Tax Unit Manager Department of Administrative Services 2023

Understanding the Tax Unit Manager at the Department Of Administrative Services

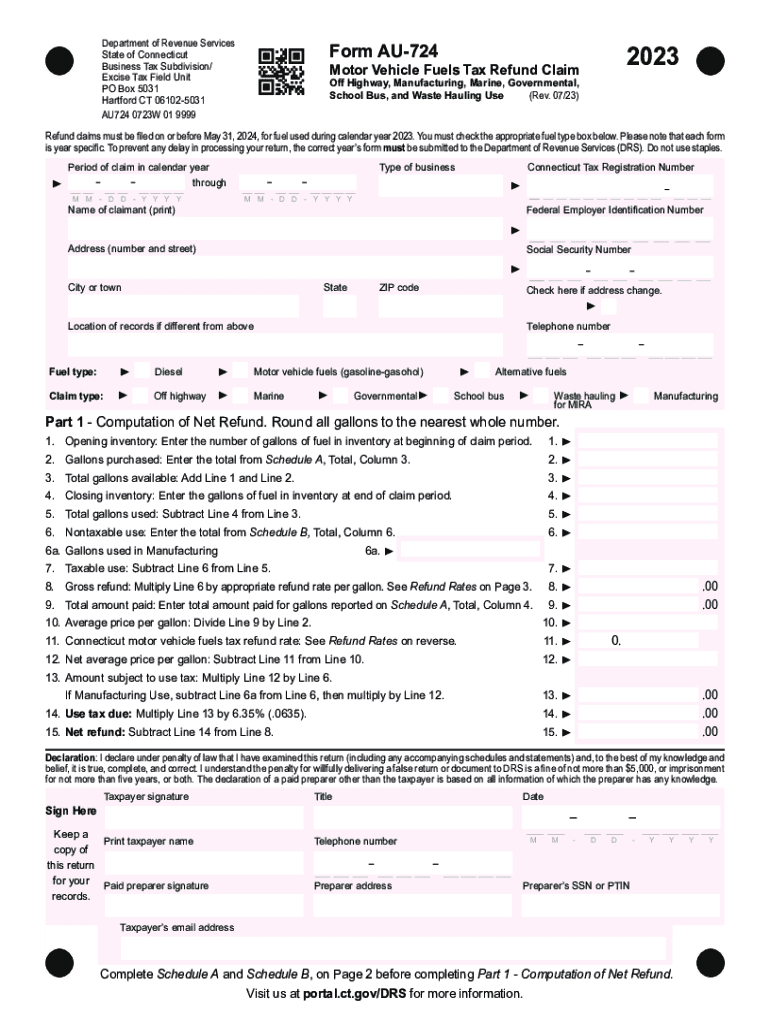

The Tax Unit Manager within the Department of Administrative Services in Connecticut plays a crucial role in overseeing the administration of the state's fuel tax. This position is responsible for ensuring compliance with tax regulations, managing tax revenue collection, and providing guidance to taxpayers regarding their obligations. The Tax Unit Manager also serves as a liaison between the state and fuel suppliers, ensuring that all parties adhere to the legal requirements set forth by the state.

Steps to Utilize the Tax Unit Manager's Services

To effectively engage with the Tax Unit Manager, individuals and businesses should follow these steps:

- Identify your specific needs regarding fuel tax compliance or inquiries.

- Gather all relevant documentation related to your fuel tax obligations.

- Contact the Tax Unit Manager's office through the official channels provided by the Department of Administrative Services.

- Prepare to discuss your situation and ask any questions you may have regarding the fuel tax process.

Required Documents for Fuel Tax Compliance

When dealing with the Tax Unit Manager, certain documents are essential for ensuring compliance with Connecticut fuel tax regulations. These may include:

- Proof of fuel purchases and sales.

- Tax exemption certificates, if applicable.

- Previous tax filings and payment records.

- Any correspondence with the Department of Administrative Services regarding fuel tax matters.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is vital for compliance with Connecticut fuel tax regulations. Key dates to remember include:

- Quarterly filing deadlines for fuel tax returns.

- Annual reconciliation deadlines.

- Due dates for any tax payments associated with fuel sales.

Penalties for Non-Compliance with Fuel Tax Regulations

Failure to comply with Connecticut fuel tax regulations can result in significant penalties. These may include:

- Monetary fines based on the amount of unpaid tax.

- Interest on late payments.

- Potential legal action for repeated non-compliance.

Eligibility Criteria for Fuel Tax Exemptions

Certain entities may qualify for exemptions from fuel tax in Connecticut. Eligibility criteria typically include:

- Non-profit organizations using fuel for exempt purposes.

- Government agencies utilizing fuel for official use.

- Specific industries that meet defined criteria set by the state.

Create this form in 5 minutes or less

Find and fill out the correct tax unit manager department of administrative services

Create this form in 5 minutes!

How to create an eSignature for the tax unit manager department of administrative services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Connecticut fuel tax?

The Connecticut fuel tax is a tax imposed on the sale of fuel within the state. It is designed to generate revenue for transportation infrastructure and maintenance. Understanding this tax is crucial for businesses operating in Connecticut, especially those involved in logistics and transportation.

-

How does airSlate SignNow help with managing Connecticut fuel tax documentation?

airSlate SignNow streamlines the process of managing documents related to the Connecticut fuel tax. With our eSigning capabilities, businesses can quickly sign and send tax-related documents, ensuring compliance and timely submissions. This efficiency helps reduce the administrative burden associated with fuel tax documentation.

-

Are there any features in airSlate SignNow that specifically assist with fuel tax compliance?

Yes, airSlate SignNow offers features that enhance compliance with the Connecticut fuel tax regulations. Our platform allows users to create templates for tax forms, track document status, and maintain a secure audit trail. These features ensure that all necessary documentation is properly managed and easily accessible.

-

What are the pricing options for airSlate SignNow for businesses dealing with Connecticut fuel tax?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses managing Connecticut fuel tax documentation. Our plans are cost-effective and designed to provide value, especially for companies that require frequent document handling. You can choose a plan that fits your budget and operational requirements.

-

Can airSlate SignNow integrate with other software to manage Connecticut fuel tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage Connecticut fuel tax records. This integration allows for automatic updates and data synchronization, ensuring that your tax information is always current and accurate.

-

What benefits does airSlate SignNow provide for businesses focused on Connecticut fuel tax?

Using airSlate SignNow provides numerous benefits for businesses focused on Connecticut fuel tax, including increased efficiency and reduced paperwork. Our platform simplifies the eSigning process, allowing for faster transactions and improved compliance. This ultimately leads to better management of tax obligations and enhanced operational productivity.

-

Is airSlate SignNow user-friendly for those unfamiliar with Connecticut fuel tax processes?

Yes, airSlate SignNow is designed to be user-friendly, even for those unfamiliar with Connecticut fuel tax processes. Our intuitive interface guides users through document creation and signing, making it accessible for everyone. Additionally, we provide resources and support to help users navigate tax-related documentation.

Get more for Tax Unit Manager Department Of Administrative Services

Find out other Tax Unit Manager Department Of Administrative Services

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online