Form 3502 2001

What is the Form 3502

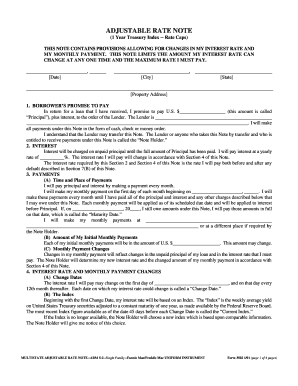

The Fannie Mae home equity note form, commonly referred to as Form 3502, is a legal document used in the context of home equity loans. This form outlines the terms and conditions of the loan agreement between the borrower and the lender. It serves as a binding contract that details the amount borrowed, interest rates, repayment terms, and other critical information necessary for both parties. Understanding this form is essential for homeowners seeking to leverage their home equity for financial needs.

How to use the Form 3502

Using Form 3502 involves several steps to ensure that all necessary information is accurately provided. First, borrowers should gather relevant personal and financial information, including income details, existing debts, and property value. Next, fill out the form with precise data, ensuring that all sections are completed. Once completed, the form must be signed by both the borrower and the lender to validate the agreement. It is crucial to retain copies of the signed form for personal records and future reference.

Steps to complete the Form 3502

Completing the Fannie Mae home equity note form requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and contact details.

- Provide information about the property, such as its address and current market value.

- Detail the loan amount you are requesting and the purpose of the loan.

- Specify the interest rate and repayment terms, including the duration of the loan.

- Review the completed form for accuracy and completeness.

- Sign the form and ensure the lender also provides their signature.

Legal use of the Form 3502

The legal use of Form 3502 is governed by various regulations that ensure its validity as a binding contract. For the form to be legally enforceable, it must be signed by both parties, and the terms must comply with state and federal laws regarding home equity loans. Additionally, electronic signatures are recognized under the ESIGN and UETA acts, provided that certain conditions are met. This ensures that the form holds legal weight in any disputes or claims that may arise.

Key elements of the Form 3502

Several key elements are essential to the Fannie Mae home equity note form. These include:

- Loan Amount: The total amount of money being borrowed.

- Interest Rate: The percentage charged on the loan amount.

- Repayment Terms: The schedule for repaying the loan, including monthly payment amounts.

- Borrower Information: Details about the borrower, including identification and financial status.

- Lender Information: Details about the lending institution.

Form Submission Methods

Submitting the Fannie Mae home equity note form can be done through various methods. Borrowers may choose to submit the form electronically, which is often faster and more efficient. Alternatively, the form can be mailed to the lender or submitted in person at a local branch office. It is important to confirm the preferred submission method with the lender to ensure timely processing of the loan application.

Quick guide on how to complete form 3502 21983205

Prepare Form 3502 easily on any device

Digital document management has gained traction among businesses and individuals. It represents an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Manage Form 3502 on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest method to edit and eSign Form 3502 effortlessly

- Find Form 3502 and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information using tools offered by airSlate SignNow designed specifically for that purpose.

- Create your eSignature via the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all details and then hit the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the risk of lost or misplaced documents, tedious form navigation, or errors that require printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 3502 and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3502 21983205

Create this form in 5 minutes!

How to create an eSignature for the form 3502 21983205

The best way to create an eSignature for your PDF document in the online mode

The best way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is the Fannie Mae home equity note form?

The Fannie Mae home equity note form is a standardized document used by lenders to secure a loan against a borrower's home equity. This form outlines the terms of the loan, including the repayment schedule and interest rate. Using this form helps ensure compliance with Fannie Mae guidelines.

-

How can I access the Fannie Mae home equity note form?

You can easily access the Fannie Mae home equity note form through our platform, which provides a user-friendly interface for downloading and filling out the document. Simply visit our airSlate SignNow landing page to find the form and related instructions. This ensures a seamless and efficient process for your home equity loan needs.

-

What are the benefits of using the Fannie Mae home equity note form?

Using the Fannie Mae home equity note form offers multiple benefits, such as ensuring standardization and compliance with lending guidelines. This form helps protect both lenders and borrowers by clearly outlining terms. Additionally, the ease of use contributes to faster processing times for home equity loans.

-

Are there any costs associated with obtaining the Fannie Mae home equity note form?

Obtaining the Fannie Mae home equity note form through airSlate SignNow is entirely free. There are no hidden fees or charges for downloading and using the document. Our goal is to provide cost-effective solutions that empower you to manage your home equity loans seamlessly.

-

How can airSlate SignNow help with eSigning the Fannie Mae home equity note form?

AirSlate SignNow enables you to easily eSign the Fannie Mae home equity note form online. Our platform allows for secure and legally binding electronic signatures, making the process quick and convenient. This feature ensures that your documents are signed and returned in no time, facilitating faster loan processing.

-

Is the Fannie Mae home equity note form compatible with other document management tools?

Yes, the Fannie Mae home equity note form is compatible with various document management tools available on airSlate SignNow. Our platform offers integrations with popular software, enhancing your workflow efficiency. This seamless integration allows you to manage your documents and signatures in one central location.

-

What features does airSlate SignNow offer for managing the Fannie Mae home equity note form?

AirSlate SignNow provides an array of features for managing the Fannie Mae home equity note form, such as customizable templates, secure storage, and real-time tracking of document status. Our platform simplifies the creation, signing, and storage of important documents, ensuring you never lose track of your paperwork.

Get more for Form 3502

Find out other Form 3502

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors