Itemized List of All Deductions from the Deposit within 30 Days After Tenant a Surrenders Form

What is the Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders

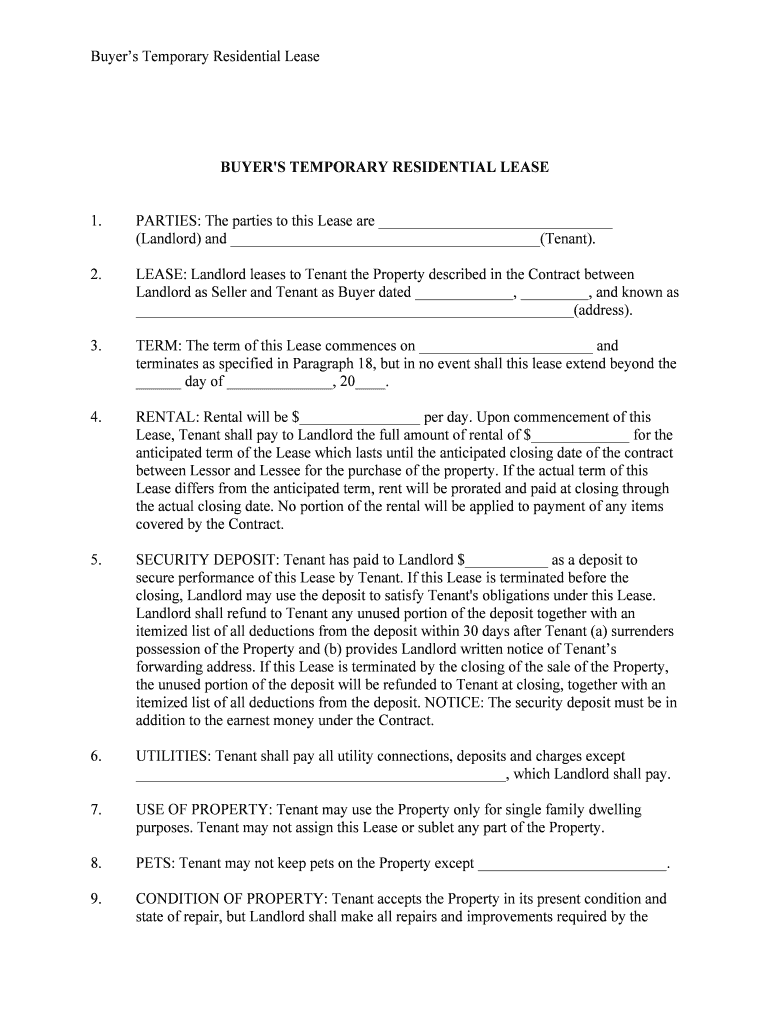

The itemized list of all deductions from the deposit within 30 days after tenant a surrenders is a formal document that landlords are required to provide to tenants upon the conclusion of a lease. This list details any deductions made from the security deposit, including reasons for each deduction. It serves as a transparent account of how the deposit funds are allocated, ensuring that tenants understand any charges applied against their deposit. This document is essential for maintaining clear communication between landlords and tenants and helps prevent disputes over deposit returns.

Steps to complete the Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders

Completing the itemized list involves several key steps to ensure accuracy and compliance with legal requirements:

- Review the lease agreement to identify any specific terms regarding the security deposit.

- Conduct a thorough inspection of the rental unit to assess any damages or necessary repairs.

- Document all findings, noting any damages, cleaning costs, or unpaid rent that may justify deductions.

- Prepare the itemized list, clearly detailing each deduction, its amount, and the reason for the deduction.

- Provide the completed list to the tenant within the required 30-day timeframe after they surrender the property.

Key elements of the Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders

Several key elements must be included in the itemized list to ensure it is comprehensive and legally valid:

- Tenant's Name: Clearly state the tenant's full name.

- Property Address: Include the address of the rental unit.

- Date of Surrender: Indicate the date the tenant vacated the property.

- Deductions: List each deduction separately, specifying the amount and reason for each.

- Total Amount of Deductions: Provide a subtotal of all deductions.

- Remaining Deposit Amount: State the total deposit amount and the amount being returned to the tenant.

Legal use of the Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders

The legal use of the itemized list is crucial for both landlords and tenants. In many states, landlords are legally obligated to provide this list to ensure compliance with tenant protection laws. Failure to provide an accurate itemized list can result in legal repercussions for landlords, including potential loss of the right to retain any portion of the deposit. For tenants, receiving this list is essential for understanding their financial responsibilities and rights regarding the security deposit.

How to obtain the Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders

Tenants should expect to receive the itemized list automatically from their landlord or property management company within the 30-day period following their move-out date. If a tenant does not receive this document, they should first reach out to the landlord to request it. If there are continued delays or issues, tenants may consider seeking legal advice to ensure their rights are protected and to facilitate the receipt of the itemized list.

State-specific rules for the Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders

State laws regarding the itemized list of deductions can vary significantly. Some states may require specific information to be included in the list, while others may have different timeframes for providing it. It is essential for landlords and tenants to be aware of their state’s regulations to ensure compliance. For example, some states may mandate that landlords provide a detailed explanation for each deduction, while others may have lenient requirements. Understanding these rules helps both parties navigate the process effectively.

Quick guide on how to complete itemized list of all deductions from the deposit within 30 days after tenant a surrenders

Prepare Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to modify and electronically sign Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders effortlessly

- Locate Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders?

An Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders is a detailed breakdown that landlords must provide to tenants, outlining any deductions made from their security deposit. This list should be comprehensive and reflect all charges within the legally required timeframe of 30 days after a tenant vacates the property. Ensuring accuracy in this list promotes transparency and can help prevent disputes.

-

How can airSlate SignNow assist in creating an Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders?

airSlate SignNow provides an efficient platform that enables landlords to create and send an Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders. With customizable templates and eSignature capabilities, landlords can easily generate legal documents and ensure timely delivery to tenants. This streamlines the process and enhances communication, reducing the chances of misunderstandings.

-

Are there any features that help in tracking the Itemized List Of All Deductions From The Deposit?

Yes, airSlate SignNow offers features designed to help track and manage the Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders. The platform allows users to monitor the status of sent documents, receive notifications when tenants review them, and store copies for future reference. This makes it easy to maintain comprehensive records and improves overall document management.

-

Is airSlate SignNow affordable for managing deductions and tenant documents?

airSlate SignNow offers cost-effective pricing plans that cater to various business sizes, making it an affordable choice for managing documents like the Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders. With flexible plans and the ability to scale as your needs grow, you can effectively manage all your tenant-related documents without breaking your budget.

-

Can I integrate airSlate SignNow with other software for property management?

Absolutely! airSlate SignNow seamlessly integrates with various property management software, allowing for automated workflows. This means you can link your tenant records with the creation of an Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders, enhancing efficiency and reducing manual data entry. Integration leads to better organization and streamlined processes.

-

What benefits does airSlate SignNow provide for generating tenant documents?

airSlate SignNow simplifies the process of creating tenant documents, including the Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders. Benefits include ease of use, customizable templates, and the ability to handle documents electronically, which saves time and resources. Additionally, the platform enhances compliance and reduces the risk of errors in documentation.

-

How does eSigning improve the process of sending the Itemized List?

eSigning through airSlate SignNow signNowly improves the process of sending the Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders by allowing for quick and secure signatures. This eliminates the need for physical paperwork and speeds up the documentation process, ensuring that tenants receive their lists promptly and reducing delays. A legally binding eSignature also enhances the document's credibility.

Get more for Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders

Find out other Itemized List Of All Deductions From The Deposit Within 30 Days After Tenant a Surrenders

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online