Instructions for Form NYC 2S Welcome to NYC Gov 2020

Understanding the NYC 1127 Form

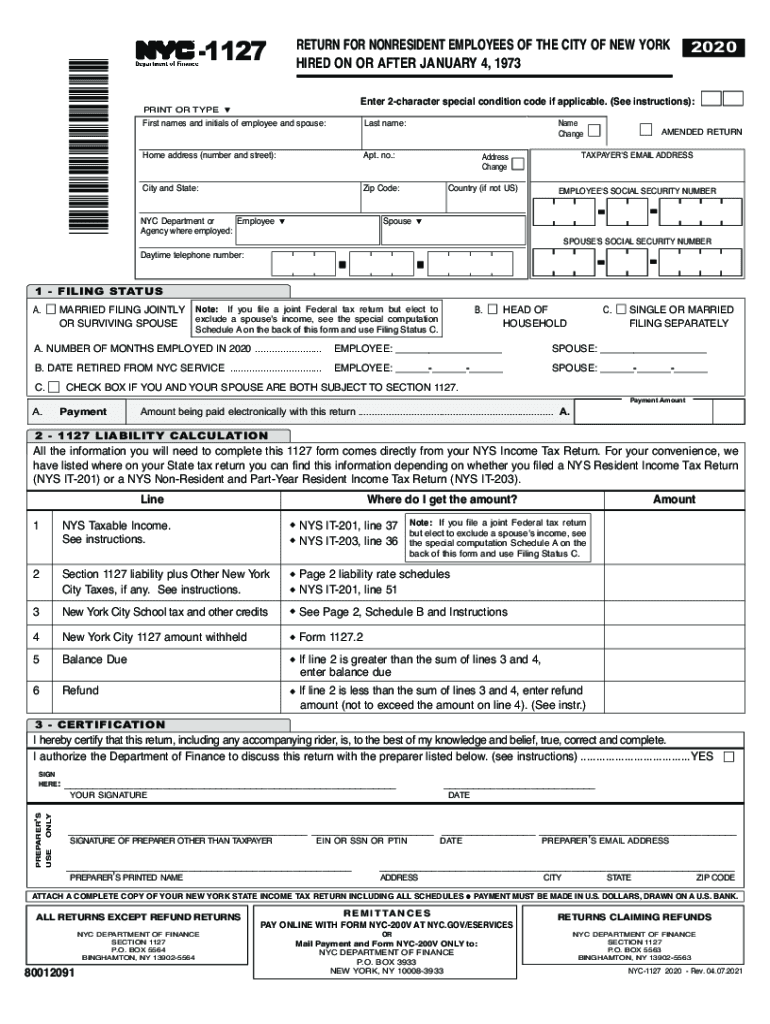

The NYC 1127 form is a tax document used by individuals and businesses in New York City to report certain financial information. This form is essential for compliance with local tax regulations and is specifically tailored for those who meet specific criteria set by the city. Understanding its purpose and requirements can help ensure accurate filing and avoid potential penalties.

Steps to Complete the NYC 1127 Form

Completing the NYC 1127 form involves several key steps:

- Gather necessary documentation, including income statements and any relevant financial records.

- Carefully read the instructions provided with the form to understand the information required.

- Fill out the form accurately, ensuring all fields are completed as per the guidelines.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the appropriate method, whether online, by mail, or in person.

Filing Deadlines for the NYC 1127 Form

It is crucial to adhere to the filing deadlines associated with the NYC 1127 form to avoid penalties. Typically, the deadline aligns with the tax year, and any extensions must be requested in advance. Keeping track of these dates ensures compliance with local tax laws.

Required Documents for Filing the NYC 1127 Form

When filing the NYC 1127 form, certain documents are required to support the information provided. These may include:

- Income statements, such as W-2s or 1099s.

- Proof of residency or business location within New York City.

- Any previous tax returns that may be relevant.

Legal Use of the NYC 1127 Form

The NYC 1127 form is legally binding when completed and submitted in accordance with local regulations. It is essential to ensure that all information is accurate and truthful to maintain compliance with tax laws. Misrepresentation or errors can lead to legal consequences and financial penalties.

Penalties for Non-Compliance with the NYC 1127 Form

Failure to file the NYC 1127 form on time or inaccuracies in the submission can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the implications of non-compliance emphasizes the importance of timely and accurate filing.

Quick guide on how to complete instructions for form nyc 2s welcome to nycgov

Effortlessly Prepare Instructions For Form NYC 2S Welcome To NYC gov on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents swiftly without delays. Manage Instructions For Form NYC 2S Welcome To NYC gov on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to Edit and eSign Instructions For Form NYC 2S Welcome To NYC gov with Ease

- Find Instructions For Form NYC 2S Welcome To NYC gov and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize key sections of your documents or redact sensitive information using the specialized tools provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your updates.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing fresh copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Instructions For Form NYC 2S Welcome To NYC gov and ensure clear communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form nyc 2s welcome to nycgov

Create this form in 5 minutes!

How to create an eSignature for the instructions for form nyc 2s welcome to nycgov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The way to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

The way to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to nyc 1127?

airSlate SignNow is a user-friendly eSignature solution designed to streamline your document signing process. In the context of nyc 1127, it helps businesses in New York City efficiently manage and eSign important documents without the hassle of physical paperwork.

-

What are the pricing plans for airSlate SignNow in nyc 1127?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes in nyc 1127. With options ranging from individual to enterprise solutions, you can choose the plan that best fits your budget and requirements for streamlined document management.

-

What features does airSlate SignNow offer for nyc 1127 businesses?

airSlate SignNow provides a range of features tailored for businesses in nyc 1127, including customizable templates, real-time collaboration, and security compliance. These features ensure that document management is efficient, secure, and meets local requirements.

-

How does airSlate SignNow improve business operations for those in nyc 1127?

By using airSlate SignNow, businesses in nyc 1127 can signNowly enhance their efficiency by reducing turnaround times for document signing. This leads to faster transactions, improved customer experiences, and ultimately, increased productivity for your organization.

-

Can airSlate SignNow integrate with other applications for users in nyc 1127?

Yes, airSlate SignNow offers seamless integrations with a variety of popular applications that businesses in nyc 1127 frequently use, such as CRM and accounting software. This integration ensures that your document workflows are cohesive, allowing for an uninterrupted operational flow.

-

Is airSlate SignNow compliant with legal requirements in nyc 1127?

Absolutely, airSlate SignNow complies with the legal standards for electronic signatures in nyc 1127 and beyond. This adherence to regulations ensures that your electronically signed documents are legally binding and recognized by governing entities.

-

How can I get started with airSlate SignNow in nyc 1127?

Getting started with airSlate SignNow in nyc 1127 is quick and easy. Simply visit our website to sign up for a free trial, explore our features, and experience firsthand how our eSignature solution can transform your document signing processes.

Get more for Instructions For Form NYC 2S Welcome To NYC gov

- Arkansas shut off form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat arkansas form

- 14 day notice to pay rent or lease terminates for residential property arkansas form

- Arkansas pay rent form

- Ar termination form

- Assignment of mortgage by individual mortgage holder arkansas form

- Assignment of mortgage by corporate mortgage holder arkansas form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property arkansas form

Find out other Instructions For Form NYC 2S Welcome To NYC gov

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple