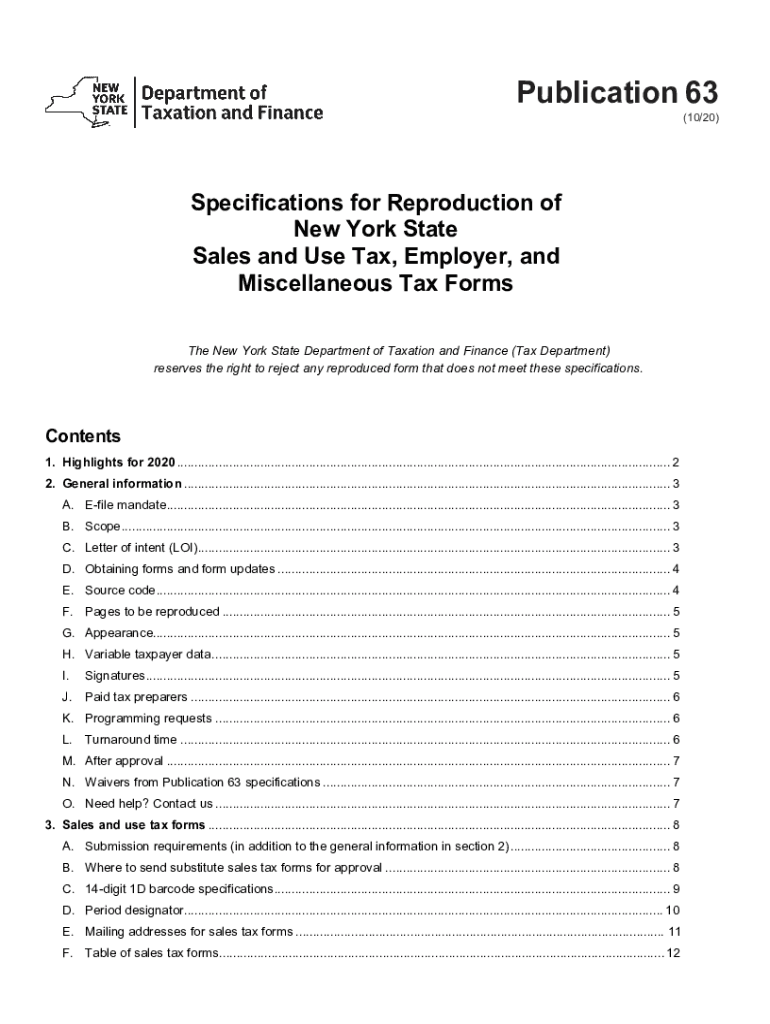

Publication 63 10 20 Specifications for Reproduction of New York State Sales and Use Tax, Employer, and Miscellaneous Tax Forms 2020-2026

What is the 83 specifications employment form fillable?

The 83 specifications employment form fillable is a crucial document used in various employment contexts, particularly for tax and compliance purposes. This form allows employers to gather essential information from employees, ensuring that they meet legal and regulatory requirements. It typically includes sections for personal details, employment history, and tax withholding information. By using a fillable format, the process becomes more efficient, allowing for easy completion and submission.

Steps to complete the 83 specifications employment form fillable

Completing the 83 specifications employment form fillable involves several straightforward steps:

- Download the form: Access the fillable version online to ensure you have the most current format.

- Fill in personal information: Provide your name, address, and contact details accurately.

- Employment details: Include your job title, department, and start date.

- Tax information: Complete the sections regarding your tax withholding preferences.

- Review: Check all entries for accuracy and completeness to avoid delays.

- Submit: Follow the specified submission method, whether online or via mail.

Legal use of the 83 specifications employment form fillable

The legal use of the 83 specifications employment form fillable is essential for compliance with federal and state employment laws. This form must be completed accurately to ensure that the information provided is valid and can be used for tax reporting and other legal purposes. Employers are responsible for maintaining these records and ensuring they meet all relevant legal standards, including those related to privacy and data protection.

Key elements of the 83 specifications employment form fillable

Understanding the key elements of the 83 specifications employment form fillable is vital for both employers and employees. Important sections typically include:

- Personal Information: Name, address, and contact details.

- Employment Information: Job title, department, and employment dates.

- Tax Withholding: Options for federal and state tax deductions.

- Signature: A space for the employee's signature to validate the information provided.

Examples of using the 83 specifications employment form fillable

The 83 specifications employment form fillable can be utilized in various scenarios, including:

- New hires completing their employment paperwork.

- Current employees updating their tax information.

- Employers conducting audits to ensure compliance with tax regulations.

Form submission methods for the 83 specifications employment form fillable

Submitting the 83 specifications employment form fillable can be done through several methods, depending on the employer's preferences:

- Online Submission: Many employers allow for electronic submission through secure portals.

- Mail: The completed form can be printed and mailed to the appropriate department.

- In-Person: Some employers may require the form to be submitted directly to HR.

Quick guide on how to complete publication 63 10 20 specifications for reproduction of new york state sales and use tax employer and miscellaneous tax forms

Easily Prepare Publication 63 10 20 Specifications For Reproduction Of New York State Sales And Use Tax, Employer, And Miscellaneous Tax Forms on Any Device

The management of online documents has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your files quickly and without delays. Manage Publication 63 10 20 Specifications For Reproduction Of New York State Sales And Use Tax, Employer, And Miscellaneous Tax Forms on any device using the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

How to Modify and eSign Publication 63 10 20 Specifications For Reproduction Of New York State Sales And Use Tax, Employer, And Miscellaneous Tax Forms Effortlessly

- Find Publication 63 10 20 Specifications For Reproduction Of New York State Sales And Use Tax, Employer, And Miscellaneous Tax Forms and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign tool, which only takes a few seconds and holds the same legal significance as a conventional wet ink signature.

- Review all details and hit the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Modify and eSign Publication 63 10 20 Specifications For Reproduction Of New York State Sales And Use Tax, Employer, And Miscellaneous Tax Forms and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 63 10 20 specifications for reproduction of new york state sales and use tax employer and miscellaneous tax forms

Create this form in 5 minutes!

How to create an eSignature for the publication 63 10 20 specifications for reproduction of new york state sales and use tax employer and miscellaneous tax forms

The way to generate an e-signature for your PDF document online

The way to generate an e-signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the 83 specifications employment form fillable?

The 83 specifications employment form fillable is a digital document designed for employees to complete and submit essential employment details. It streamlines the onboarding process by allowing businesses to collect necessary information electronically, reducing paperwork and enhancing efficiency.

-

How does airSlate SignNow facilitate the use of the 83 specifications employment form fillable?

AirSlate SignNow provides a user-friendly platform that allows businesses to create, send, and eSign the 83 specifications employment form fillable. With its drag-and-drop interface, you can customize fields to gather specific employee data, making it easier to manage forms digitally.

-

Can I integrate the 83 specifications employment form fillable with other tools?

Yes, airSlate SignNow offers seamless integrations with various applications such as CRM systems, cloud storage, and email platforms. This ensures that the data collected through the 83 specifications employment form fillable can be easily synchronized and managed across your preferred tools.

-

What are the pricing options for using the 83 specifications employment form fillable with airSlate SignNow?

AirSlate SignNow offers flexible pricing plans, including free trials and subscription models that cater to businesses of all sizes. You can choose a plan that best suits your needs and try out the service, including the use of the 83 specifications employment form fillable, without any initial investment.

-

What benefits does the 83 specifications employment form fillable provide for businesses?

The 83 specifications employment form fillable enhances operational efficiency by minimizing paperwork, reducing errors, and speeding up the onboarding process. It helps businesses comply with regulations and maintain organized records, ultimately leading to better employee experiences.

-

Is the 83 specifications employment form fillable secure?

Absolutely. AirSlate SignNow prioritizes the security of your documents and implements robust encryption protocols to safeguard data within the 83 specifications employment form fillable. This means sensitive employee information is protected throughout the signing and submission process.

-

Can I track the completion status of the 83 specifications employment form fillable?

Yes, airSlate SignNow provides real-time tracking features that allow you to monitor the status of the 83 specifications employment form fillable. You will receive notifications when the form is opened, signed, and completed, ensuring you stay updated on your onboarding processes.

Get more for Publication 63 10 20 Specifications For Reproduction Of New York State Sales And Use Tax, Employer, And Miscellaneous Tax Forms

- Fencing contract for contractor arkansas form

- Hvac contract for contractor arkansas form

- Landscape contract for contractor arkansas form

- Commercial contract for contractor arkansas form

- Excavator contract for contractor arkansas form

- Renovation contract for contractor arkansas form

- Residential cleaning contract for contractor arkansas form

- Concrete mason contract for contractor arkansas form

Find out other Publication 63 10 20 Specifications For Reproduction Of New York State Sales And Use Tax, Employer, And Miscellaneous Tax Forms

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure