Arizona Adjustment 2018-2026

What is the Arizona Adjustment

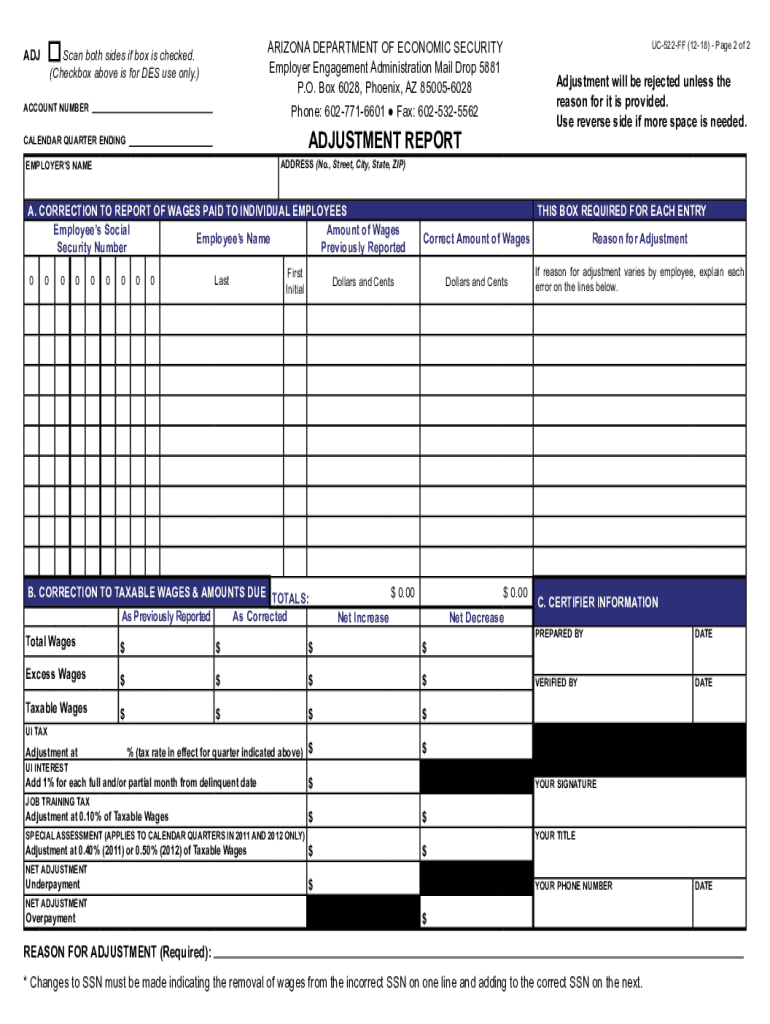

The Arizona Adjustment refers to the process of modifying certain tax-related documents and calculations specific to Arizona tax regulations. This adjustment is often necessary for individuals and businesses to ensure compliance with state tax laws. It typically involves changes to income, deductions, and credits that may affect the overall tax liability. Understanding the Arizona Adjustment is crucial for accurate tax reporting and to avoid potential penalties.

Steps to complete the Arizona Adjustment

Completing the Arizona Adjustment involves several key steps to ensure accuracy and compliance. Follow these steps:

- Gather all necessary financial documents, including income statements and prior tax returns.

- Identify any changes in income or deductions that may affect your tax situation.

- Fill out the Arizona UC 522 form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the designated method, whether online, by mail, or in person.

Legal use of the Arizona Adjustment

The legal use of the Arizona Adjustment is governed by state tax laws and regulations. To ensure that the adjustment is recognized legally, it is essential to comply with the requirements set forth by the Arizona Department of Revenue. This includes using the correct forms, providing accurate information, and adhering to submission deadlines. Failure to comply can result in penalties or denial of the adjustment.

Required Documents

To successfully complete the Arizona Adjustment, certain documents are required. These typically include:

- Previous tax returns to reference prior income and deductions.

- W-2 forms or 1099 forms that report income.

- Documentation for any deductions or credits claimed, such as receipts or invoices.

- Any correspondence from the Arizona Department of Revenue regarding previous adjustments or inquiries.

Eligibility Criteria

Eligibility for making an Arizona Adjustment can vary based on individual circumstances. Generally, taxpayers must meet specific criteria, such as:

- Being a resident of Arizona or having income sourced from Arizona.

- Having a valid reason for making the adjustment, such as changes in income or deductions.

- Filing the adjustment within the prescribed time frame set by state regulations.

Form Submission Methods

Submitting the Arizona Adjustment can be done through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online submission through the Arizona Department of Revenue's e-filing system.

- Mailing the completed form to the appropriate address specified by the department.

- In-person submission at designated tax offices or service centers.

Quick guide on how to complete arizona adjustment

Finalize Arizona Adjustment effortlessly on any gadget

Web-based document administration has become increasingly favored by organizations and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, as you can easily obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Arizona Adjustment on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest method to modify and electronically sign Arizona Adjustment without hassle

- Obtain Arizona Adjustment and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes just moments and carries the same legal significance as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form hunting, or errors that require new document copies to be printed out. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Arizona Adjustment and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona adjustment

Create this form in 5 minutes!

How to create an eSignature for the arizona adjustment

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What is the az adjustment feature in airSlate SignNow?

The az adjustment feature in airSlate SignNow enables users to efficiently customize workflows based on their specific business needs. This feature allows for streamlined document processing and enhances productivity by ensuring that the signing process is tailored to the user’s requirements.

-

How much does airSlate SignNow cost with the az adjustment features?

airSlate SignNow offers various pricing plans that accommodate businesses of all sizes. The az adjustment features are included in our premium packages, ensuring that users receive maximum flexibility and customization for a competitive price.

-

Can I integrate airSlate SignNow with other tools for az adjustment?

Yes, airSlate SignNow allows seamless integration with numerous third-party applications, enhancing the az adjustment capabilities. This ensures that your signing workflow can connect with existing tools and platforms to further optimize document management processes.

-

What are the benefits of using the az adjustment feature?

The az adjustment feature enhances efficiency by allowing personalized workflows, improving the user experience. Businesses can reduce time spent on document processing and ensure compliance with tailored processes, ultimately driving greater productivity and satisfaction.

-

Is the az adjustment feature easy to use for beginners?

Absolutely! The az adjustment feature in airSlate SignNow is designed to be user-friendly, making it accessible for individuals with varying levels of technical expertise. Even beginners can navigate the platform easily and make adjustments without extensive training.

-

Does airSlate SignNow provide support for az adjustment customization?

Yes, airSlate SignNow offers excellent customer support, including tutorials and guides specifically for the az adjustment feature. Our team is always ready to assist users with any questions or guidance needed to tailor their document workflows effectively.

-

What types of documents can I manage with az adjustment in airSlate SignNow?

With the az adjustment feature, users can manage a wide variety of documents, including contracts, agreements, and forms. This flexibility allows businesses to streamline various document workflows, ensuring all necessary paperwork is handled efficiently.

Get more for Arizona Adjustment

Find out other Arizona Adjustment

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself