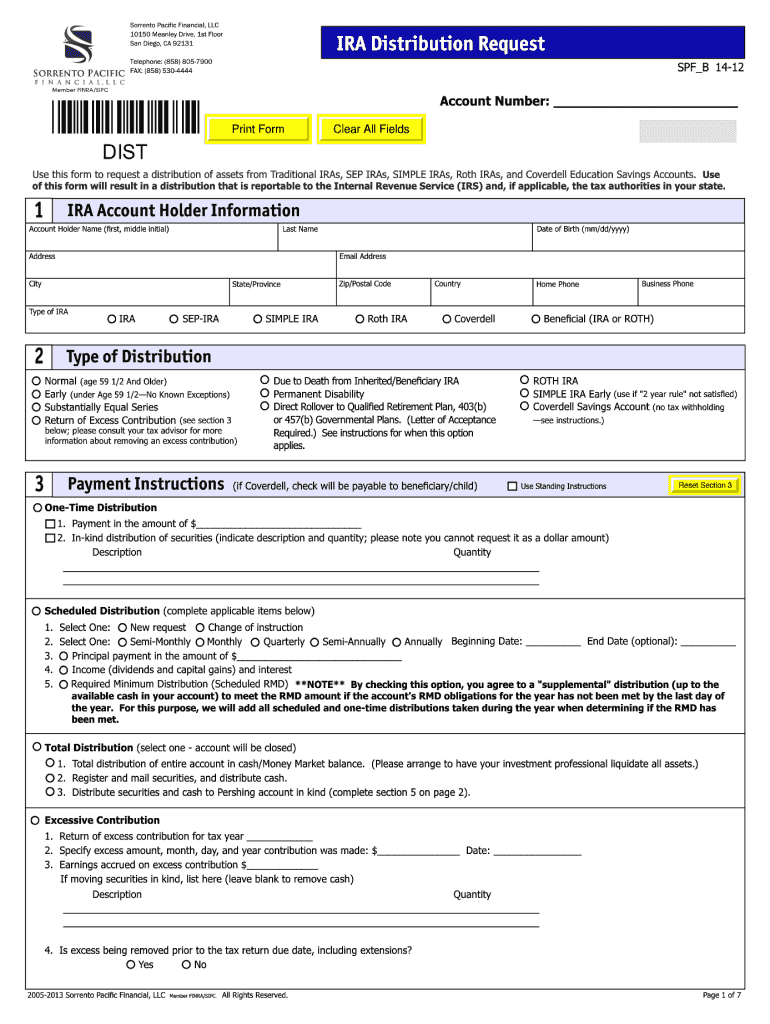

Ira Distibution Request Sorrento Pacific Form

What is the Etrade Coverdell Form?

The Etrade Coverdell form is a crucial document used to manage and request distributions from a Coverdell Education Savings Account (ESA). This account is designed to help families save for educational expenses, including tuition, fees, books, and other related costs for elementary, secondary, and post-secondary education. Understanding the purpose and function of this form is essential for account holders who wish to access their funds for educational purposes.

Steps to Complete the Etrade Coverdell Form

Completing the Etrade Coverdell form involves several key steps to ensure accuracy and compliance with IRS regulations. Here’s a simplified process:

- Gather Required Information: Collect necessary personal information, including your account number, the beneficiary's details, and the amount you wish to withdraw.

- Fill Out the Form: Carefully enter your information in the designated fields. Ensure that all details are correct to avoid processing delays.

- Review the Form: Double-check all entries for accuracy. Mistakes can lead to complications in the distribution process.

- Submit the Form: Choose your preferred method of submission, whether online, by mail, or in person, and ensure it reaches Etrade promptly.

Legal Use of the Etrade Coverdell Form

The Etrade Coverdell form must be completed in accordance with IRS guidelines to ensure that distributions are legally valid. This includes adhering to rules regarding qualified education expenses and the age limits for beneficiaries. Misuse of the funds or improper completion of the form can result in tax penalties and the loss of tax advantages associated with the Coverdell ESA.

Eligibility Criteria for Etrade Coverdell Distributions

To qualify for distributions from a Coverdell ESA, certain eligibility criteria must be met. The beneficiary must be under the age of thirty, and the funds must be used for qualified education expenses. Additionally, contributions to the Coverdell must not exceed the annual limit set by the IRS. Understanding these criteria is crucial for account holders to ensure compliance and avoid potential penalties.

Form Submission Methods

The Etrade Coverdell form can be submitted through various methods to accommodate different preferences. Options include:

- Online Submission: Many users prefer to submit their forms electronically through the Etrade platform, ensuring quick processing.

- Mail: For those who prefer traditional methods, forms can be printed and mailed to the appropriate Etrade address.

- In-Person: Some account holders may choose to visit an Etrade branch to submit their forms directly.

IRS Guidelines for Etrade Coverdell Distributions

It is essential for account holders to be aware of IRS guidelines regarding Coverdell distributions. These guidelines specify what constitutes a qualified education expense and outline the tax implications of distributions. Familiarizing oneself with these regulations helps ensure that the funds are used appropriately and that account holders remain compliant with tax laws.

Quick guide on how to complete ira distibution request sorrento pacific form

Effortlessly Prepare Ira Distibution Request Sorrento Pacific Form on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without any holdups. Manage Ira Distibution Request Sorrento Pacific Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

How to Modify and eSign Ira Distibution Request Sorrento Pacific Form with Ease

- Obtain Ira Distibution Request Sorrento Pacific Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign Ira Distibution Request Sorrento Pacific Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

Do military personnel need money to fill out a leave request form?

It’s great that you asked. The answer is NO. Also, whatever you are doing with this person, STOP!Bloody hell, how many of these “I need your money to see you sweetheart” scammers are there? It’s probably that or someone totally misunderstood something.All military paperwork is free! However, whether their commander or other sort of boss will let them return or not depends on the nature of duty, deployment terms, and other conditions. They can’t just leave on a whim, that would be desertion and it’s (sorry I don’t know how it works in America) probably punishable by firing (as in termination of job) or FIRING (as in execution)!!!Soldiers are generally paid enough to fly commercial back to home country.Do not give these people any money or any contact information! If you pay him, you’ll probably get a receipt from Nigeria and nothing else.

-

Does a girlfriend have to fill out a leave request form for a US Army Soldier in Special Operations in Africa?

Let me guess, you've been contacted via email by somebody you’ve never met. they've told you a story about being a deployed soldier. At some stage in the dialogue they’ve told you about some kind of emotional drama, sick relative/kid etc. They tell you that because they are in a dangerous part of the world with no facilities they need you to fill in a leave application for them. Some part of this process will inevitably involve you having to pay some money on their behalf. The money will need to be paid via ‘Western Union’. Since you havent had much involvement with the military in the past you dont understand and are tempted to help out this poor soldier. they promise to pay you back once they get back from war.if this sounds familiar you are being scammed. There is no soldier just an online criminal trying to steal your money. If you send any money via Western Union it is gone, straight into the pockets of the scammer. you cant get it back, it is not traceable, this is why scammers love Western Union. They aernt going to pay you back, once they have your money you will only hear from them again if they think they can double down and squeeze more money out of you.Leave applications need to be completed by soldiers themselves. They are normally approved by their unit chain of command. If there is a problem the soldier’s commander will summon them internally to resolve the issue. This is all part of the fun of being a unit commander!! If the leave is not urgent they will wait for a convenient time during a rotation etc to work out the problems, if the leave is urgent (dying parent/spouse/kid etc) they will literally get that soldier out of an operational area ASAP. Operational requirements come first but it would need to be something unthinkable to prevent the Army giving immediate emergency leave to somebody to visit their dying kid in hospital etc.The process used by the scammers is known as ‘Advance fee fraud’ and if you want to read about the funny things people do to scam the scammers have a read over on The largest scambaiting community on the planet!

-

I recently opened a Fidelity Roth IRA and it says my account is closed and I need to submit a W-9 form. Can anyone explain how this form relates to an IRA and why I need to fill it out?

Financial institutions are required to obtain tax ID numbers when opening an account, and the fact that it's an IRA doesn't exempt them from that requirement. They shouldn't have opened it without the W-9 in the first place, but apparently they did. So now they had to close it until they get the required documentation.

Create this form in 5 minutes!

How to create an eSignature for the ira distibution request sorrento pacific form

How to make an electronic signature for your Ira Distibution Request Sorrento Pacific Form in the online mode

How to generate an eSignature for your Ira Distibution Request Sorrento Pacific Form in Google Chrome

How to make an eSignature for putting it on the Ira Distibution Request Sorrento Pacific Form in Gmail

How to make an eSignature for the Ira Distibution Request Sorrento Pacific Form straight from your smartphone

How to make an eSignature for the Ira Distibution Request Sorrento Pacific Form on iOS

How to make an electronic signature for the Ira Distibution Request Sorrento Pacific Form on Android OS

People also ask

-

What is an Etrade Coverdell account?

An Etrade Coverdell account is an education savings account that allows individuals to save for educational expenses. This type of account provides tax-free growth on investments and tax-free withdrawals for qualified education costs. It's a great option for families planning for their children's future education.

-

How can airSlate SignNow assist with Etrade Coverdell documentation?

airSlate SignNow streamlines the process of managing Etrade Coverdell documentation by providing a platform for electronic signatures and secure document management. Users can easily send, sign, and store important documents related to their Coverdell accounts. This simplifies the paperwork involved in setting up and managing educational savings.

-

What are the benefits of using airSlate SignNow for my Etrade Coverdell?

Using airSlate SignNow for your Etrade Coverdell offers several benefits including speed, security, and ease of use. The platform ensures that all documents are processed quickly, reducing delays in account management. Additionally, the security features protect sensitive information related to your educational savings.

-

Is there a cost to use airSlate SignNow for Etrade Coverdell?

airSlate SignNow offers a cost-effective solution with various pricing plans that cater to different business needs. Users can benefit from lower operational costs while managing their Etrade Coverdell documentation. Detailed pricing information can be accessed on the airSlate SignNow website.

-

Can I integrate airSlate SignNow with my existing financial software for Etrade Coverdell?

Yes, airSlate SignNow integrates seamlessly with various financial software, enhancing your ability to manage an Etrade Coverdell account. This integration allows for easy transfer of information and increases efficiency in your documentation process. You can connect your tools to simplify your workflows.

-

What features does airSlate SignNow provide for Etrade Coverdell users?

airSlate SignNow provides features such as electronic signatures, document templates, and tracking capabilities for Etrade Coverdell users. These features facilitate smooth document flow and ensure compliance with regulations. Additionally, it simplifies the process of sending documents for signatures without the need for physical paperwork.

-

How secure is using airSlate SignNow for my Etrade Coverdell documents?

airSlate SignNow prioritizes security, utilizing encryption and secure authentication processes to protect your Etrade Coverdell documents. All transactions are monitored and compliant with industry standards, ensuring the confidentiality of your financial information. You can trust that your documents are safe with airSlate SignNow.

Get more for Ira Distibution Request Sorrento Pacific Form

Find out other Ira Distibution Request Sorrento Pacific Form

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy