Form 770ES, Virginia Estimated Income Tax Payment Vouchers for Estates, Trusts, and Unified Nonresidents 2021

What is the Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents

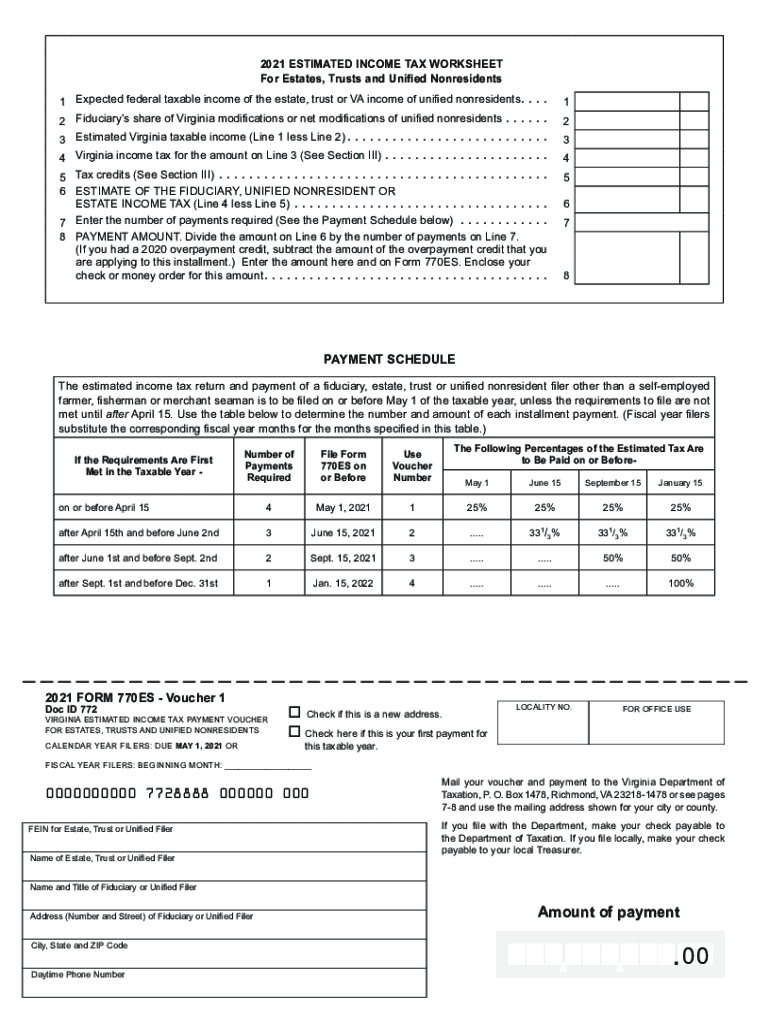

The Form 770ES is a crucial document used for making estimated income tax payments in Virginia, specifically designed for estates, trusts, and unified nonresidents. This form allows these entities to fulfill their tax obligations on a quarterly basis, ensuring compliance with state tax regulations. It is essential for managing tax liabilities effectively and avoiding penalties associated with underpayment.

How to use the Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents

Using the Form 770ES involves a straightforward process. First, determine the estimated tax liability based on income projections for the year. Next, fill out the form with accurate information, including the entity's name, address, and tax identification number. The completed form can then be submitted along with the estimated payment. It is advisable to keep a copy of the form and payment confirmation for your records.

Steps to complete the Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents

Completing the Form 770ES requires careful attention to detail. Follow these steps:

- Gather necessary financial information, including income statements and previous tax returns.

- Calculate the estimated tax liability for the year.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the form along with the payment by the due date.

Legal use of the Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents

The Form 770ES is legally recognized for tax purposes in Virginia. When filled out correctly and submitted on time, it serves as a valid method for fulfilling estimated tax obligations. Compliance with state tax laws is crucial to avoid penalties, and using this form ensures adherence to legal requirements for estates and trusts.

Filing Deadlines / Important Dates

Timely filing of the Form 770ES is essential to avoid penalties. Payments are typically due on the 15th of April, June, September, and January for the respective quarters. It is important to be aware of these deadlines to ensure compliance and avoid interest on late payments.

Form Submission Methods (Online / Mail / In-Person)

The Form 770ES can be submitted through various methods. Taxpayers have the option to file online, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate Virginia tax office. In-person submissions may also be possible at designated tax offices. Each method should ensure that the form is submitted by the deadline to avoid penalties.

Key elements of the Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents

Key elements of the Form 770ES include the entity's identification details, the estimated payment amounts, and the payment period. Accurate completion of these elements is vital for the form's validity. Additionally, ensuring that the form is signed and dated is essential for legal compliance.

Quick guide on how to complete 2021 form 770es virginia estimated income tax payment vouchers for estates trusts and unified nonresidents

Complete Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, alter, and eSign your documents swiftly without delays. Manage Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents effortlessly

- Locate Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, the hassle of searching for forms, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and eSign Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 770es virginia estimated income tax payment vouchers for estates trusts and unified nonresidents

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 770es virginia estimated income tax payment vouchers for estates trusts and unified nonresidents

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

How to create an e-signature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

How to create an e-signature for a PDF file on Android

People also ask

-

What is Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents?

Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents, is used to make estimated income tax payments in Virginia for various entities. This form helps ensure compliance with Virginia tax laws by enabling trusts and estates to report and pay estimated taxes accurately ahead of the due dates.

-

How can airSlate SignNow help with Form 770ES submission?

airSlate SignNow streamlines the process of preparing and submitting Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents, by providing easy-to-use eSigning and document management features. This allows users to complete and send their tax forms quickly and securely, reducing the hassle of manual paperwork.

-

What are the pricing options for using airSlate SignNow to manage Form 770ES?

airSlate SignNow offers flexible pricing plans that cater to different user needs, whether for individuals or businesses handling Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents. Pricing is competitive and includes various features that enhance document management and signing, ensuring you get the best value for your money.

-

Are there any specific features of airSlate SignNow that assist with tax documents like Form 770ES?

Yes, airSlate SignNow includes features such as templates specifically designed for tax forms, including Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents. Additionally, it offers audit trials and secure storage, ensuring that all your documents are organized and compliant with regulatory standards.

-

What benefits does airSlate SignNow provide for filing Form 770ES?

Using airSlate SignNow for filing Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents, allows for quicker processing times and less paperwork due to its efficient electronic signing feature. Furthermore, users can keep track of their submissions and receive reminders for due dates, ensuring timely compliance with Virginia tax regulations.

-

Can airSlate SignNow integrate with other accounting software for tax preparation?

Absolutely, airSlate SignNow offers integrations with popular accounting software, allowing users to easily manage their tax documents and Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents, directly from their preferred platforms. This integration reduces data entry errors and streamlines the overall tax preparation process.

-

Is it possible to track the status of Form 770ES submissions through airSlate SignNow?

Yes, airSlate SignNow provides users with the ability to track the status of their Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents, submissions. This feature allows you to verify when documents have been signed and submitted, providing peace of mind and ensuring you meet all deadlines.

Get more for Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents

- Employment of sales representative to sell wholesale beauty form

- Employment agreement with cook who has a learning disability form

- Record label contract samplertf google docs form

- Promotional letter bridal shop form

- Exhibit 101 exclusive recording artist agreement with form

- Business sale agreement templatesole proprietorship form

- Subscription agreement joint state government commission form

- Notary public manual hawaii ag hawaiigov form

Find out other Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe