Office of Tax and Revenue D 41 Otr Cfo Dc Gov Form

Understanding the DC D76 PDF Form

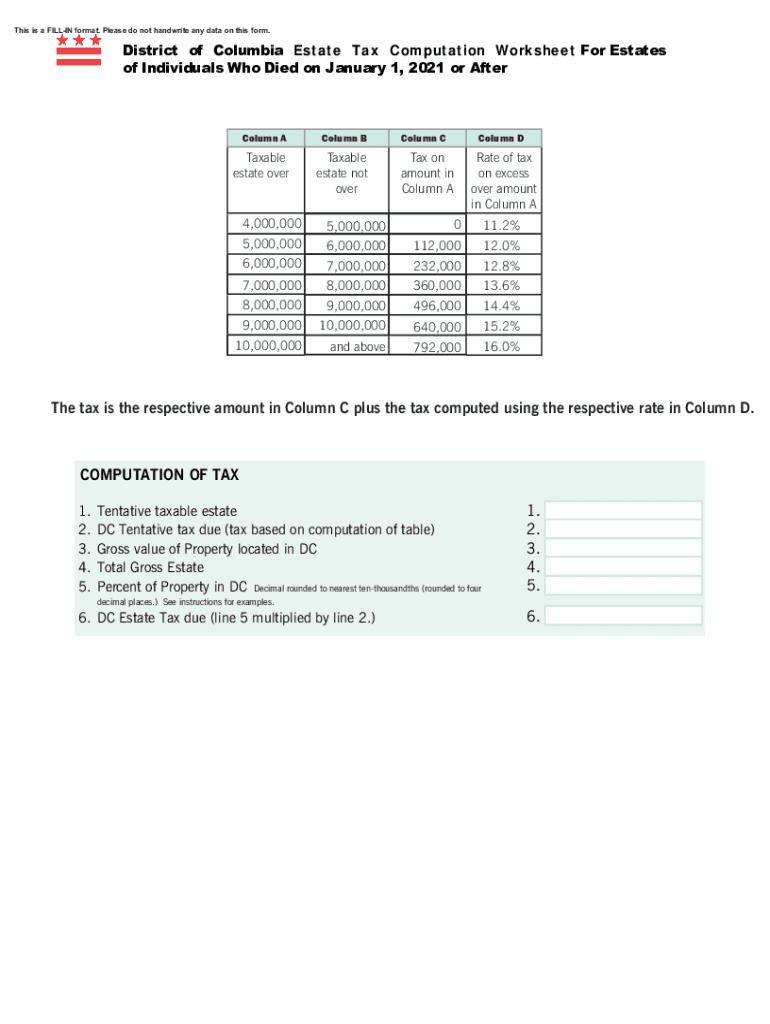

The DC D76 PDF form is essential for filing the estate tax return in the District of Columbia. This document is used to report the estate's value and calculate the tax owed to the local government. It is crucial for executors and administrators of estates to understand the requirements and implications of this form. The D76 form must be accurately completed to ensure compliance with local tax laws, and it serves as a formal declaration of the estate's financial standing.

Steps to Complete the DC D76 PDF Form

Completing the DC D76 PDF form involves several steps to ensure accuracy and compliance. First, gather all necessary documentation related to the estate, including asset valuations, debts, and expenses. Next, accurately fill out each section of the form, providing detailed information about the decedent and the estate's assets. It is essential to double-check calculations and ensure that all required attachments are included. Finally, submit the completed form to the Office of Tax and Revenue by the specified deadline to avoid penalties.

Required Documents for the DC D76 PDF Form

When preparing to file the DC D76 PDF form, several documents are required to support the information provided. These documents typically include:

- Death certificate of the decedent

- Inventory of estate assets

- Valuation appraisals for real estate and significant personal property

- Documentation of debts and liabilities

- Any previous tax returns related to the estate

Having these documents readily available will facilitate the completion of the form and ensure that all necessary information is accurately reported.

Filing Deadlines for the DC D76 PDF Form

It is important to be aware of the filing deadlines associated with the DC D76 PDF form to avoid penalties. The estate tax return must typically be filed within nine months of the decedent's date of death. However, an extension may be available under certain circumstances. Executors should plan accordingly and ensure that all documentation is prepared in advance to meet this timeline.

Penalties for Non-Compliance with the DC D76 PDF Form

Failing to file the DC D76 PDF form on time or submitting inaccurate information can result in significant penalties. These may include fines and interest on unpaid taxes. It is vital for executors to understand the importance of compliance with tax regulations to avoid these consequences. Ensuring that the form is completed accurately and submitted on time will help mitigate any potential risks associated with non-compliance.

Digital vs. Paper Version of the DC D76 PDF Form

The DC D76 PDF form is available in both digital and paper formats. Utilizing the digital version can streamline the filing process, allowing for easier completion and submission. Electronic filing may also reduce the risk of errors and provide immediate confirmation of submission. However, some individuals may prefer the traditional paper method, which allows for physical documentation. Understanding the advantages and disadvantages of each format can help executors choose the best option for their needs.

Quick guide on how to complete office of tax and revenue 2004 d 41 otrcfodcgov

Effortlessly prepare Office Of Tax And Revenue D 41 Otr cfo dc gov on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without any delays. Manage Office Of Tax And Revenue D 41 Otr cfo dc gov on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Office Of Tax And Revenue D 41 Otr cfo dc gov with ease

- Find Office Of Tax And Revenue D 41 Otr cfo dc gov and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Office Of Tax And Revenue D 41 Otr cfo dc gov and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the office of tax and revenue 2004 d 41 otrcfodcgov

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

How to generate an e-signature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the dc d76 pdf and how does it work with airSlate SignNow?

The dc d76 pdf is a digital document format that can be seamlessly integrated into airSlate SignNow's eSignature platform. With airSlate SignNow, users can easily upload, edit, and eSign dc d76 pdf files, streamlining the document workflow for businesses. This feature allows for quick document turnaround and enhances collaboration.

-

Are there any costs associated with using airSlate SignNow for dc d76 pdf documents?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those that work with dc d76 pdf documents. While there may be costs involved, many users find that the investment leads to signNow savings in time and resources. You can explore the pricing options on our website.

-

What features does airSlate SignNow offer for managing dc d76 pdf files?

airSlate SignNow includes various features for managing dc d76 pdf files, such as customizable templates, in-line editing, and secure storage. These functionalities ensure that users can create and manage their documents efficiently while maintaining compliance and security standards. This versatility makes it an excellent choice for businesses of all sizes.

-

Can I automate the process of sending dc d76 pdf documents for signature?

Yes, airSlate SignNow allows users to automate the sending of dc d76 pdf documents for signatures. Automation features streamline the workflow, reducing manual tasks and speeding up the signature process. This can greatly enhance productivity and ensure quicker turnaround times for important documents.

-

How does airSlate SignNow integrate with other tools for handling dc d76 pdf files?

airSlate SignNow offers integrations with various tools and platforms, making it easy to handle dc d76 pdf documents in conjunction with other business applications. Users can link their favorite CRM systems, cloud storage, and productivity tools to enhance their document workflow. This flexibility increases efficiency and simplifies document management.

-

Is it safe to send dc d76 pdf documents through airSlate SignNow?

Yes, sending dc d76 pdf documents through airSlate SignNow is secure. The platform employs industry-standard encryption and compliance protocols to protect sensitive information. Users can confidently send documents knowing that their data is safeguarded during the signing process.

-

What benefits does airSlate SignNow provide when dealing with dc d76 pdf documents?

Using airSlate SignNow for dc d76 pdf documents provides numerous benefits, such as reduced turnaround time, improved compliance, and enhanced collaboration. The intuitive interface makes it easy for users to navigate and manage their documents effectively. Overall, it empowers teams to work more efficiently and achieve their goals.

Get more for Office Of Tax And Revenue D 41 Otr cfo dc gov

- Option to purchase addendum to residential lease lease or rent to own alabama form

- Alabama prenuptial premarital agreement with financial statements alabama form

- Alabama prenuptial premarital agreement without financial statements alabama form

- Amendment to prenuptial or premarital agreement alabama form

- Financial statements only in connection with prenuptial premarital agreement alabama form

- Revocation of premarital or prenuptial agreement alabama form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children alabama form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497295381 form

Find out other Office Of Tax And Revenue D 41 Otr cfo dc gov

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request