Form 1099 NEC Rev April 2024

What is the Form 1099 NEC Rev April

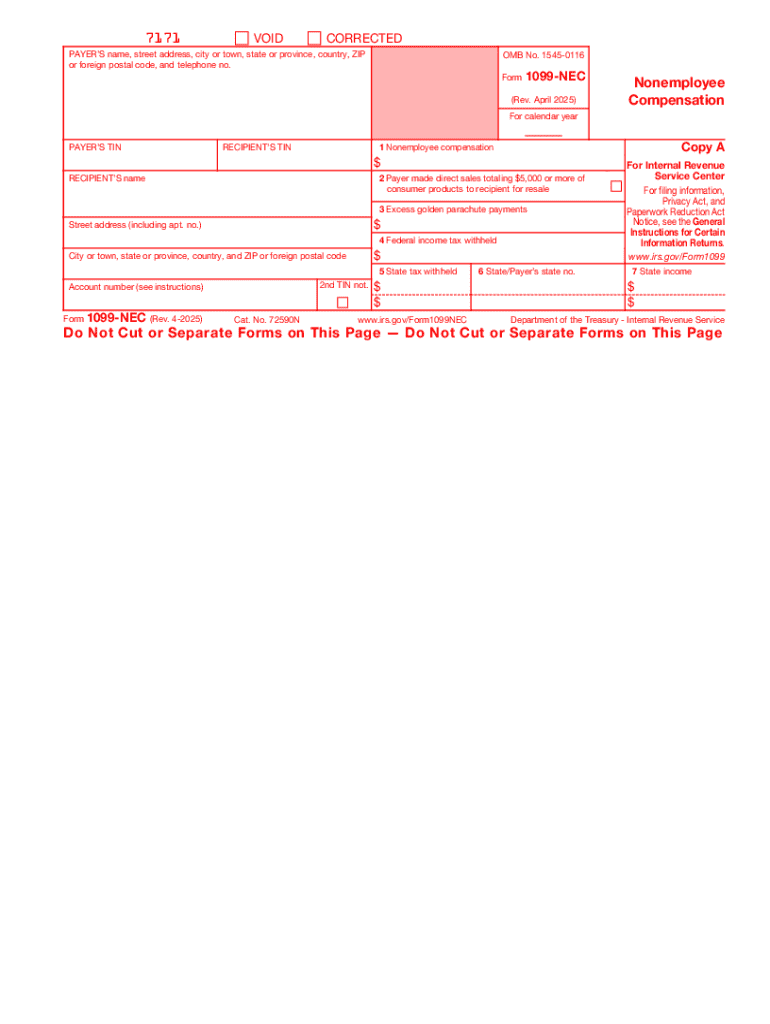

The Form 1099 NEC Rev April is a tax form used in the United States to report nonemployee compensation. This form is specifically designed for businesses to report payments made to independent contractors, freelancers, and other nonemployees. It is crucial for ensuring that the Internal Revenue Service (IRS) receives accurate information about income that is not subject to withholding. The "NEC" in the form's title stands for "Nonemployee Compensation," indicating its primary purpose in the tax reporting process.

How to use the Form 1099 NEC Rev April

Using the Form 1099 NEC Rev April involves several steps to ensure compliance with IRS regulations. Businesses must accurately fill out the form with the required information, including the payer's details, recipient's information, and the total amount paid during the tax year. Once completed, the form must be distributed to both the recipient and the IRS. It is important to keep a copy for your records as well. This form plays a vital role in tax reporting and helps recipients accurately report their income on their tax returns.

Steps to complete the Form 1099 NEC Rev April

Completing the Form 1099 NEC Rev April requires careful attention to detail. Follow these steps:

- Gather necessary information, including the payer's and recipient's names, addresses, and taxpayer identification numbers (TINs).

- Enter the total amount of nonemployee compensation paid to the recipient in Box 1.

- Complete any additional boxes that may apply, such as federal income tax withheld if applicable.

- Review the form for accuracy before submitting it.

- Distribute copies to the recipient and the IRS by the specified deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 NEC Rev April are critical for compliance. The form must be submitted to the IRS by January thirty-first of the year following the tax year in which the payments were made. Recipients should also receive their copies by this date. Adhering to these deadlines helps avoid penalties and ensures that all parties have the necessary documentation for tax reporting.

Legal use of the Form 1099 NEC Rev April

The legal use of the Form 1099 NEC Rev April is essential for both businesses and recipients. It is required for any payments made to nonemployees totaling $600 or more within a tax year. Failure to issue this form when required can lead to penalties for the payer. Recipients rely on this form to accurately report their income, making it a vital document in the tax process. Understanding the legal implications ensures compliance with IRS regulations and protects both parties involved.

Who Issues the Form

The Form 1099 NEC Rev April is typically issued by businesses that pay independent contractors, freelancers, or other nonemployees for services rendered. This includes various types of organizations, such as sole proprietorships, partnerships, and corporations. It is the responsibility of the payer to ensure that the form is accurately completed and submitted to the IRS and the recipient. Proper issuance of this form is crucial for maintaining transparent financial practices and fulfilling tax obligations.

Handy tips for filling out Form 1099 NEC Rev April online

Quick steps to complete and e-sign Form 1099 NEC Rev April online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Get access to a HIPAA and GDPR compliant service for optimum simplicity. Use signNow to e-sign and send out Form 1099 NEC Rev April for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 nec rev april

Create this form in 5 minutes!

How to create an eSignature for the form 1099 nec rev april

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1099 NEC Rev April?

Form 1099 NEC Rev April is a tax form used to report non-employee compensation to the IRS. It is essential for businesses that pay independent contractors or freelancers. Understanding this form is crucial for compliance and accurate tax reporting.

-

How can airSlate SignNow help with Form 1099 NEC Rev April?

airSlate SignNow provides a streamlined solution for sending and eSigning Form 1099 NEC Rev April. Our platform ensures that your documents are securely signed and stored, making it easy to manage your tax forms efficiently. This helps you stay organized and compliant with IRS regulations.

-

What features does airSlate SignNow offer for managing Form 1099 NEC Rev April?

With airSlate SignNow, you can easily create, send, and track Form 1099 NEC Rev April. Our features include customizable templates, real-time tracking, and secure cloud storage. These tools simplify the process of managing your tax documents and enhance your workflow.

-

Is there a cost associated with using airSlate SignNow for Form 1099 NEC Rev April?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, ensuring you get the best value for managing Form 1099 NEC Rev April. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for Form 1099 NEC Rev April?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and business software, making it easy to manage Form 1099 NEC Rev April alongside your other financial documents. This integration enhances efficiency and ensures that all your data is synchronized.

-

What are the benefits of using airSlate SignNow for Form 1099 NEC Rev April?

Using airSlate SignNow for Form 1099 NEC Rev April offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete the signing process quickly, ensuring that you meet deadlines and maintain compliance with tax regulations.

-

How secure is airSlate SignNow when handling Form 1099 NEC Rev April?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect your Form 1099 NEC Rev April and other sensitive documents. You can trust that your information is safe and compliant with industry standards.

Get more for Form 1099 NEC Rev April

- Bfs rp p 51 real property assessment division form

- Online jsa template form

- Snow load design criteria request klamath county klamathcounty form

- Appendix e pesticide use proposal form fs 2100 2

- Nc temporary tag form

- Manual molle form

- Level iv referral form fairfax county public schools fcps

- Fairfax county schools medication form

Find out other Form 1099 NEC Rev April

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed