Department of Revenue Services Form CT 15A State of 2021

What is the Department of Revenue Services Form CT 15A?

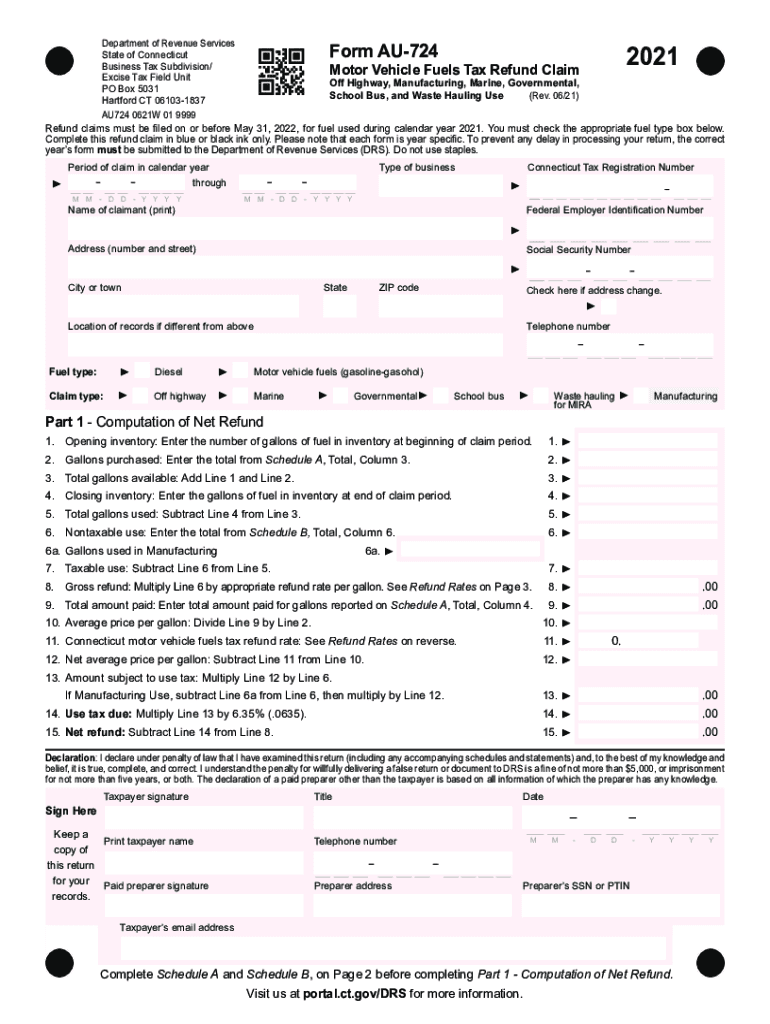

The Department of Revenue Services Form CT 15A is a crucial document for individuals and businesses in Connecticut that need to report and pay fuel taxes. This form is specifically designed for the reporting of the Connecticut fuel tax, which applies to the sale and use of fuel within the state. Understanding the purpose and requirements of Form CT 15A can help ensure compliance with state tax regulations.

Steps to Complete the Department of Revenue Services Form CT 15A

Completing the CT 15A form involves several important steps to ensure accuracy and compliance. First, gather all necessary information, including your business details, fuel purchase records, and previous tax filings. Next, fill out the form by entering the required data in the designated fields. Pay special attention to the calculations for fuel usage and tax owed. After completing the form, review it for any errors or omissions before submission. Finally, submit the form either online or via mail, following the guidelines provided by the Department of Revenue Services.

Legal Use of the Department of Revenue Services Form CT 15A

The legal use of Form CT 15A is governed by Connecticut state tax laws. This form must be completed accurately to ensure that all fuel taxes are reported and paid in compliance with state regulations. Failure to use the form correctly can result in penalties or fines. It is essential to understand the legal implications of submitting the form, including the requirement for accurate reporting of fuel consumption and tax liabilities.

Filing Deadlines and Important Dates for Form CT 15A

Filing deadlines for the CT 15A form are critical to avoid penalties. Typically, the form must be submitted quarterly, with specific due dates set by the Department of Revenue Services. It is important to stay informed about these deadlines to ensure timely filing. Missing a deadline can result in additional fees, interest charges, and potential audits. Always check the latest updates from the Department to confirm current filing timelines.

Form Submission Methods for CT 15A

There are several methods available for submitting the CT 15A form. Taxpayers can file online through the Connecticut Department of Revenue Services website, which provides a convenient and efficient option. Alternatively, the form can be printed and mailed to the appropriate address specified in the filing instructions. In some cases, in-person submissions may also be accepted at designated state offices. Choosing the right submission method can streamline the filing process and ensure that your form is received on time.

Penalties for Non-Compliance with Form CT 15A

Non-compliance with the requirements of Form CT 15A can lead to significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. It is crucial for taxpayers to understand the consequences of failing to file or inaccurately reporting fuel taxes. Staying compliant with all filing requirements not only avoids penalties but also fosters good standing with the state tax authorities.

Quick guide on how to complete department of revenue services form ct 15a state of

Effortlessly Prepare Department Of Revenue Services Form CT 15A State Of on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly option to traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Department Of Revenue Services Form CT 15A State Of on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Alter and eSign Department Of Revenue Services Form CT 15A State Of with Ease

- Find Department Of Revenue Services Form CT 15A State Of and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal value as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

No more worries about lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Department Of Revenue Services Form CT 15A State Of while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of revenue services form ct 15a state of

Create this form in 5 minutes!

How to create an eSignature for the department of revenue services form ct 15a state of

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is Connecticut AU tax and how does it apply to eSigning documents?

Connecticut AU tax refers to the state's tax implications on eSigned documents. When using airSlate SignNow for eSigning, it is important to understand how Connecticut AU tax may influence your business transactions. We provide resources to help you navigate these regulations effectively.

-

How does airSlate SignNow help simplify the process of managing Connecticut AU tax?

AirSlate SignNow offers innovative features that streamline document management, which can help businesses stay compliant with Connecticut AU tax regulations. By automating the signing process, you can save time and reduce the chances of error in documentation, making it easier to manage your tax obligations.

-

What features does airSlate SignNow offer for handling Connecticut AU tax documents?

Our platform provides customizable templates and secure eSignature capabilities tailored for handling Connecticut AU tax documents. These features not only enhance the signing experience but also ensure that all required information is accurately captured and securely stored.

-

Is there a pricing model that accommodates small businesses when dealing with Connecticut AU tax?

Yes, airSlate SignNow offers competitive pricing plans that are ideal for small businesses navigating Connecticut AU tax regulations. Our cost-effective solutions provide all the essential features you need without breaking the budget, allowing you to focus on compliance and growth.

-

Can airSlate SignNow integrate with accounting software for managing Connecticut AU tax?

Absolutely! AirSlate SignNow integrates seamlessly with popular accounting software, which can streamline the tracking and reporting of Connecticut AU tax. This integration allows for efficient document flow and ensures that tax-related documents are easily accessible when needed.

-

What benefits does airSlate SignNow provide in relation to Connecticut AU tax compliance?

Using airSlate SignNow helps ensure compliance with Connecticut AU tax regulations by providing secure, traceable signatures and a clear audit trail for all documents. This transparency is crucial in case of future audits and helps businesses maintain efficient operations while adhering to tax laws.

-

How can airSlate SignNow assist with the audit process for Connecticut AU tax?

AirSlate SignNow facilitates the audit process for Connecticut AU tax by maintaining a comprehensive record of all signed documents. Our platform's features allow for easy retrieval of documents, which can signNowly reduce the time spent during audits and improve accuracy in reporting.

Get more for Department Of Revenue Services Form CT 15A State Of

- Ifyouareregisteringachangeinpartnerscompleteform

- Company tax return ct600 2020 version 3 use for accounting periods starting on or after 1 april 2015 form

- Tax return for trustees of registered pension schemes 2020 use form sa9702020 to file your tax returnfor the tax year ended 5

- Msf 4705 bill of sale form

- Where to post the aw8 retirement form

- Pension credit entitlement form

- Aw8p pension claim form 442590227

- Ch2 online form

Find out other Department Of Revenue Services Form CT 15A State Of

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP