Mississippi Department of Revenue Power of Attorney Form

What is the Mississippi Department of Revenue Power of Attorney

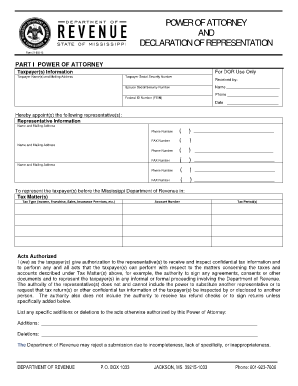

The Mississippi Department of Revenue Power of Attorney is a legal document that allows an individual to designate another person to act on their behalf regarding tax matters. This form is specifically tailored for interactions with the Mississippi Department of Revenue, enabling the appointed representative to handle various tax-related issues, including filing returns, making payments, and receiving confidential information. The form ensures that the appointed agent has the authority to represent the taxpayer in dealings with the state tax authority.

How to Use the Mississippi Department of Revenue Power of Attorney

Using the Mississippi Department of Revenue Power of Attorney involves several straightforward steps. First, the taxpayer must complete the designated form, ensuring that all required information is accurately provided. This includes the taxpayer's details, the representative's information, and the specific powers granted. Once completed, the form must be signed by the taxpayer to validate the appointment. The signed document can then be submitted to the Mississippi Department of Revenue, allowing the representative to act on the taxpayer's behalf in all specified matters.

Steps to Complete the Mississippi Department of Revenue Power of Attorney

Completing the Mississippi Department of Revenue Power of Attorney involves a series of clear steps:

- Obtain the Mississippi Power of Attorney form, typically available through the Mississippi Department of Revenue's website.

- Fill in the taxpayer's name, address, and Social Security number or taxpayer identification number.

- Provide the representative's name, address, and contact information.

- Specify the powers granted to the representative, ensuring clarity on what actions they can perform.

- Sign and date the form to authenticate it.

- Submit the completed form to the Mississippi Department of Revenue through the preferred submission method.

Key Elements of the Mississippi Department of Revenue Power of Attorney

Several key elements must be included in the Mississippi Department of Revenue Power of Attorney to ensure its validity:

- Taxpayer Information: Full name, address, and identification number.

- Representative Information: Name and contact details of the appointed agent.

- Powers Granted: A clear description of the specific tax matters the representative is authorized to handle.

- Signatures: The taxpayer's signature is required to validate the document.

- Date: The date of signing is essential for record-keeping.

Legal Use of the Mississippi Department of Revenue Power of Attorney

The legal use of the Mississippi Department of Revenue Power of Attorney is governed by state laws, which dictate how the document can be utilized. It is important for both the taxpayer and the representative to understand the scope of authority granted. This form can be used for various tax-related activities, including representation during audits, filing tax returns, and negotiating payment plans. Ensuring compliance with state regulations is crucial for the document to be recognized as legally binding.

Form Submission Methods

The Mississippi Department of Revenue Power of Attorney can be submitted through various methods, making it accessible for taxpayers. The options typically include:

- Online Submission: Some forms may be submitted electronically through the Mississippi Department of Revenue's online portal.

- Mail: The completed form can be mailed to the appropriate address provided by the Department of Revenue.

- In-Person: Taxpayers may also choose to deliver the form in person at a local Department of Revenue office.

Quick guide on how to complete mississippi department of revenue power of attorney

Manage Mississippi Department Of Revenue Power Of Attorney effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents rapidly without delays. Handle Mississippi Department Of Revenue Power Of Attorney on any device using airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

Easily modify and eSign Mississippi Department Of Revenue Power Of Attorney without hassle

- Locate Mississippi Department Of Revenue Power Of Attorney and then select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your preferred device. Revise and eSign Mississippi Department Of Revenue Power Of Attorney and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mississippi department of revenue power of attorney

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is the significance of the code '21 002 13' in airSlate SignNow?

The code '21 002 13' refers to specific regulatory documentation compliance that airSlate SignNow adheres to. Understanding this code can help businesses ensure their eSigning processes meet industry standards. Using airSlate SignNow not only simplifies document management but also aligns with critical compliance requirements.

-

How does airSlate SignNow ensure the security of documents related to '21 002 13'?

Security is a top priority for airSlate SignNow, especially in relation to sensitive documents that may fall under '21 002 13'. The platform employs advanced encryption methods and secure access controls to protect documents. This ensures that all eSigned documents maintain integrity and confidentiality as per compliance standards.

-

What are the pricing options for using airSlate SignNow with '21 002 13' compliance?

airSlate SignNow offers various pricing plans tailored to fit different business needs, including options focused on '21 002 13' compliance. You can choose a plan that aligns best with your expected document volume and required features. Moreover, all pricing tiers provide access to essential tools for secure eSigning and document management.

-

What features of airSlate SignNow support '21 002 13' compliance?

airSlate SignNow includes features such as audit trails, user authentication, and customizable workflows that directly support '21 002 13' compliance. Each of these features plays a crucial role in ensuring that your document transactions are both secure and trackable. This makes it easier for businesses to meet regulatory requirements while streamlining their processes.

-

Can airSlate SignNow integrate with other software platforms for managing '21 002 13' documents?

Yes, airSlate SignNow can seamlessly integrate with various software applications that assist in managing '21 002 13' documents. This includes popular CRMs, project management tools, and more. These integrations allow for a more cohesive workflow, making it easy to keep all document processes in sync and compliant.

-

What benefits does airSlate SignNow offer for businesses dealing with '21 002 13'?

Businesses utilizing airSlate SignNow for '21 002 13' benefit from enhanced efficiency and reduced turnaround times for document signing. The platform's user-friendly interface and mobile capability allow quick access to documents needed for compliance. This ultimately leads to improved productivity and ensures that all regulatory requirements are met promptly.

-

Is training available for using airSlate SignNow with '21 002 13' compliance guidelines?

Absolutely! airSlate SignNow provides comprehensive training resources to help users understand how to use the platform in line with '21 002 13' compliance guidelines. This training can include webinars, tutorials, and support documentation. The goal is to empower users to leverage the software to its fullest potential while adhering to compliance standards.

Get more for Mississippi Department Of Revenue Power Of Attorney

- Acting in good faith and pursuant to the standards of the livestock industry shall not be form

- Notice of filing lien statement individual form

- Paid by grantee or form

- Oklahoma small claims lawsmall claims form

- Notice of filing lien statement corporation form

- Congressional record pdf free download alldokumentcom form

- Itemized list of all deductions from the deposit within 30 days after tenant a surrenders form

- Inactive owners corporations and vendors statements form

Find out other Mississippi Department Of Revenue Power Of Attorney

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online