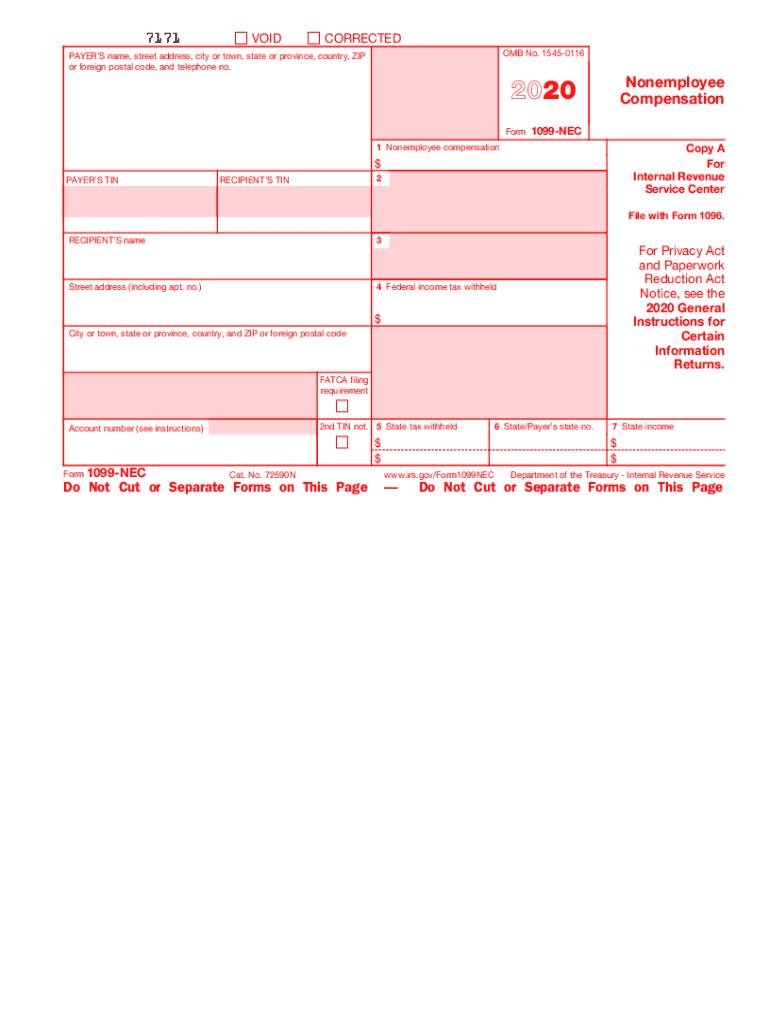

1099 Nec Form 2020

What is the 1099 NEC Form?

The 1099 NEC form is a tax document used in the United States to report non-employee compensation. This form is essential for businesses that have paid independent contractors, freelancers, or other non-employees for services rendered. The 1099 NEC form was reintroduced for the tax year 2020, separating it from the 1099 MISC form, which previously reported both employee and non-employee compensation. This change simplifies the reporting process for businesses and ensures compliance with IRS regulations.

Steps to Complete the 1099 NEC Form

Completing the 1099 NEC form involves several key steps:

- Gather Information: Collect the necessary information about the payee, including their name, address, and taxpayer identification number (TIN).

- Report Payments: Accurately report the total amount paid to the non-employee in Box 1 of the form.

- Provide Payer Information: Fill in your business name, address, and TIN in the appropriate sections.

- Review for Accuracy: Double-check all entries for accuracy to avoid penalties or delays.

- Distribute Copies: Provide the payee with their copy of the form and submit the other copies to the IRS and state tax authorities as required.

IRS Guidelines

The IRS has specific guidelines regarding the use of the 1099 NEC form. It is crucial to understand the following:

- Form 1099 NEC must be filed for each non-employee who has received $600 or more in compensation during the tax year.

- The form must be submitted to the IRS by January 31 of the year following the tax year in which payments were made.

- Electronic filing is encouraged for businesses submitting more than 250 forms, as it streamlines the process and ensures timely submission.

Filing Deadlines / Important Dates

Understanding the deadlines for filing the 1099 NEC form is essential for compliance:

- January 31: The deadline for providing the payee with their copy of the 1099 NEC form.

- January 31: The deadline for filing the 1099 NEC form with the IRS, whether electronically or by mail.

Legal Use of the 1099 NEC Form

The legal use of the 1099 NEC form is governed by IRS regulations. It is important to ensure that:

- The form is used exclusively for reporting non-employee compensation.

- All information provided on the form is accurate and complete to avoid penalties.

- Forms must be retained for at least three years for audit purposes.

Who Issues the Form

The 1099 NEC form is issued by businesses that have paid non-employees for services. This includes various entities such as sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). It is the responsibility of the payer to ensure that the form is filled out correctly and submitted on time to both the payee and the IRS.

Quick guide on how to complete 1099 nec form

Effortlessly Prepare 1099 Nec Form on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed materials, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without any hold-ups. Handle 1099 Nec Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and eSign 1099 Nec Form with Ease

- Locate 1099 Nec Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method of sending your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign 1099 Nec Form and facilitate outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 nec form

Create this form in 5 minutes!

How to create an eSignature for the 1099 nec form

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is a 1099 correction 2020 and why do I need it?

A 1099 correction 2020 is a form used to rectify incorrect information that was previously submitted to the IRS for the tax year 2020. Correcting errors on a 1099 form is essential to ensure compliance with tax regulations and avoid potential penalties. airSlate SignNow provides a seamless way to manage this process efficiently while maintaining accurate records.

-

How does airSlate SignNow assist with 1099 corrections?

airSlate SignNow simplifies the 1099 correction 2020 process by allowing users to easily eSign and send corrected documents electronically. The platform ensures that users can track, manage, and securely sign their correction forms, making it easier to stay compliant with IRS requirements. With our service, you can streamline your document workflows efficiently.

-

Is there a cost associated with using airSlate SignNow for 1099 corrections?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. While the specific cost for processing 1099 correction 2020 forms may vary based on the selected plan, our solutions are generally designed to be cost-effective, enabling businesses of all sizes to manage their documentation easily.

-

What features should I expect when using airSlate SignNow for 1099 correction 2020?

When using airSlate SignNow for 1099 correction 2020, you can expect features such as secure electronic signatures, document tracking, customizable templates, and integration capabilities with popular accounting software. These features enable users to manage their correction documents effectively while ensuring data integrity and compliance.

-

Can airSlate SignNow integrate with my current accounting software for 1099 corrections?

Absolutely! airSlate SignNow offers integrations with various accounting software solutions that can help streamline the process of preparing your 1099 correction 2020 forms. This allows you to pull data directly from your accounting platform, minimizing manual input and enhancing accuracy.

-

What are the benefits of using airSlate SignNow for my 1099 correction 2020 needs?

Using airSlate SignNow for 1099 correction 2020 offers several benefits, including increased efficiency, reduced paperwork, and enhanced security for sensitive tax documents. Our platform allows for quick turnaround times on corrections, ultimately helping you stay compliant and improving your overall productivity.

-

How secure is the information I send with airSlate SignNow for corrections?

Security is a top priority for airSlate SignNow. Our platform utilizes advanced encryption technologies to safeguard all data, including those related to 1099 correction 2020 submissions. This ensures that your sensitive information remains protected and confidential throughout the signing and submission processes.

Get more for 1099 Nec Form

- Veteran application for admission iowa form

- Form 1776 missouri department of revenue

- State of iowa taxesiowa department of revenueiowa individual tax informationiowa department of revenuestate of iowa taxesiowa

- Supplemental security income in wisconsinwisconsinsupplemental security income in wisconsinwisconsinwisconsin dmv official form

- Bid confirmation summary sheet form

- Schedule f 622996868 form

- Form mo fpt food pantry homeless shelter or soup kitchen tax credit

- Form 13615

Find out other 1099 Nec Form

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed