Information May Not Apply

Understanding the WI Income Expense Statement

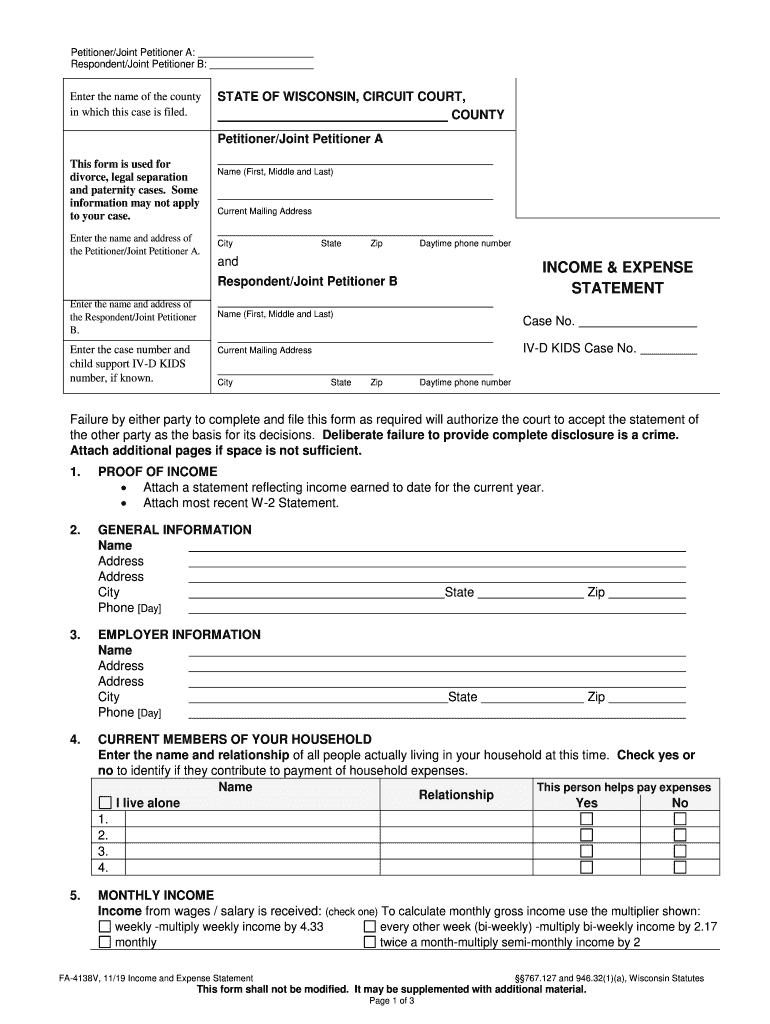

The WI income expense statement is a crucial document for individuals and businesses in Wisconsin, particularly for those who need to report their income and expenses for tax purposes. This form provides a comprehensive overview of financial activities, allowing the state to assess tax obligations accurately. It typically includes various sections where taxpayers can detail their sources of income, deductible expenses, and any other relevant financial information.

Steps to Complete the WI Income Expense Statement

Completing the WI income expense statement involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary financial documents, including receipts, bank statements, and previous tax returns. Next, fill in the personal information section, including your name, address, and Social Security number. Then, accurately report your income sources, such as wages, business income, and interest earned. After that, list all deductible expenses, ensuring you have supporting documentation for each claim. Finally, review the completed form for accuracy before submission.

Legal Use of the WI Income Expense Statement

The legal use of the WI income expense statement is essential for compliance with state tax laws. This form must be completed accurately to avoid potential penalties or audits from the Wisconsin Department of Revenue. It serves as a formal declaration of your financial activities and is used to determine your tax liability. Ensuring that all information is truthful and substantiated by documentation is critical to maintaining legal standing.

Required Documents for the WI Income Expense Statement

When preparing the WI income expense statement, several documents are required to support the information provided. These documents typically include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Bank statements showing income deposits

- Previous tax returns for reference

Having these documents readily available will streamline the process of completing the form and ensure that all reported figures are accurate.

Form Submission Methods

The WI income expense statement can be submitted through various methods, providing flexibility for taxpayers. Individuals can choose to file online through the Wisconsin Department of Revenue's website, which offers a secure and efficient process. Alternatively, the form can be mailed to the appropriate tax office, ensuring that it is postmarked by the filing deadline. In-person submissions may also be possible at designated tax offices, allowing for direct assistance if needed.

IRS Guidelines for Reporting Income and Expenses

While the WI income expense statement is specific to Wisconsin, it is essential to align with IRS guidelines when reporting income and expenses. The IRS requires taxpayers to report all income, regardless of the source, and allows for specific deductions that can reduce taxable income. Familiarizing yourself with IRS regulations ensures that your state filing is consistent with federal requirements, minimizing the risk of discrepancies that could lead to audits or penalties.

Examples of Using the WI Income Expense Statement

Practical examples of using the WI income expense statement can help clarify its purpose. For instance, a self-employed individual may use this form to report income from freelance projects while detailing business-related expenses such as office supplies and travel costs. Similarly, a small business owner can provide an overview of revenue generated and expenses incurred, such as payroll and utilities, to accurately reflect their financial status for tax purposes. These examples illustrate the versatility and importance of the WI income expense statement in various financial scenarios.

Quick guide on how to complete information may not apply

Complete Information May Not Apply effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to obtain the correct format and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents promptly without interruptions. Manage Information May Not Apply on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The easiest method to modify and eSign Information May Not Apply without hassle

- Obtain Information May Not Apply and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent parts of the documents or obscure confidential information with tools designed by airSlate SignNow specifically for that function.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device you choose. Alter and eSign Information May Not Apply and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the information may not apply

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is a WI income expense statement?

A WI income expense statement is a financial document that summarizes an entity's income and expenses over a specific period. It is crucial for understanding profitability and managing finances in Wisconsin. By using airSlate SignNow, you can easily create and manage this statement, ensuring accuracy and compliance.

-

How does airSlate SignNow help with creating a WI income expense statement?

airSlate SignNow provides a user-friendly platform that allows you to generate a WI income expense statement quickly. With customizable templates and intuitive editing features, you can tailor your document to meet specific needs, ensuring all necessary details are included.

-

What are the pricing options for using airSlate SignNow for WI income expense statements?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose from monthly or annual subscriptions, which provide access to features that streamline the preparation of your WI income expense statement at a cost-effective rate.

-

What features does airSlate SignNow offer for managing financial documents?

With airSlate SignNow, you receive a suite of features designed to facilitate the management of financial documents like the WI income expense statement. Key features include e-signatures, cloud storage, and document tracking, ensuring your processes are efficient and secure.

-

Can airSlate SignNow integrate with other financial software for WI income expense statements?

Yes, airSlate SignNow seamlessly integrates with a variety of financial software, enhancing the preparation of your WI income expense statement. This integration allows for automatic syncing of data, improving accuracy and saving you valuable time.

-

What are the benefits of using airSlate SignNow for a WI income expense statement?

Using airSlate SignNow for your WI income expense statement simplifies the process of document management and signing. The platform enhances collaboration, reduces paperwork, and ensures that all stakeholders can access and approve documents from anywhere, improving overall efficiency.

-

Is there a trial period for airSlate SignNow to handle WI income expense statements?

Yes, airSlate SignNow typically offers a trial period for new users, allowing you to explore its features while creating your WI income expense statement. This trial helps you understand how the tool can meet your specific financial document needs before committing to a subscription.

Get more for Information May Not Apply

Find out other Information May Not Apply

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will