Guidelines for Completion of Form NR301 Guidelines for 2020

Understanding the W-8 BEN Form

The W-8 BEN form is a crucial document for non-U.S. persons who receive income from U.S. sources. This form certifies that the individual is not a U.S. citizen or resident and claims a reduced rate of, or exemption from, withholding tax as per applicable tax treaties. It is essential for ensuring compliance with U.S. tax laws while allowing foreign individuals to benefit from tax treaty provisions.

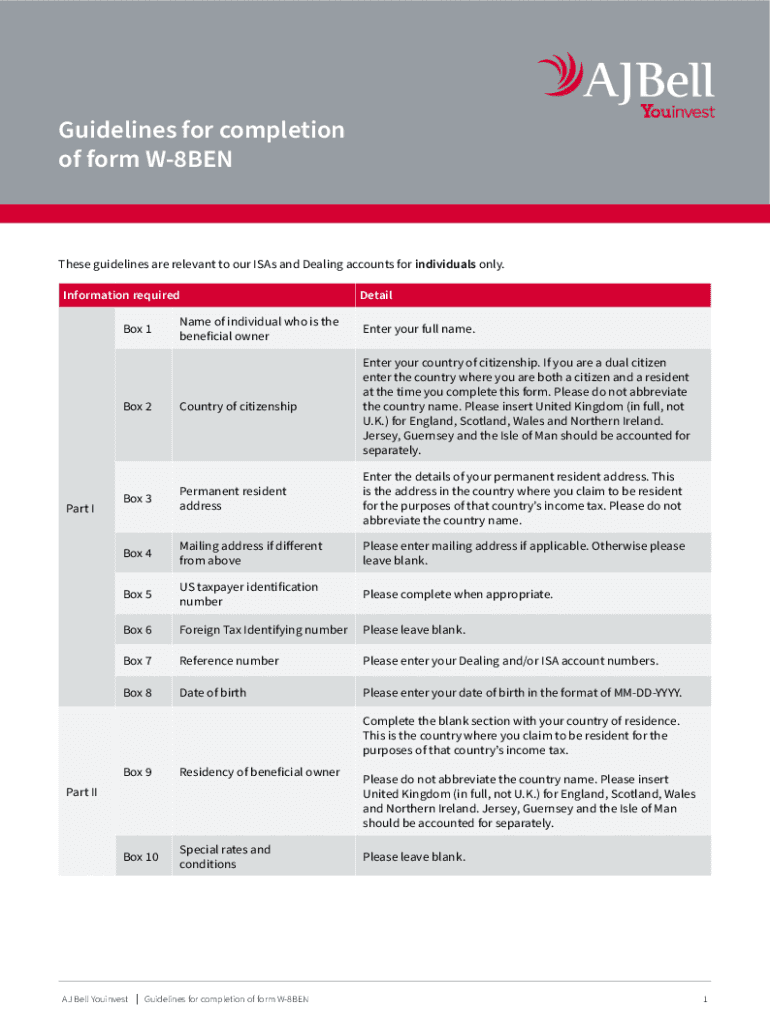

Steps to Complete the W-8 BEN Form

Completing the W-8 BEN form involves several key steps:

- Provide your name and country of citizenship in the appropriate fields.

- Enter your permanent address outside the U.S., ensuring it is not a P.O. box.

- Include your mailing address if it differs from your permanent address.

- Fill in your U.S. taxpayer identification number (if applicable) or foreign tax identifying number.

- Sign and date the form, certifying that the information provided is accurate.

Legal Use of the W-8 BEN Form

The W-8 BEN form serves as a legal declaration of your foreign status and eligibility for reduced withholding tax rates. It is important to submit this form to the U.S. withholding agent or financial institution that requires it. Failure to provide a valid W-8 BEN may result in the withholding of taxes at the maximum rate, which can significantly affect your income from U.S. sources.

Required Documents for Submission

When completing the W-8 BEN form, you may need to provide additional documentation to support your claims. This can include:

- A copy of your passport or national identification card.

- Proof of residency in your country of citizenship.

- Any relevant tax treaty documentation to substantiate your claims for reduced withholding rates.

Filing Deadlines and Important Dates

While the W-8 BEN form does not have a specific filing deadline, it is important to submit it before any payments are made to you. This ensures that the correct withholding tax rate is applied. It is advisable to review your W-8 BEN form annually or whenever there are changes in your circumstances, such as a change in residency or tax status.

Examples of Using the W-8 BEN Form

Foreign individuals may encounter various situations where the W-8 BEN form is necessary. Common examples include:

- Receiving dividends from U.S. corporations.

- Gaining income from rental properties located in the U.S.

- Participating in U.S. investment funds or partnerships.

Quick guide on how to complete guidelines for completion of form nr301 guidelines for

Effortlessly prepare Guidelines For Completion Of Form NR301 Guidelines For on any device

Digital document management has become increasingly favored by businesses and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the resources required to create, edit, and electronically sign your documents quickly and efficiently. Manage Guidelines For Completion Of Form NR301 Guidelines For on any platform with the airSlate SignNow applications for Android or iOS and enhance your document-driven processes today.

Steps to modify and electronically sign Guidelines For Completion Of Form NR301 Guidelines For with ease

- Find Guidelines For Completion Of Form NR301 Guidelines For and click Get Form to commence.

- Utilize the resources we offer to fill out your document.

- Highlight important sections of your documents or mask sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Disregard the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any chosen device. Edit and electronically sign Guidelines For Completion Of Form NR301 Guidelines For to ensure outstanding communication at every step of the document creation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct guidelines for completion of form nr301 guidelines for

Create this form in 5 minutes!

How to create an eSignature for the guidelines for completion of form nr301 guidelines for

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the w8 ben bell form and why is it important?

The w8 ben bell form is a tax form used by foreign entities to signNow their non-U.S. status and claim tax treaty benefits. This form is essential for businesses looking to avoid withholding taxes on U.S. income. Understanding how to properly fill out and submit the w8 ben bell form can save your business money and simplify compliance.

-

How can airSlate SignNow help me with the w8 ben bell form?

airSlate SignNow provides an efficient platform for managing and signing documents, including the w8 ben bell form. You can easily upload, share, and eSign this form, ensuring that you meet all necessary requirements. Our user-friendly interface simplifies the process, making it faster and more reliable.

-

Are there any costs associated with using airSlate SignNow for the w8 ben bell form?

Yes, while airSlate SignNow offers various subscription plans, pricing can vary based on features and the number of users. You can choose a plan that fits your business needs, making the handling of the w8 ben bell form cost-effective. Try our platform today to explore the options available.

-

What features does airSlate SignNow offer for processing documents like the w8 ben bell form?

airSlate SignNow includes features such as document templates, cloud storage, and eSignature support, which are perfect for handling the w8 ben bell form. Our platform enables real-time collaboration and tracking, ensuring you never miss a step in the document signing process. These tools help streamline your workflow.

-

Can I integrate airSlate SignNow with other applications for handling the w8 ben bell form?

Absolutely! airSlate SignNow offers seamless integrations with popular business applications like Google Drive, Microsoft 365, and CRM systems. These integrations allow you to manage the w8 ben bell form alongside your other vital documents in a unified environment.

-

Is my data secure when using airSlate SignNow to handle the w8 ben bell form?

Yes, data security is a top priority at airSlate SignNow. Our platform employs encryption and secure cloud storage to protect sensitive information, including the details within your w8 ben bell form. You can trust that your documents are safe while being processed and stored.

-

How long does it take to set up my account for using the w8 ben bell form with airSlate SignNow?

Setting up your airSlate SignNow account is quick and easy, typically taking just a few minutes. Once registered, you'll have immediate access to tools for managing the w8 ben bell form and other documents. Our tutorial resources help guide you through the initial steps.

Get more for Guidelines For Completion Of Form NR301 Guidelines For

- Wv husband form

- West virginia revocation form

- Postnuptial property agreement west virginia west virginia form

- West virginia postnuptial agreement form

- Quitclaim deed from husband and wife to an individual west virginia form

- West virginia wife form

- West virginia deed 497431574 form

- West virginia form

Find out other Guidelines For Completion Of Form NR301 Guidelines For

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word