Form 770ES, Virginia Estimated Income Tax Payment Vouchers for Estates, Trusts, and Unified Nonresidents Virginia Estimated Inco 2024-2026

Understanding Form 770ES for Virginia Estimated Income Tax Payments

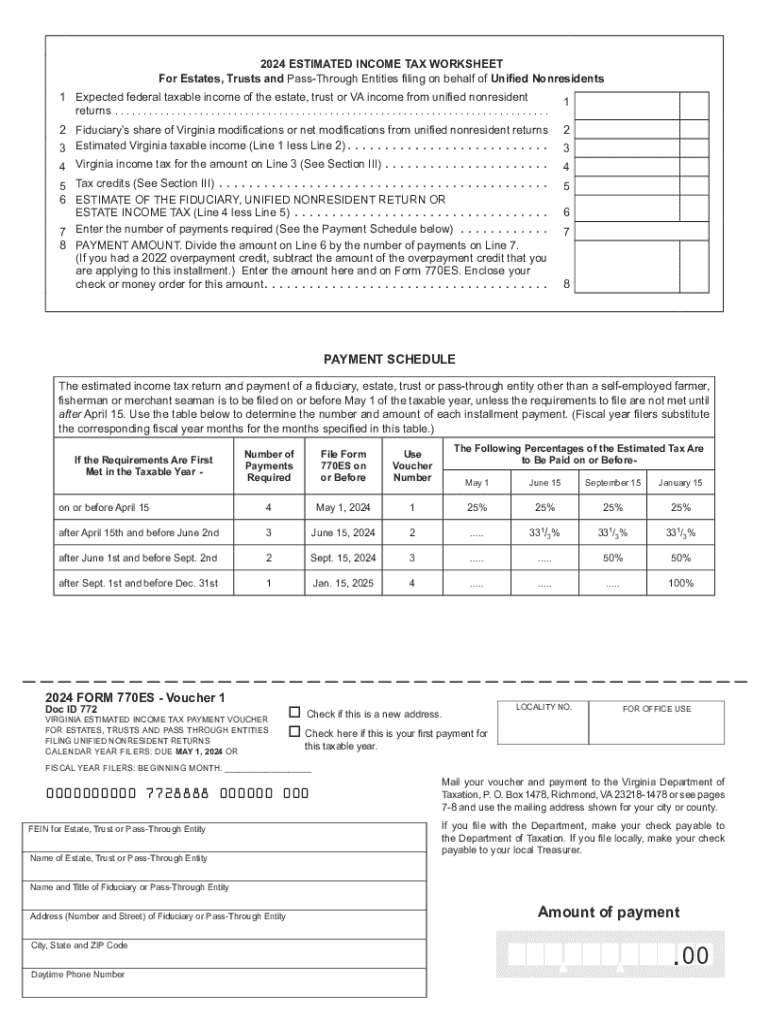

The Form 770ES is a crucial document used for making estimated income tax payments in Virginia, specifically for estates, trusts, and unified nonresidents. This form allows taxpayers to report and pay their estimated tax liabilities throughout the year, ensuring compliance with state tax regulations. It is essential for those managing estates or trusts to be aware of their tax obligations to avoid penalties and maintain good standing with the Virginia Department of Taxation.

Steps to Complete the Form 770ES

Completing the Form 770ES requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial information, including income estimates and deductions.

- Calculate the estimated tax liability based on your projected income for the year.

- Fill out the form with accurate figures, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the form along with your estimated tax payment by the specified deadlines.

Legal Use of the Form 770ES

The Form 770ES is legally recognized for reporting estimated income tax payments in Virginia. It is important for estates and trusts to use this form to fulfill their tax obligations. By submitting the form, taxpayers acknowledge their responsibility to pay the estimated taxes owed, which helps avoid legal issues and penalties associated with non-compliance.

Key Elements of the Form 770ES

Several key elements are essential when filling out the Form 770ES:

- Taxpayer Information: Include the name, address, and identification number of the estate or trust.

- Estimated Tax Calculation: Provide a detailed estimate of income and deductions to calculate the tax owed.

- Payment Information: Specify the payment amount and the period for which the payment is made.

- Signature: The form must be signed by the authorized representative of the estate or trust.

Filing Deadlines for Form 770ES

Timely submission of the Form 770ES is critical to avoid penalties. Generally, estimated tax payments are due on specific dates throughout the year. Taxpayers should be aware of the quarterly deadlines to ensure their payments are submitted on time. Missing these deadlines can result in interest and penalties, which can significantly increase the total tax liability.

Obtaining the Form 770ES

The Form 770ES can be obtained through the Virginia Department of Taxation's website or by contacting their office directly. It is important to ensure that you have the most current version of the form, as tax regulations and forms may change from year to year. Having the correct form is essential for accurate filing and compliance with state tax laws.

Create this form in 5 minutes or less

Find and fill out the correct form 770es virginia estimated income tax payment vouchers for estates trusts and unified nonresidents virginia estimated income

Create this form in 5 minutes!

How to create an eSignature for the form 770es virginia estimated income tax payment vouchers for estates trusts and unified nonresidents virginia estimated income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 770es estimated pricing for airSlate SignNow?

The 2023 770es estimated pricing for airSlate SignNow offers flexible plans tailored to meet various business needs. Our pricing is competitive and designed to provide maximum value for document signing solutions. You can choose from monthly or annual subscriptions, ensuring you find the best fit for your budget.

-

How does airSlate SignNow enhance document signing in 2023?

In 2023, airSlate SignNow enhances document signing by providing a user-friendly interface and advanced features that streamline the eSigning process. With our platform, you can easily send, sign, and manage documents from any device. This efficiency is crucial for businesses looking to save time and improve workflow.

-

What features are included in the 2023 770es estimated package?

The 2023 770es estimated package includes essential features such as customizable templates, real-time tracking, and secure cloud storage. Additionally, users benefit from advanced security measures and compliance with industry standards. These features ensure that your document signing process is both efficient and secure.

-

Can airSlate SignNow integrate with other software in 2023?

Yes, airSlate SignNow offers seamless integrations with various software applications in 2023. This includes popular tools like CRM systems, project management software, and cloud storage services. These integrations help streamline your workflow and enhance productivity by connecting all your essential tools.

-

What are the benefits of using airSlate SignNow for businesses in 2023?

Using airSlate SignNow in 2023 provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for document transactions. Businesses can save time and resources by automating the signing process, allowing teams to focus on more critical tasks. Additionally, our platform ensures compliance with legal standards.

-

Is airSlate SignNow suitable for small businesses in 2023?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses in 2023. Our cost-effective solutions and user-friendly interface make it easy for small teams to manage their document signing needs without the complexity of larger systems. This accessibility helps small businesses thrive.

-

How secure is the 2023 770es estimated solution?

The 2023 770es estimated solution from airSlate SignNow prioritizes security with advanced encryption and compliance with industry regulations. We implement robust security measures to protect your sensitive documents and ensure that your data remains confidential. Trust in our platform for secure document transactions.

Get more for Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents Virginia Estimated Inco

- Excavation contractor package wisconsin form

- Renovation contractor package wisconsin form

- Concrete mason contractor package wisconsin form

- Demolition contractor package wisconsin form

- Security contractor package wisconsin form

- Insulation contractor package wisconsin form

- Paving contractor package wisconsin form

- Site work contractor package wisconsin form

Find out other Form 770ES, Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts, And Unified Nonresidents Virginia Estimated Inco

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement