Refund Claims Must Be Filed on or Before May31, 2021, for Fuel Used during Calendar Year 2020

Understanding the Refund Claims for Fuel Used

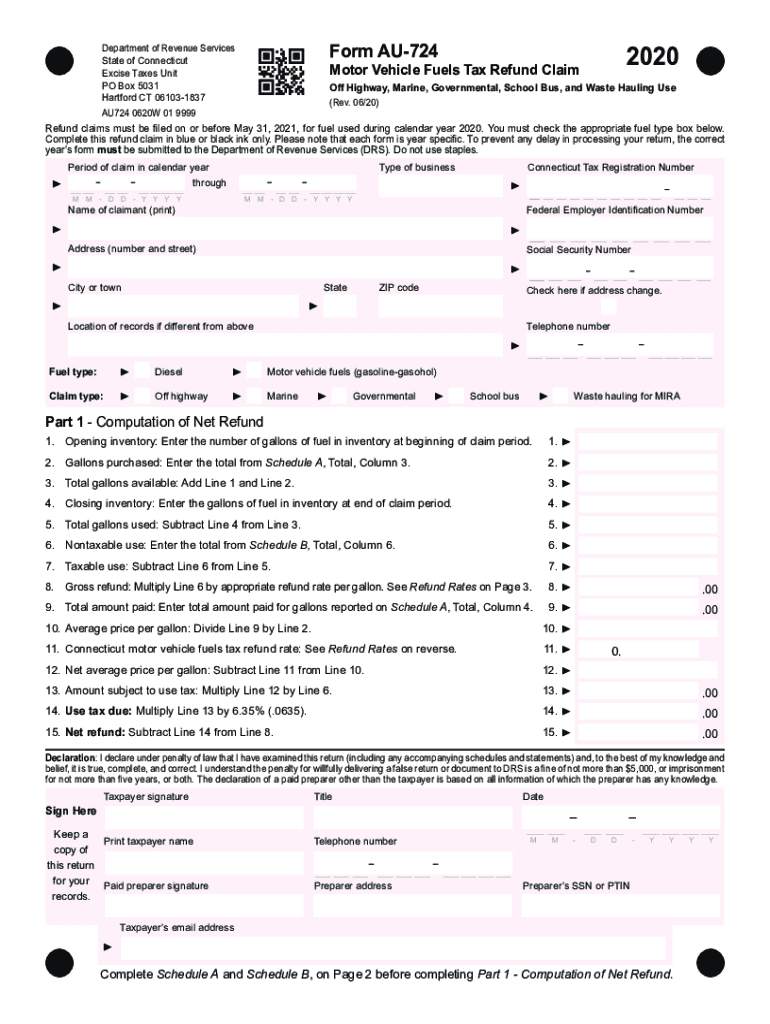

The au 724 form is essential for individuals and businesses seeking to claim refunds on fuel taxes paid in Connecticut. Refund claims must be filed on or before May 31, 2021, for fuel used during the calendar year. This form allows taxpayers to recover some of the taxes imposed on motor fuels, which can significantly benefit those who utilize fuel for business operations or other eligible purposes.

Steps to Complete the Refund Claims

To successfully complete the au 724 form, follow these steps:

- Gather necessary documentation, including receipts and records of fuel purchases.

- Fill out the au 724 form accurately, ensuring all required fields are completed.

- Calculate the total amount of fuel used and the corresponding tax paid.

- Attach supporting documents to substantiate your claim.

- Submit the completed form by the deadline of May 31, 2021, either online or via mail.

Eligibility Criteria for Refund Claims

To be eligible for a refund using the au 724 form, applicants must meet specific criteria. Generally, the fuel must have been used for taxable purposes, and the claimant must be able to provide proof of purchase. Additionally, both individuals and businesses can apply, but they must ensure that their claims align with Connecticut's fuel tax regulations.

Required Documents for Submission

When submitting the au 724 form, it is crucial to include all required documents. These typically consist of:

- Receipts for fuel purchases.

- Proof of payment for the fuel.

- Any additional documentation that supports the claim, such as business records if applicable.

Failure to provide adequate documentation may result in delays or denial of the refund claim.

Filing Deadlines and Important Dates

Awareness of filing deadlines is vital for ensuring that your au 724 form is submitted on time. Claims for fuel used during the calendar year must be submitted by May 31, 2021. It is advisable to prepare and submit your claim well in advance of this deadline to avoid any last-minute issues.

Consequences of Non-Compliance

Not adhering to the regulations surrounding the au 724 form can lead to penalties. If claims are filed late or if the information provided is inaccurate, taxpayers may face fines or disqualification from receiving refunds. It is essential to ensure that all information is correct and submitted on time to avoid these consequences.

Quick guide on how to complete refund claims must be filed on or before may31 2021 for fuel used during calendar year 2020

Easily Prepare Refund Claims Must Be Filed On Or Before May31, 2021, For Fuel Used During Calendar Year on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents swiftly without any holdups. Manage Refund Claims Must Be Filed On Or Before May31, 2021, For Fuel Used During Calendar Year on any platform using airSlate SignNow's Android or iOS applications and streamline any document-based task today.

The Easiest Way to Edit and Electronically Sign Refund Claims Must Be Filed On Or Before May31, 2021, For Fuel Used During Calendar Year

- Obtain Refund Claims Must Be Filed On Or Before May31, 2021, For Fuel Used During Calendar Year and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and electronically sign Refund Claims Must Be Filed On Or Before May31, 2021, For Fuel Used During Calendar Year to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct refund claims must be filed on or before may31 2021 for fuel used during calendar year 2020

Create this form in 5 minutes!

How to create an eSignature for the refund claims must be filed on or before may31 2021 for fuel used during calendar year 2020

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the au 724 form and why is it important?

The au 724 form is a crucial document used in various business transactions, allowing organizations to officially sign and validate agreements. Using airSlate SignNow to handle the au 724 form simplifies the signing process, ensuring it is completed efficiently and securely.

-

How does airSlate SignNow simplify the au 724 form signing process?

airSlate SignNow streamlines the signing process for the au 724 form by allowing users to send documents for eSignature in just a few clicks. The platform offers an intuitive interface and real-time tracking, making it easy to manage the entire workflow associated with the au 724 form.

-

What are the pricing options for using airSlate SignNow with the au 724 form?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs when handling the au 724 form. Prospective customers can choose from a variety of subscription options to find the most cost-effective solution for their eSigning requirements.

-

Can I use airSlate SignNow to integrate the au 724 form with other applications?

Yes, airSlate SignNow supports integrations with multiple applications, allowing users to connect their documents, including the au 724 form, with CRM systems, cloud storage, and productivity tools. This enhances the overall workflow and improves efficiency when managing signed documents.

-

What features does airSlate SignNow offer for the au 724 form?

airSlate SignNow provides several features specifically designed for the au 724 form, including customizable templates, automatic reminders, and secure storage options. These features ensure that your documents are not only properly signed but also organized and easily accessible.

-

Is it secure to sign the au 724 form using airSlate SignNow?

Absolutely! airSlate SignNow utilizes state-of-the-art security measures to protect the integrity of the au 724 form and other signed documents. SSL encryption and audit trails ensure that your sensitive information is safe and compliant with legal standards.

-

How can airSlate SignNow benefit my business with the au 724 form?

By using airSlate SignNow for the au 724 form, your business can signNowly reduce the time spent on documents and enhance overall productivity. The eSigning solution allows for faster turnaround times, eliminating the delays associated with traditional signing methods.

Get more for Refund Claims Must Be Filed On Or Before May31, 2021, For Fuel Used During Calendar Year

- Letter from tenant to landlord with demand that landlord repair floors stairs or railings utah form

- Utah tenant landlord 497427441 form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles utah form

- Letter from tenant to landlord about landlords failure to make repairs utah form

- Letter from landlord to tenant as notice that rent was voluntarily lowered in exchange for tenant agreeing to make repairs 497427444 form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession utah form

- Letter from tenant to landlord about illegal entry by landlord utah form

- Letter from landlord to tenant about time of intent to enter premises utah form

Find out other Refund Claims Must Be Filed On Or Before May31, 2021, For Fuel Used During Calendar Year

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online