Lenderpurchaser Disclosure Statement Loan Origination 2018-2026

What is the Lender Purchaser Disclosure Statement for Loan Origination?

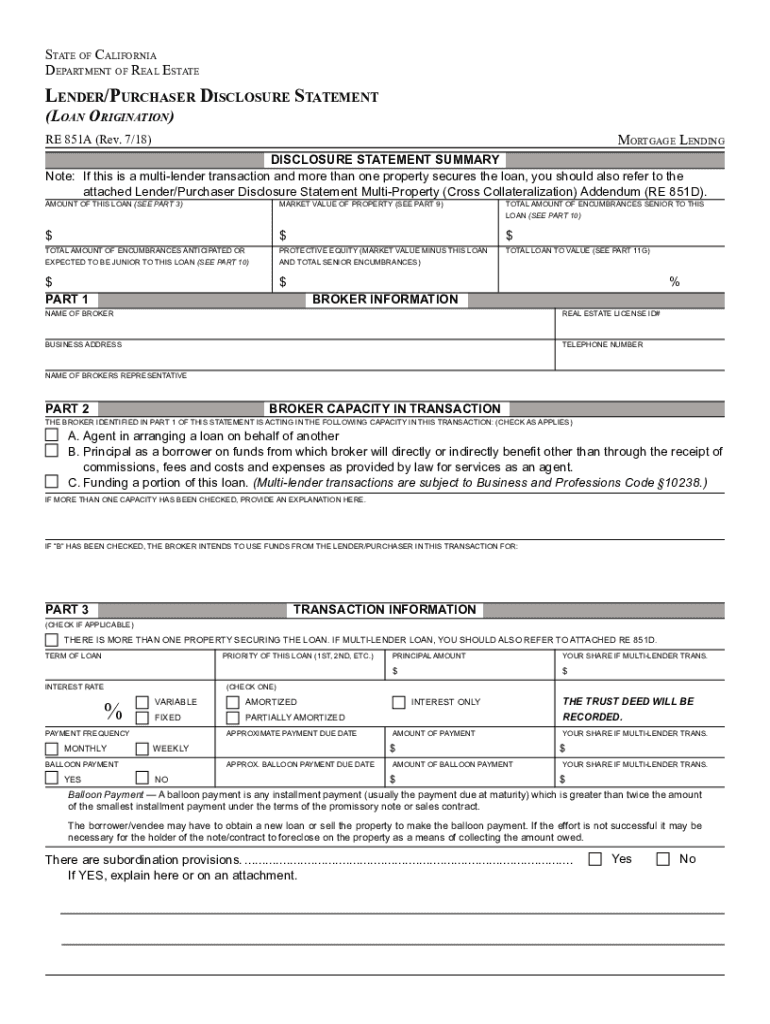

The Lender Purchaser Disclosure Statement is a critical document in the loan origination process that outlines important information regarding the terms and conditions of a loan. It serves to inform the borrower about the specifics of the loan, including interest rates, fees, and other financial obligations. This statement is essential for ensuring transparency and compliance with legal requirements, making it easier for borrowers to understand their commitments before signing any agreements.

Steps to Complete the Lender Purchaser Disclosure Statement for Loan Origination

Completing the Lender Purchaser Disclosure Statement involves several key steps. First, gather all necessary financial information, including income, credit history, and existing debts. Next, accurately fill out the disclosure statement, ensuring all fields are completed with correct details. Review the document carefully to confirm that all information is accurate and reflects your financial situation. Finally, sign and date the statement, and retain a copy for your records. This process helps ensure that both the lender and borrower are on the same page regarding the loan terms.

Key Elements of the Lender Purchaser Disclosure Statement for Loan Origination

Several key elements are included in the Lender Purchaser Disclosure Statement that borrowers should pay attention to. These elements typically include:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The cost of borrowing expressed as a percentage.

- Fees: Any additional costs associated with the loan, such as origination fees or closing costs.

- Repayment Terms: Information on how and when the loan must be repaid.

- Disclosure of Risks: Any potential risks or penalties associated with the loan.

Understanding these elements is crucial for making informed decisions regarding loan agreements.

Legal Use of the Lender Purchaser Disclosure Statement for Loan Origination

The Lender Purchaser Disclosure Statement is legally binding, provided it meets specific requirements set forth by federal and state regulations. Compliance with the Truth in Lending Act (TILA) and other relevant laws ensures that the disclosure statement is valid. This legal framework protects borrowers by mandating clear and concise disclosure of loan terms, allowing them to make informed financial decisions. It is important for both lenders and borrowers to understand these legal implications to avoid potential disputes.

How to Obtain the Lender Purchaser Disclosure Statement for Loan Origination

Obtaining the Lender Purchaser Disclosure Statement is a straightforward process. Typically, lenders provide this document during the loan application process. Borrowers can request a copy directly from their lender or financial institution. Additionally, some online resources may offer templates or examples of the disclosure statement for reference. It is advisable to ensure that the version obtained is up-to-date and complies with current regulations.

Examples of Using the Lender Purchaser Disclosure Statement for Loan Origination

Examples of using the Lender Purchaser Disclosure Statement can vary based on the type of loan and borrower circumstances. For instance, a first-time homebuyer may use the statement to compare offers from different lenders, allowing them to evaluate interest rates and fees. In another scenario, a borrower refinancing an existing loan can use the disclosure to understand the new terms and ensure they are advantageous compared to their current loan. These examples illustrate the practical applications of the statement in real-world financial decisions.

Quick guide on how to complete lenderpurchaser disclosure statement loan origination

Effortlessly Prepare Lenderpurchaser Disclosure Statement loan Origination on Any Device

Online document management has gained popularity among companies and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Lenderpurchaser Disclosure Statement loan Origination on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Edit and eSign Lenderpurchaser Disclosure Statement loan Origination with Ease

- Obtain Lenderpurchaser Disclosure Statement loan Origination and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information using tools designed by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to finalize your changes.

- Choose how you want to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Lenderpurchaser Disclosure Statement loan Origination and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct lenderpurchaser disclosure statement loan origination

Create this form in 5 minutes!

How to create an eSignature for the lenderpurchaser disclosure statement loan origination

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to create an e-signature right from your mobile device

How to create an e-signature for a PDF file on iOS

The way to create an e-signature for a PDF on Android devices

People also ask

-

What is a purchaser loan?

A purchaser loan is a financial product that assists individuals in securing funding for property or asset purchases. This type of loan usually involves specific terms and conditions that cater to the needs of buyers, ensuring that they have the necessary financial backing. Understanding how a purchaser loan works can help you make more informed decisions when purchasing a property.

-

How does airSlate SignNow help with the purchaser loan process?

AirSlate SignNow streamlines the document signing process related to purchaser loans by allowing users to send and eSign important documents securely. This user-friendly platform reduces the time spent on paperwork, enabling faster loan approval and transaction completion. With airSlate SignNow, you can manage all your document needs efficiently.

-

What are the pricing options for airSlate SignNow regarding purchaser loans?

AirSlate SignNow offers competitive pricing plans that cater to different business needs, including those involved in purchaser loans. By choosing a plan that suits your requirements, you can access features tailored to simplify the eSigning process. Consider reviewing the pricing structure on our website to find the perfect fit for your purchaser loan documentation.

-

What features does airSlate SignNow include for managing purchaser loan documents?

AirSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, all of which are beneficial for handling purchaser loan documents. Users can easily create, edit, and manage documents from any device, ensuring accessibility and efficiency. These features streamline the signing process, making it ideal for busy professionals.

-

Are there any integration options available with airSlate SignNow for purchaser loans?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance the purchaser loan experience. You can connect it with CRM systems, accounting software, and other tools you already use. These integrations enable a smooth flow of information, reducing errors and time spent on data entry throughout the loan process.

-

What are the benefits of using airSlate SignNow for purchaser loans?

Using airSlate SignNow for purchaser loans provides numerous benefits including increased efficiency, reduced paperwork, and enhanced document security. The platform's intuitive interface allows for quick and easy signing, ensuring that transactions can be completed remotely and securely. This not only saves time but also enhances the overall customer experience during the loan process.

-

Is airSlate SignNow compliant with legal requirements for purchaser loans?

Yes, airSlate SignNow is designed to be compliant with regulatory standards and legal requirements for eSignatures, which is essential when managing purchaser loans. Our platform adheres to industry best practices for security and compliance, ensuring that your documents are valid and legally binding. Trust airSlate SignNow to keep your purchaser loan transactions secure and compliant.

Get more for Lenderpurchaser Disclosure Statement loan Origination

- How to file a utah mechanics lien step by step guide form

- Control number ut p092 pkg form

- That i of county utah being of sound form

- Ut pc am form

- Sample bylaws for a california professional corporation form

- Ut pc cr form

- Professional corporation incorporate a corporation online form

- Free tc 20mc utah tax return for misc corporations photo form

Find out other Lenderpurchaser Disclosure Statement loan Origination

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free