Form 770ES Viriginia Estimated Tax Payment Vouchers for Estates, Trusts and Unified Nonresidents Form 770ES Viriginia Estimated 2017

What is the Form 770ES Virginia Estimated Tax Payment Vouchers for Estates, Trusts and Unified Nonresidents

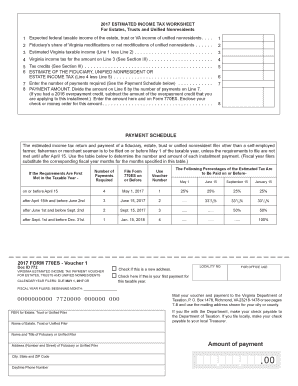

The Form 770ES Virginia Estimated Tax Payment Vouchers is a document used by estates, trusts, and unified nonresidents to make estimated tax payments to the state of Virginia. This form is essential for entities that expect to owe tax of $1,000 or more when filing their annual tax return. By using this form, taxpayers can ensure they meet their tax obligations throughout the year rather than facing a large tax bill at the end of the year.

How to Use the Form 770ES Virginia Estimated Tax Payment Vouchers

To use the Form 770ES, taxpayers must first determine their estimated tax liability for the year. This involves calculating the expected income, deductions, and credits. Once the estimated tax amount is established, the taxpayer can fill out the Form 770ES, indicating the payment amount and the due date. It is crucial to submit the form along with the payment by the specified deadlines to avoid penalties.

Steps to Complete the Form 770ES Virginia Estimated Tax Payment Vouchers

Completing the Form 770ES involves several steps:

- Gather necessary financial documents to estimate your income and deductions.

- Calculate your estimated tax liability for the year.

- Fill out the Form 770ES with your personal and financial information.

- Indicate the payment amount and the due date.

- Review the form for accuracy before submitting.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Form 770ES. Generally, estimated tax payments are due on the 15th of April, June, September, and January of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes. Taxpayers should mark these dates on their calendars to ensure timely payments.

Legal Use of the Form 770ES Virginia Estimated Tax Payment Vouchers

The Form 770ES is legally binding when filled out correctly and submitted according to Virginia tax laws. It is essential for estates, trusts, and unified nonresidents to comply with state regulations regarding estimated tax payments. Proper use of this form helps avoid legal complications and ensures that tax obligations are met in a timely manner.

Key Elements of the Form 770ES Virginia Estimated Tax Payment Vouchers

Key elements of the Form 770ES include:

- Taxpayer identification information, including name and address.

- Estimated tax payment amount.

- Payment due date.

- Signature and date of submission.

These elements are critical for processing the payment and ensuring compliance with state tax laws.

Quick guide on how to complete 2017 form 770es viriginia estimated tax payment vouchers for estates trusts and unified nonresidents 2017 form 770es viriginia

Complete Form 770ES Viriginia Estimated Tax Payment Vouchers For Estates, Trusts And Unified Nonresidents Form 770ES Viriginia Estimated effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly solution to traditional printed and signed documents, allowing you to find the correct form and securely retain it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delay. Handle Form 770ES Viriginia Estimated Tax Payment Vouchers For Estates, Trusts And Unified Nonresidents Form 770ES Viriginia Estimated on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Form 770ES Viriginia Estimated Tax Payment Vouchers For Estates, Trusts And Unified Nonresidents Form 770ES Viriginia Estimated with ease

- Locate Form 770ES Viriginia Estimated Tax Payment Vouchers For Estates, Trusts And Unified Nonresidents Form 770ES Viriginia Estimated and click Get Form to initiate.

- Employ the tools we offer to complete your document.

- Emphasize essential sections of your documents or obscure confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and click the Done button to save your modifications.

- Choose how you want to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Alter and eSign Form 770ES Viriginia Estimated Tax Payment Vouchers For Estates, Trusts And Unified Nonresidents Form 770ES Viriginia Estimated to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 form 770es viriginia estimated tax payment vouchers for estates trusts and unified nonresidents 2017 form 770es viriginia

Create this form in 5 minutes!

How to create an eSignature for the 2017 form 770es viriginia estimated tax payment vouchers for estates trusts and unified nonresidents 2017 form 770es viriginia

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to create an e-signature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

How to create an e-signature for a PDF file on Android OS

People also ask

-

What is Form 770ES Virginia Estimated Tax Payment Vouchers For Estates, Trusts And Unified Nonresidents Form 770ES Virginia Estimated Tax Payment Vouchers?

Form 770ES Virginia Estimated Tax Payment Vouchers For Estates, Trusts And Unified Nonresidents Form 770ES Virginia Estimated Tax Payment Vouchers are used to make estimated tax payments for estates and trusts in Virginia. This form helps ensure compliance with state tax regulations and assists in managing tax obligations effectively.

-

How do I fill out Form 770ES Virginia Estimated Tax Payment Vouchers?

Filling out Form 770ES Virginia Estimated Tax Payment Vouchers For Estates, Trusts And Unified Nonresidents Form 770ES Virginia Estimated Tax Payment Vouchers requires accurate financial information regarding the estate or trust. You will need to calculate the estimated tax owed and ensure all required fields are completed to prevent errors.

-

What are the deadlines for submitting Form 770ES Virginia Estimated Tax Payment Vouchers?

The deadlines for submitting Form 770ES Virginia Estimated Tax Payment Vouchers For Estates, Trusts And Unified Nonresidents Form 770ES Virginia Estimated Tax Payment Vouchers coincide with Virginia's estimated tax payment schedule. It is crucial to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

-

Can I eSign Form 770ES Virginia Estimated Tax Payment Vouchers?

Yes, you can eSign Form 770ES Virginia Estimated Tax Payment Vouchers For Estates, Trusts And Unified Nonresidents Form 770ES Virginia Estimated Tax Payment Vouchers using airSlate SignNow. Our platform provides a secure and efficient way to electronically sign and submit your tax vouchers.

-

What are the benefits of using airSlate SignNow for Form 770ES Virginia Estimated Tax Payment Vouchers?

Using airSlate SignNow for Form 770ES Virginia Estimated Tax Payment Vouchers For Estates, Trusts And Unified Nonresidents Form 770ES Virginia Estimated Tax Payment Vouchers simplifies the eSigning process. It enhances compliance, reduces paper usage, and accelerates the submission timeline for your tax obligations.

-

Is airSlate SignNow compatible with other accounting software for Form 770ES Virginia Estimated Tax Payment Vouchers?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions. This compatibility allows for efficient transfer of data related to Form 770ES Virginia Estimated Tax Payment Vouchers For Estates, Trusts And Unified Nonresidents Form 770ES Virginia Estimated Tax Payment Vouchers, streamlining your tax preparation process.

-

What is the cost of using airSlate SignNow for Form 770ES Virginia Estimated Tax Payment Vouchers?

The cost of using airSlate SignNow for Form 770ES Virginia Estimated Tax Payment Vouchers For Estates, Trusts And Unified Nonresidents Form 770ES Virginia Estimated Tax Payment Vouchers varies based on the plan you select. We offer flexible pricing options to suit your business needs without compromising on functionality or service.

Get more for Form 770ES Viriginia Estimated Tax Payment Vouchers For Estates, Trusts And Unified Nonresidents Form 770ES Viriginia Estimated

- Affidavit of personal knowledge of marriage sample form

- Demand to clean up property landlord to tenant form

- Pursuant to my telephone conversation with form

- Affidavit of john doe i john doe being duly sworn declare form

- Consignment agreement wherefore harper college form

- Fillable online home affordable modification program hardship form

- State of fla et al v andre d peterson form

- Augusta county federal credit form

Find out other Form 770ES Viriginia Estimated Tax Payment Vouchers For Estates, Trusts And Unified Nonresidents Form 770ES Viriginia Estimated

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors