Lender Statement 2015

What is the Lender Statement

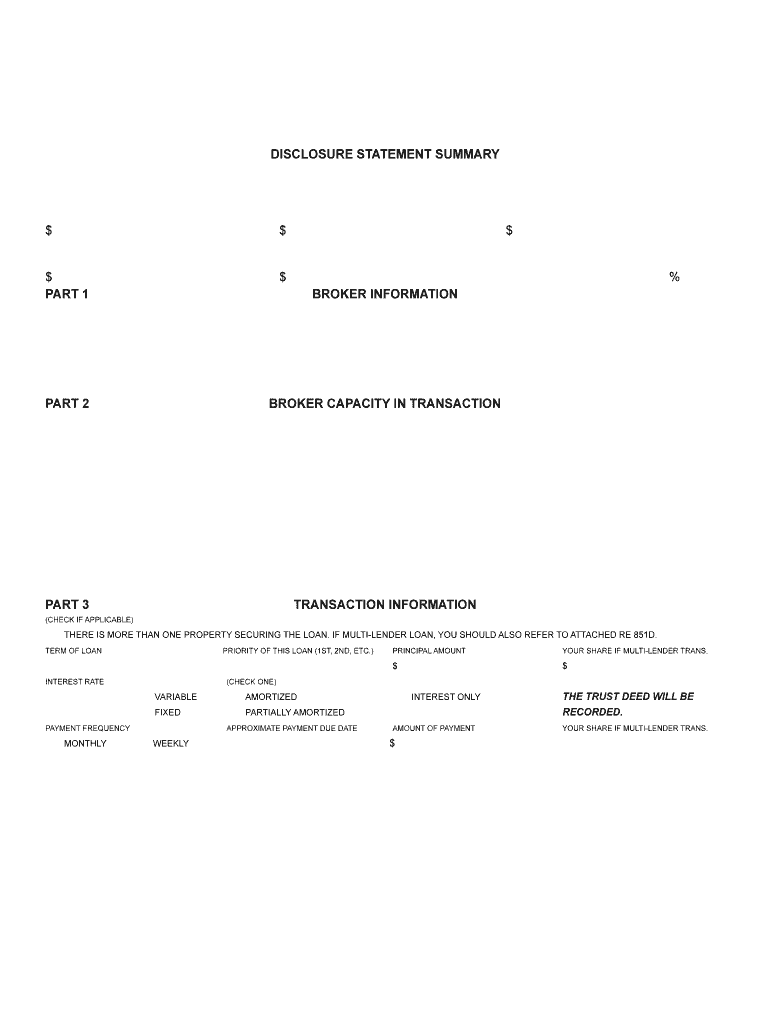

The lender statement, often referred to as the California lender disclosure, is a crucial document that outlines the terms and conditions of a loan agreement. It provides borrowers with essential information regarding the loan, including interest rates, fees, and repayment terms. This statement ensures transparency between lenders and borrowers, enabling informed decision-making. The lender statement is particularly important in California, where specific regulations govern its content and delivery.

How to Obtain the Lender Statement

To obtain the lender statement, borrowers typically need to request it directly from their lender. Most lenders provide this document as part of the loan application process or upon request. It is advisable for borrowers to review the lender statement carefully to ensure all details are accurate and complete. Additionally, some lenders may offer electronic versions of the statement, which can be accessed through their online platforms.

Steps to Complete the Lender Statement

Completing the lender statement involves several key steps:

- Gather necessary information: Collect all relevant financial details, including income, existing debts, and credit history.

- Review the lender's requirements: Ensure you understand what information the lender needs and any specific formatting or documentation requirements.

- Fill out the form: Carefully input all required information into the lender statement, ensuring accuracy to avoid delays.

- Review and sign: Double-check the completed statement for errors before signing it electronically or in person.

Legal Use of the Lender Statement

The lender statement holds legal significance as it serves as a binding agreement between the lender and borrower. In California, the lender statement must comply with state regulations, ensuring it contains all necessary disclosures. This includes information about loan terms, fees, and the borrower's rights. Failure to provide a proper lender statement can result in legal repercussions for the lender, including penalties and potential lawsuits.

Key Elements of the Lender Statement

Several key elements must be included in the lender statement to ensure compliance and clarity:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The annual percentage rate (APR) applicable to the loan.

- Fees: Any associated fees, including origination fees, closing costs, and prepayment penalties.

- Repayment Terms: Details on the repayment schedule, including due dates and payment amounts.

- Borrower Rights: Information regarding the borrower's rights under state and federal law.

Disclosure Requirements

Disclosure requirements for the lender statement are governed by both federal and state laws. In California, lenders must provide clear and comprehensive disclosures to borrowers, ensuring they understand the terms of their loan. This includes the Truth in Lending Act (TILA) requirements, which mandate clear communication of loan terms and costs. Lenders must also adhere to the California Finance Lenders Law, which outlines specific disclosure obligations to protect consumers.

Quick guide on how to complete lender statement

Complete Lender Statement effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents promptly without delays. Manage Lender Statement on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign Lender Statement with ease

- Find Lender Statement and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device of your choice. Modify and eSign Lender Statement and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct lender statement

Create this form in 5 minutes!

How to create an eSignature for the lender statement

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is the CA finance lender disclosure PDF?

The CA finance lender disclosure PDF is a document required by California laws that provides borrowers with essential information about loan terms and conditions. airSlate SignNow allows you to easily create, send, and electronically sign this important document, ensuring compliance and transparency for your clients.

-

How can airSlate SignNow help with CA finance lender disclosure PDFs?

With airSlate SignNow, you can quickly generate CA finance lender disclosure PDFs and send them for electronic signatures. This solution streamlines the process, reducing the time it takes to close deals while ensuring that all legal requirements are met effortlessly.

-

What features does airSlate SignNow offer for creating documents?

airSlate SignNow includes several features that enhance document creation, including templates for CA finance lender disclosure PDFs, collaborative editing, and integrated workflows. These features help businesses save time and reduce errors, making document management more efficient.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small enterprises. By providing features that simplify the creation and sending of CA finance lender disclosure PDFs, it helps businesses save both time and money on document management.

-

Can I customize the CA finance lender disclosure PDF using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize the CA finance lender disclosure PDF to fit their business needs. You can add your branding, modify the content, and ensure that all necessary information is included before sending it out for signatures.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integration with numerous business applications, enhancing its functionality. You can connect it with CRM systems, project management tools, and more to streamline the workflow involving CA finance lender disclosure PDFs and other important documents.

-

Is eSigning CA finance lender disclosure PDFs legally valid?

Yes, electronically signing CA finance lender disclosure PDFs using airSlate SignNow is legally valid and complies with eSignature laws. This means you can confidently send and sign documents digitally, ensuring they hold up in court and meet regulatory requirements.

Get more for Lender Statement

- Medical record addendum template form

- Claimant statement sample form

- Technical report form

- Lic form for claiming hcbmsb

- Rush health care surrogate act form

- Asus warranty information form

- Gc 312 confidential supplemental information judicial council forms

- Hourly rate employment contract template form

Find out other Lender Statement

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later