UK AJBYI Form GCCTF W8BEN Fill Online, Printable 2021-2026

What is the UK AJBYI Form GCCTF W8BEN?

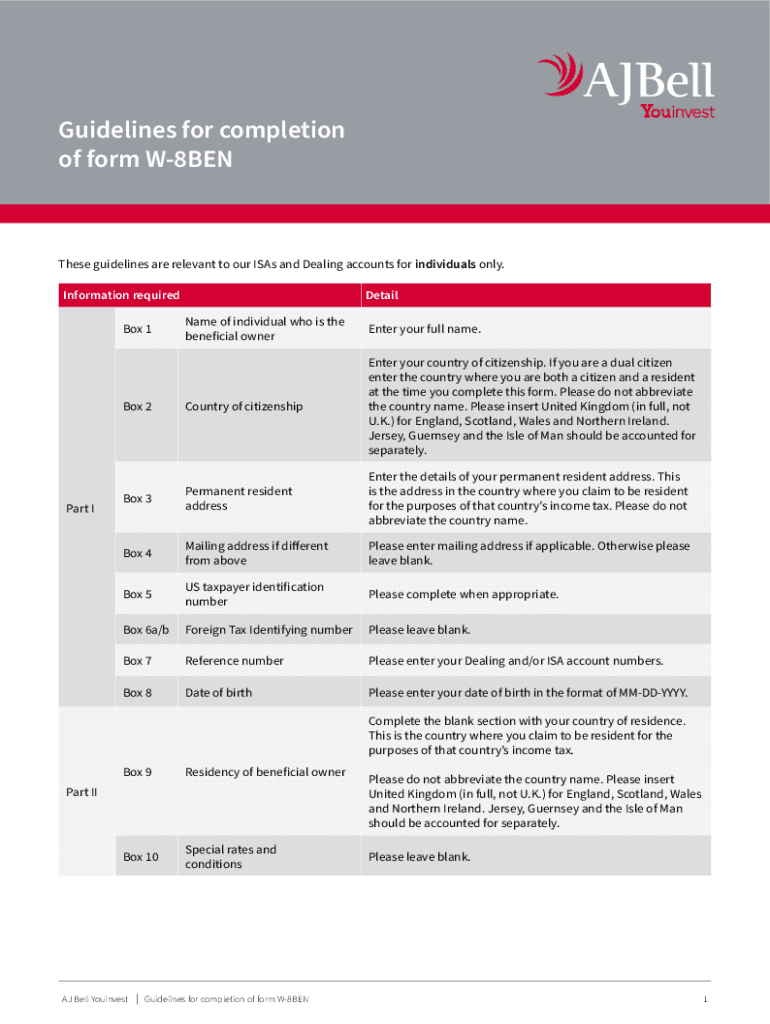

The UK AJBYI Form GCCTF W8BEN is a tax form used by non-U.S. individuals to certify their foreign status and claim tax treaty benefits. This form is essential for individuals who receive income from U.S. sources and want to avoid or reduce withholding tax rates based on applicable tax treaties. The W8BEN form helps establish that the individual is not a U.S. taxpayer and provides necessary information to the withholding agent regarding the individual's foreign status.

Steps to Complete the UK AJBYI Form GCCTF W8BEN

Filling out the W8BEN form involves several key steps to ensure accuracy and compliance:

- Personal Information: Enter your name, country of citizenship, and permanent address. Ensure that this information matches your official documents.

- Tax Identification Number: Provide your foreign tax identification number, if applicable. This helps the IRS identify your tax status.

- Claim of Tax Treaty Benefits: Indicate whether you are claiming benefits under a tax treaty between your country and the United States. Include the specific article of the treaty that applies.

- Signature: Sign and date the form. Your signature certifies that the information provided is accurate and complete.

Legal Use of the UK AJBYI Form GCCTF W8BEN

The W8BEN form is legally binding and must be filled out correctly to avoid potential penalties. It is crucial for non-U.S. individuals to understand that submitting an incorrect or incomplete form can lead to higher withholding taxes or legal issues with the IRS. The form serves as a declaration of your foreign status and is used by U.S. payers to determine the appropriate withholding tax rate on payments made to you.

IRS Guidelines for the UK AJBYI Form GCCTF W8BEN

The IRS provides specific guidelines regarding the completion and submission of the W8BEN form. It is important to review these guidelines to ensure compliance:

- Submission Timing: The form should be submitted before receiving any payments to ensure the correct withholding rate is applied.

- Renewal Requirements: The W8BEN form must be renewed every three years or whenever there are changes to your information.

- Record Keeping: Retain a copy of the completed form for your records, as it may be needed for future reference or audits.

Examples of Using the UK AJBYI Form GCCTF W8BEN

There are various scenarios where the W8BEN form is applicable:

- Investment Income: If you are a foreign investor receiving dividends from U.S. stocks, you would use the W8BEN to claim reduced withholding rates.

- Royalties: Non-U.S. individuals receiving royalties from U.S. sources can utilize the form to certify their foreign status and potentially lower withholding taxes.

- Independent Contractors: Foreign freelancers or contractors providing services to U.S. companies may need to submit the W8BEN to avoid higher tax withholdings on their payments.

Eligibility Criteria for the UK AJBYI Form GCCTF W8BEN

To be eligible to use the W8BEN form, individuals must meet specific criteria:

- Non-U.S. Status: The individual must not be a U.S. citizen or resident alien.

- Foreign Income: The income being received must originate from U.S. sources.

- Tax Treaty Benefits: The individual must be a resident of a country that has a tax treaty with the United States to claim reduced withholding rates.

Quick guide on how to complete 2020 uk ajbyi form gcctf w8ben fill online printable

Finish UK AJBYI Form GCCTF W8BEN Fill Online, Printable effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, amend, and electronically sign your documents quickly without delays. Manage UK AJBYI Form GCCTF W8BEN Fill Online, Printable on any gadget using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign UK AJBYI Form GCCTF W8BEN Fill Online, Printable with ease

- Locate UK AJBYI Form GCCTF W8BEN Fill Online, Printable and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign feature, which takes moments and holds the same legal legitimacy as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign UK AJBYI Form GCCTF W8BEN Fill Online, Printable and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 uk ajbyi form gcctf w8ben fill online printable

Create this form in 5 minutes!

How to create an eSignature for the 2020 uk ajbyi form gcctf w8ben fill online printable

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is the W8BEN form UK and who needs it?

The W8BEN form UK is a tax form used by non-US residents, including UK citizens, to signNow their foreign status for tax purposes. It is essential for individuals and entities that receive income from US sources to ensure they are not subjected to unnecessary withholding taxes.

-

How does airSlate SignNow help with filling out the W8BEN form UK?

AirSlate SignNow simplifies the process of filling out the W8BEN form UK by providing easy-to-use templates and eSigning capabilities. Users can conveniently enter their information and electronically sign the document, ensuring compliance and accuracy with minimal effort.

-

Is there a cost associated with using airSlate SignNow for the W8BEN form UK?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including affordable options for businesses and individuals who need to manage W8BEN form UK documentation. Users can choose a plan that fits their budget and requirements while enjoying the platform's extensive features.

-

What features does airSlate SignNow offer for managing the W8BEN form UK?

AirSlate SignNow provides several powerful features tailored for managing the W8BEN form UK, including document templates, eSignature capabilities, and secure cloud storage. These functionalities ensure a streamlined process for signing and storing tax-related documents.

-

Can I integrate airSlate SignNow with other applications for the W8BEN form UK?

Yes, airSlate SignNow supports integrations with various applications that can enhance your workflow for the W8BEN form UK. This means you can connect it with CRMs, cloud storage services, and other tools to facilitate seamless document management.

-

What are the benefits of using airSlate SignNow for the W8BEN form UK?

Using airSlate SignNow for the W8BEN form UK offers numerous benefits, including increased efficiency, enhanced security, and cost savings. The platform ensures that signing and sending documents are easy and fast, while also keeping your sensitive information protected.

-

How do I ensure my W8BEN form UK is completed correctly with airSlate SignNow?

To ensure your W8BEN form UK is completed correctly, airSlate SignNow provides user-friendly guidance and templates that help you navigate the required fields. Additionally, you can review your entries before signing to confirm accuracy and compliance with IRS requirements.

Get more for UK AJBYI Form GCCTF W8BEN Fill Online, Printable

- Washington postnuptial agreement form

- Wisconsin no fault agreed uncontested divorce package for dissolution of marriage for people with minor children form

- Wisconsin no fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without form

- Wisconsin contractors forms package

- Wisconsin excavation contractor package form

- Wisconsin insulation contractor package form

- West virginia no fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or form

- West virginia satisfaction cancellation or release of mortgage package form

Find out other UK AJBYI Form GCCTF W8BEN Fill Online, Printable

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy