ADJUSTABLE RATE NOTE 1 Year Treasury Fannie Mae 2020-2026

Understanding the adjustable rate note 1 Year Treasury Fannie Mae

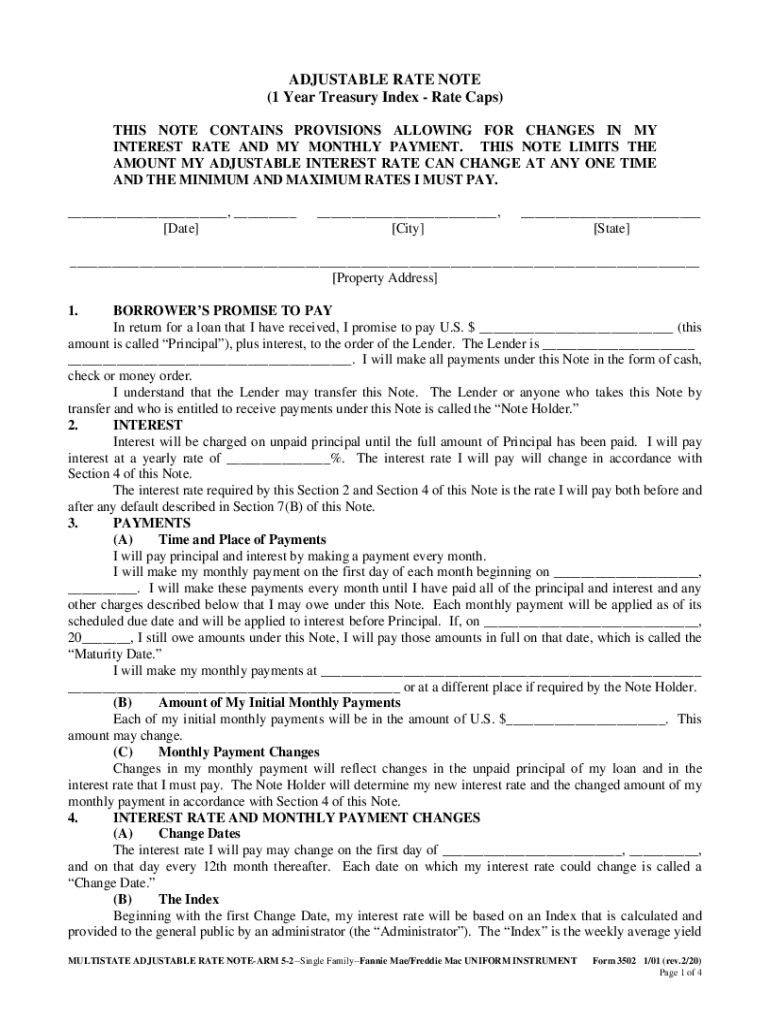

The adjustable rate note 1 Year Treasury Fannie Mae is a financial instrument used in mortgage lending. It is designed for borrowers who prefer a loan with an interest rate that can change over time, typically based on the performance of the 1 Year Treasury index. This type of note offers flexibility, allowing borrowers to benefit from potentially lower rates during the initial period of the loan. Understanding the specifics of this note is crucial for making informed decisions regarding mortgage options.

Steps to complete the adjustable rate note 1 Year Treasury Fannie Mae

Completing the adjustable rate note involves several key steps to ensure accuracy and compliance. Start by gathering all necessary personal and financial information, including income details and employment history. Next, carefully fill out the form, ensuring that all sections are completed accurately. Pay special attention to the interest rate terms and adjustment periods, as these will affect your mortgage payments. Once the form is filled out, review it for any errors before signing. Using a reliable eSigning platform can streamline this process, ensuring that your document is securely signed and stored.

Key elements of the adjustable rate note 1 Year Treasury Fannie Mae

Several key elements define the adjustable rate note. These include the loan amount, interest rate, adjustment intervals, and the index used for rate adjustments, which in this case is the 1 Year Treasury. Additionally, the note outlines the terms of payment, including the frequency of payments and any potential caps on rate increases. Understanding these elements is essential for borrowers to anticipate future payment changes and manage their finances effectively.

Legal use of the adjustable rate note 1 Year Treasury Fannie Mae

The legal use of the adjustable rate note is governed by various federal and state regulations. It is essential for borrowers to understand their rights and obligations under the note. The note must comply with the requirements set forth by the Consumer Financial Protection Bureau (CFPB) and other relevant authorities. This includes ensuring that all disclosures are made to the borrower, such as the terms of the adjustable rate and potential risks associated with rate changes. Legal compliance helps protect both the lender and the borrower throughout the loan process.

How to obtain the adjustable rate note 1 Year Treasury Fannie Mae

Obtaining the adjustable rate note involves contacting a lender or financial institution that offers Fannie Mae products. Borrowers can request the note directly from their lender or access it through official Fannie Mae channels. It is advisable to compare different lenders to find the best terms and conditions. Once the appropriate lender is chosen, the borrower can initiate the application process, which will include submitting necessary documentation and completing the note.

Examples of using the adjustable rate note 1 Year Treasury Fannie Mae

Examples of using the adjustable rate note can vary based on individual financial situations. For instance, a borrower may choose this note if they anticipate interest rates will remain stable or decrease over the next few years. Another example could involve a borrower who plans to sell their home before the first adjustment period, allowing them to benefit from lower initial rates without facing potential rate increases. Understanding these scenarios can help borrowers make strategic decisions regarding their mortgage options.

Quick guide on how to complete adjustable rate note 1 year treasury fannie mae

Complete ADJUSTABLE RATE NOTE 1 Year Treasury Fannie Mae effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Manage ADJUSTABLE RATE NOTE 1 Year Treasury Fannie Mae on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to alter and eSign ADJUSTABLE RATE NOTE 1 Year Treasury Fannie Mae with ease

- Find ADJUSTABLE RATE NOTE 1 Year Treasury Fannie Mae and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight key sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from a device of your preference. Modify and eSign ADJUSTABLE RATE NOTE 1 Year Treasury Fannie Mae and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct adjustable rate note 1 year treasury fannie mae

Create this form in 5 minutes!

People also ask

-

What is Fannie Mae 2, and how does it relate to airSlate SignNow?

Fannie Mae 2 refers to specific guidelines and policies set forth by Fannie Mae for mortgage lending. AirSlate SignNow simplifies the document signing process related to Fannie Mae 2 compliance, enabling users to securely eSign and manage documents efficiently.

-

How much does airSlate SignNow cost for Fannie Mae 2 document processing?

AirSlate SignNow offers various pricing plans to accommodate different business needs, including specific packages designed for Fannie Mae 2 document processing. You can choose from monthly or annual subscriptions, ensuring you have a cost-effective solution that meets your requirements without compromising on features.

-

What features does airSlate SignNow provide for managing Fannie Mae 2 documents?

AirSlate SignNow offers robust features like customizable templates, secure eSigning, and document tracking specifically for Fannie Mae 2 documentation. These tools facilitate seamless workflows and ensure compliance with regulatory standards while enhancing productivity.

-

Can I integrate airSlate SignNow with other software for Fannie Mae 2 processes?

Yes, airSlate SignNow integrates with various software solutions, making it easy to manage Fannie Mae 2 processes. Whether you use CRM systems or cloud storage services, its integration capabilities ensure smooth operations and efficient document handling.

-

Is airSlate SignNow secure for handling Fannie Mae 2 documents?

Absolutely! AirSlate SignNow is designed with security in mind, implementing advanced encryption and security protocols to protect Fannie Mae 2 documents. Your sensitive information is safeguarded, giving you peace of mind while eSigning and sharing critical documents.

-

What are the benefits of using airSlate SignNow for Fannie Mae 2 workflows?

Using airSlate SignNow for Fannie Mae 2 workflows greatly enhances efficiency and reduces turnaround time for document processing. Its user-friendly interface and automation features allow businesses to optimize their workflows, ultimately increasing productivity and ensuring compliance.

-

Can I access airSlate SignNow on mobile for Fannie Mae 2 document signing?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage Fannie Mae 2 document signing on the go. Whether you’re in the office or out in the field, you can easily eSign and track documents right from your smartphone or tablet.

Get more for ADJUSTABLE RATE NOTE 1 Year Treasury Fannie Mae

- Name and address of nearest relative not living with you form

- Defendant gives notice that these interrogatories are continuing in nature and form

- Interrogatories mva p dbreen goril law form

- Form of amended and restated operating agreement

- Affidavit of jurisdiction over a non resident 275 forms

- Form 240 rev 1010 the family court of the state of delaware

- Get the form 241 affidavit that a partys address is unknown

- Instructions to the petitioner for accomplishing publication form

Find out other ADJUSTABLE RATE NOTE 1 Year Treasury Fannie Mae

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement