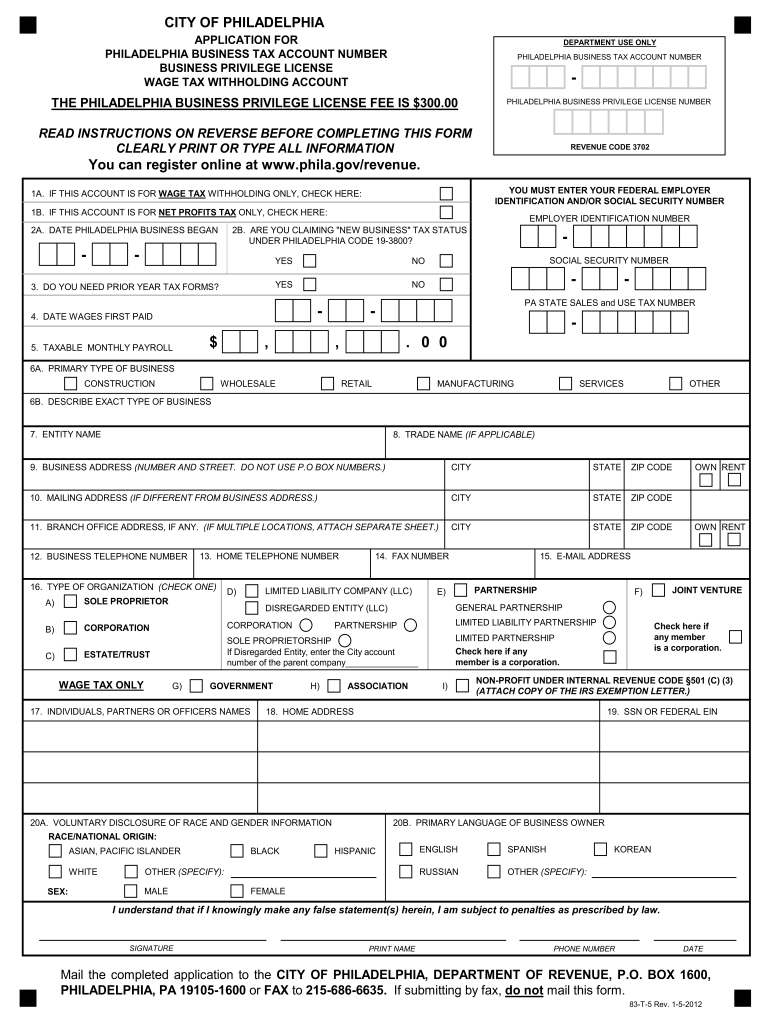

83 T5 Fillable Form 2012

What is the 83 T5 Fillable Form

The 83 T5 Fillable Form is a tax document used in the United States for reporting income from certain types of investments. This form is typically utilized by individuals who have received income from trusts or estates, as well as those who have received dividends or interest payments. The fillable version allows users to enter their information directly into the form online, making it easier to complete and submit. It is essential for ensuring accurate reporting and compliance with IRS requirements.

How to use the 83 T5 Fillable Form

Using the 83 T5 Fillable Form involves several straightforward steps. First, access the form through a secure platform that allows for electronic completion. Fill in the required fields with accurate information, including your personal details and the income amounts received. After completing the form, review it for accuracy to avoid any potential issues with the IRS. Once verified, you can submit the form electronically or print it for mailing, depending on your preference.

Steps to complete the 83 T5 Fillable Form

Completing the 83 T5 Fillable Form requires careful attention to detail. Follow these steps:

- Open the fillable form on a compatible device.

- Enter your name, address, and Social Security number in the designated fields.

- Input the total amount of income received from the relevant sources.

- Check for any deductions or credits that may apply to your situation.

- Review all entered information for accuracy.

- Save your completed form securely.

- Submit the form electronically or print it for mailing.

Legal use of the 83 T5 Fillable Form

The 83 T5 Fillable Form is legally recognized by the IRS as a valid method for reporting income. It is crucial to ensure that the form is filled out correctly and submitted on time to avoid penalties. The IRS accepts electronic signatures on this form, which enhances its usability in a digital format. Compliance with the legal requirements surrounding this form helps safeguard against potential audits and ensures that taxpayers fulfill their obligations.

Filing Deadlines / Important Dates

When dealing with the 83 T5 Fillable Form, it is essential to be aware of key filing deadlines. Typically, the form must be submitted by April fifteenth of the tax year following the income reporting. However, if you need additional time, you may file for an extension. It is important to keep track of these dates to avoid late fees and ensure timely processing of your tax return.

Who Issues the Form

The 83 T5 Fillable Form is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement. This form is part of the IRS's broader effort to facilitate accurate income reporting and compliance among taxpayers. It is important to obtain the most current version of the form directly from the IRS or a trusted source to ensure that you are using the correct format and following the latest guidelines.

Quick guide on how to complete 83 t5 fillable 2012 form

Your assistance manual on how to prepare your 83 T5 Fillable Form

If you’re interested in understanding how to finalize and submit your 83 T5 Fillable Form, below are a few simple guidelines to make tax filing easier.

First, you only need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that allows you to modify, draft, and complete your income tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to adjust answers where necessary. Simplify your tax management with sophisticated PDF editing, eSigning, and user-friendly sharing.

Complete the following steps to finalize your 83 T5 Fillable Form in no time:

- Establish your account and begin working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Get form to access your 83 T5 Fillable Form in our editor.

- Populate the essential fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and rectify any discrepancies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make use of this guide to file your taxes electronically with airSlate SignNow. Bear in mind that filing on paper can lead to return errors and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 83 t5 fillable 2012 form

FAQs

-

What is the best way to fill out an 83(b) form?

Read Understanding an 83(b) Election to learn how to complete an 83(b) election, but from the way you phrased the question, I am not sure you understand what exactly an 83(b) election accomplishes.If a third party invests in your business, that is not necessarily a taxable transaction to you, unless you are personally selling the shares yourself rather than issuing new shares. If you are selling shares, an 83(b) election would not apply.If you are receiving "founder's shares" in the business and those shares are subject to some type of restrictions on your ability to sell them, then 83(b) very well may be appropriate, but it does not mean you will avoid the taxes. In fact you will actually accelerate your recognition of ordinary income for the current value of the shares you receive and owe tax on that income. With an 83(b) election, you pay the tax now to avoid paying more tax in the future (assuming the value of the stock increases) when the stock vests or the restrictions expire. After making an 83(b) election you pay capital gains tax on future increases in value rather than ordinary income tax and you only pay the capital gains tax when you sell the shares that were subject to the election.There are pros and cons to an 83(b) election and I would strongly suggest that you seek advice from tax professional before you decide how to proceed.

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How do I transfer data from Google Sheets cells to a PDF fillable form?

I refer you a amazing pdf editor, her name is Puspita, She work in fiverr, She is just amazing, Several time I am use her services. You can contact with her.puspitasaha : I will create fillable pdf form or edit pdf file for $5 on www.fiverr.com

-

How do I fill out a fillable PDF on an iPad?

there is an app for that !signNow Fill & Sign on the App Store

-

Do foreign entrepreneurs that have Startup U.S. corporations need to fill an 83(b) election form?

Only if you have plans to move to the U.S and become an individual taxpayer.If you plan to continue in your country and pay taxes over capital gains in there, you as an individual are only subject to this kind of taxation in your country. If you plan to move to U.S. you should fill the 83b election. In case you dont have an SSN or ITIN, you should fill it with "awaiting ITIN" in the ITIN field.

Create this form in 5 minutes!

How to create an eSignature for the 83 t5 fillable 2012 form

How to create an electronic signature for the 83 T5 Fillable 2012 Form online

How to create an electronic signature for your 83 T5 Fillable 2012 Form in Google Chrome

How to make an eSignature for putting it on the 83 T5 Fillable 2012 Form in Gmail

How to make an eSignature for the 83 T5 Fillable 2012 Form right from your smart phone

How to generate an eSignature for the 83 T5 Fillable 2012 Form on iOS devices

How to create an eSignature for the 83 T5 Fillable 2012 Form on Android

People also ask

-

What is the 83 T5 Fillable Form?

The 83 T5 Fillable Form is a tax document used in Canada to report income from stock options or other forms of compensation. Utilizing an 83 T5 Fillable Form allows individuals and businesses to easily complete and submit their tax obligations. With airSlate SignNow, you can seamlessly fill out and eSign your 83 T5 Fillable Form online, ensuring compliance and accuracy.

-

How do I fill out the 83 T5 Fillable Form using airSlate SignNow?

Filling out the 83 T5 Fillable Form with airSlate SignNow is simple. Just upload the form to our platform, fill in the required fields using our user-friendly interface, and save your changes. Once completed, you can easily eSign the document and share it with others as needed.

-

What are the benefits of using the 83 T5 Fillable Form with airSlate SignNow?

Using the 83 T5 Fillable Form with airSlate SignNow streamlines your tax filing process, saving you time and reducing errors. Our platform offers templates, customizable fields, and secure storage, making it easy to manage your documents. Additionally, eSigning the form ensures a legally binding agreement, enhancing your document's validity.

-

Is there a cost associated with using the 83 T5 Fillable Form on airSlate SignNow?

Yes, while airSlate SignNow offers a range of pricing plans, using the 83 T5 Fillable Form may incur costs depending on the features you choose. We provide affordable subscription options tailored to fit various business needs. Explore our pricing page for detailed information on plans and features.

-

Can I integrate the 83 T5 Fillable Form with other applications?

Absolutely! airSlate SignNow allows seamless integration of the 83 T5 Fillable Form with popular applications such as Google Drive, Dropbox, and Salesforce. This means you can access your documents easily and streamline your workflow without switching between platforms.

-

What security measures does airSlate SignNow offer for the 83 T5 Fillable Form?

airSlate SignNow prioritizes the security of your documents, including the 83 T5 Fillable Form. We utilize advanced encryption protocols and secure servers to protect your data. Additionally, our platform complies with various industry standards to ensure that your information remains confidential and secure.

-

Can I track the status of my 83 T5 Fillable Form after sending it for eSignature?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your 83 T5 Fillable Form after it has been sent for eSignature. You will receive notifications when the document is viewed, signed, or completed, giving you peace of mind throughout the process.

Get more for 83 T5 Fillable Form

Find out other 83 T5 Fillable Form

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation