2015 butlercountyohio

- Cabo certification form

- Xofigo insurance benefit verification request form il pparx

- Cookcounty clerk of court form

- Bonus form

- Arizona for your protection arizona law requires the us life form

- City of lapeer special event application ci lapeer mi form

Find out other 1099 Nec Form

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later