Operations BureauPenalty Waiver 2020

What is the Operations Bureau Penalty Waiver?

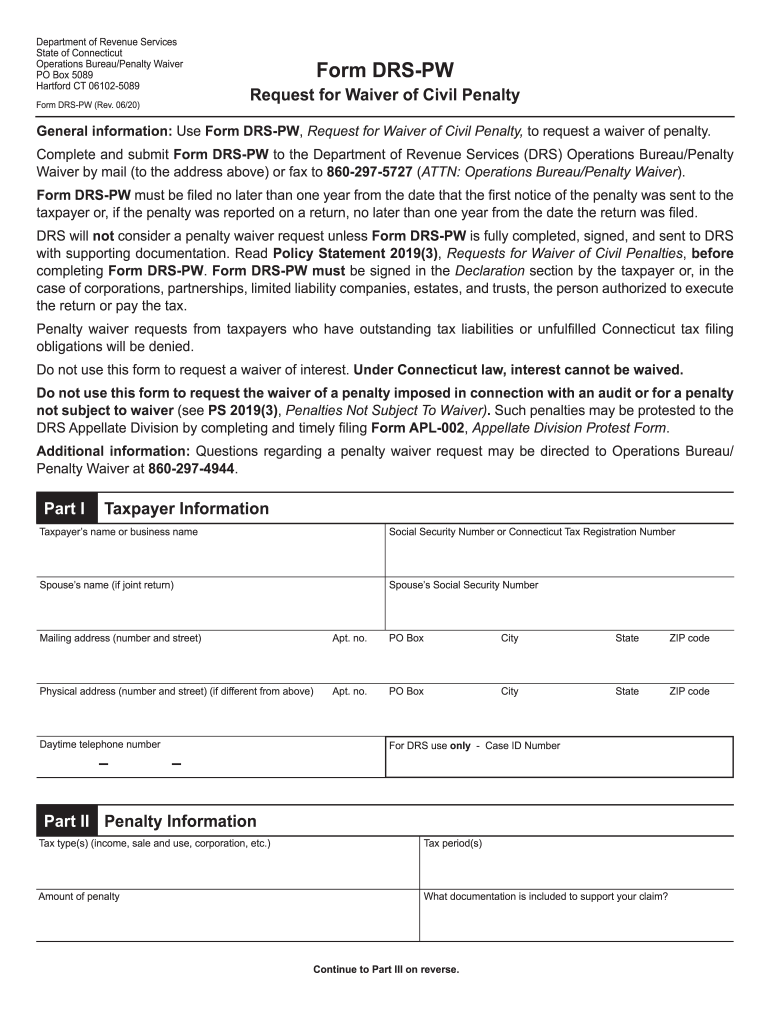

The Operations Bureau Penalty Waiver is a formal request submitted to the Connecticut Department of Revenue Services (DRS) that allows taxpayers to seek relief from penalties associated with late filings or payments of state taxes. This waiver is particularly relevant for individuals and businesses who may have encountered unforeseen circumstances that hindered their ability to comply with tax obligations. Understanding the specifics of this waiver can help taxpayers navigate the complexities of state tax regulations and potentially reduce their financial liabilities.

Steps to Complete the Operations Bureau Penalty Waiver

Completing the Operations Bureau Penalty Waiver involves several important steps to ensure that the request is processed efficiently. Here are the key steps to follow:

- Gather necessary documentation that supports your request, such as proof of circumstances that led to the late filing or payment.

- Obtain the appropriate form for the penalty waiver, which is typically available on the Connecticut DRS website.

- Fill out the form accurately, providing all required information, including your tax identification number and details about the penalties incurred.

- Attach any supporting documents that substantiate your claim for a waiver.

- Submit the completed form and documentation to the DRS, either online, by mail, or in person, depending on the submission methods available.

Eligibility Criteria for the Operations Bureau Penalty Waiver

To qualify for the Operations Bureau Penalty Waiver, taxpayers must meet specific eligibility criteria set forth by the Connecticut DRS. Generally, the following conditions must be satisfied:

- The taxpayer must demonstrate a valid reason for the late filing or payment, such as illness, natural disasters, or other extenuating circumstances.

- The penalties in question must relate to state tax obligations, including income, sales, or business taxes.

- The taxpayer must not have a history of repeated late filings or payments, which may affect the likelihood of approval.

Required Documents for the Operations Bureau Penalty Waiver

When submitting a request for the Operations Bureau Penalty Waiver, it is essential to include all required documents to support your case. Commonly required documents may include:

- Proof of timely filing of all other tax returns, if applicable.

- Documentation that substantiates the reason for the late filing or payment, such as medical records or correspondence with other government agencies.

- A copy of the notice received from the DRS regarding the penalties incurred.

Form Submission Methods for the Operations Bureau Penalty Waiver

Taxpayers have several options for submitting the Operations Bureau Penalty Waiver form. The methods include:

- Online submission through the Connecticut DRS e-Services portal, which provides a secure and efficient way to file.

- Mailing the completed form and supporting documents to the appropriate DRS address specified on the form.

- In-person submission at designated DRS offices, which may be beneficial for those who prefer direct interaction with DRS staff.

Key Elements of the Operations Bureau Penalty Waiver

Understanding the key elements of the Operations Bureau Penalty Waiver can enhance the chances of a successful application. Important aspects include:

- A clear explanation of the circumstances leading to the penalty, emphasizing any unforeseen events.

- Accurate completion of the form, ensuring that all sections are filled out as required.

- Timely submission, as delays may affect the outcome of the waiver request.

Quick guide on how to complete operations bureaupenalty waiver

Effortlessly Prepare Operations BureauPenalty Waiver on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing users to access the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, edit, and eSign your documents swiftly without delays. Handle Operations BureauPenalty Waiver on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The Easiest Way to Edit and eSign Operations BureauPenalty Waiver with Minimal Effort

- Obtain Operations BureauPenalty Waiver and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign feature, which takes only seconds and carries the same legal significance as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Operations BureauPenalty Waiver and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct operations bureaupenalty waiver

Create this form in 5 minutes!

How to create an eSignature for the operations bureaupenalty waiver

The way to create an eSignature for a PDF document in the online mode

The way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is a penalty waiver ct?

A penalty waiver ct allows individuals to request a reduction or elimination of penalties associated with late payments or missed deadlines on Connecticut tax obligations. This can provide signNow financial relief, making it a vital resource for taxpayers in CT who may be struggling to meet their financial responsibilities.

-

How can airSlate SignNow assist with penalty waiver ct applications?

airSlate SignNow simplifies the process of submitting a penalty waiver ct application by allowing users to easily create, sign, and send documents electronically. This efficient workflow minimizes delays and ensures that all necessary forms are completed correctly and submitted on time.

-

Are there any fees associated with using airSlate SignNow for penalty waiver ct documents?

While airSlate SignNow offers flexible pricing plans, submitting a penalty waiver ct application through our platform is often more cost-effective than traditional methods. Users can choose a plan that best fits their needs, ensuring a budget-friendly solution for managing all document-related tasks.

-

What features does airSlate SignNow offer for managing penalty waiver ct documents?

airSlate SignNow provides robust features such as customizable templates, real-time tracking, and secure cloud storage for penalty waiver ct documents. These features streamline the entire process, making it easier for users to manage their requests efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for managing penalty waiver ct?

Yes, airSlate SignNow supports integrations with various applications, allowing users to streamline their workflow when dealing with penalty waiver ct. Whether you need to sync documents with accounting software or CRM platforms, our integrations enhance productivity and collaboration.

-

What benefits does using airSlate SignNow provide for penalty waiver ct submissions?

Using airSlate SignNow for penalty waiver ct submissions offers numerous benefits, including faster submission times, reduced paperwork, and higher accuracy. This ensures that your requests are handled efficiently and increases the likelihood of receiving approval from the tax authorities.

-

Is it easy to get started with airSlate SignNow for penalty waiver ct?

Absolutely! Getting started with airSlate SignNow for penalty waiver ct is a straightforward process. Simply sign up for an account, and you can access a variety of templates and tools designed specifically for efficient document management.

Get more for Operations BureauPenalty Waiver

Find out other Operations BureauPenalty Waiver

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien