Instructions for Form it 196 Tax NY Gov 2022-2026

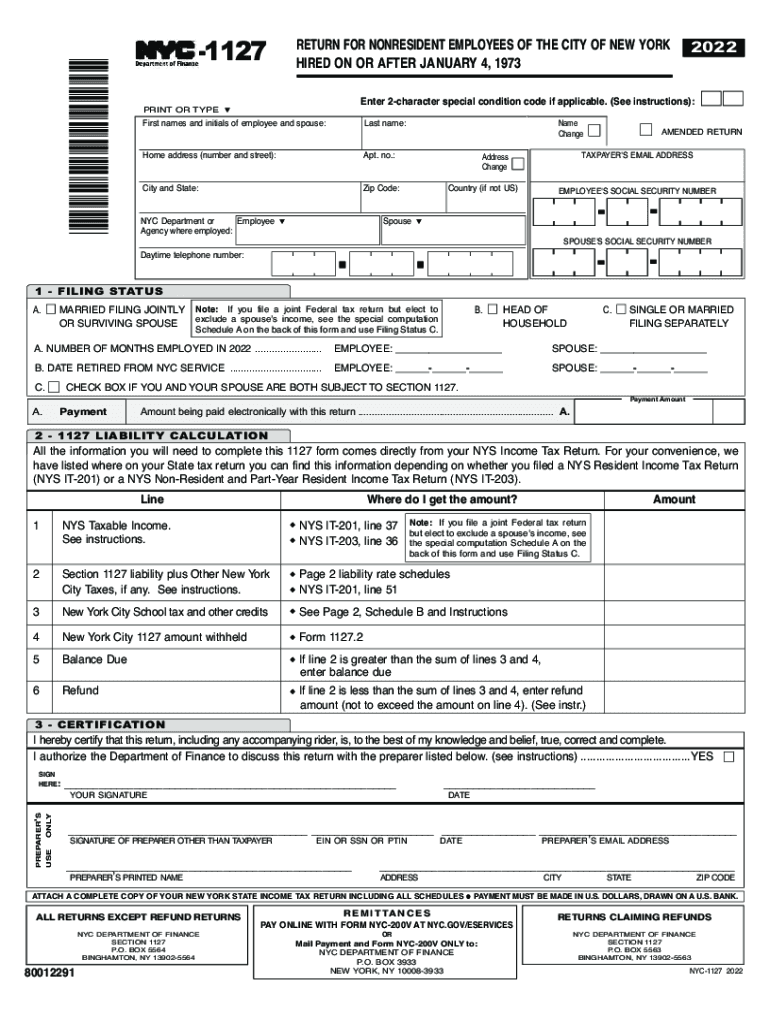

What is the 2020 NYC 1127 Form?

The 2020 NYC 1127 form is a tax return document used by nonresidents who earn income in New York City. This form allows individuals to report their income and calculate the appropriate tax liability. It is essential for nonresidents to accurately complete this form to ensure compliance with local tax laws and avoid penalties.

Steps to Complete the 2020 NYC 1127 Form

Completing the 2020 NYC 1127 form involves several key steps:

- Gather all necessary financial documents, including W-2s and 1099s.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income earned in New York City, detailing sources and amounts.

- Calculate your tax liability using the provided tax tables.

- Review the form for accuracy before submission.

Legal Use of the 2020 NYC 1127 Form

The 2020 NYC 1127 form is legally binding when completed correctly. To ensure its validity, it is crucial to adhere to the guidelines set forth by the New York City Department of Finance. This includes providing accurate information and submitting the form by the specified deadline. Noncompliance can result in penalties, including fines or additional taxes owed.

Filing Deadlines for the 2020 NYC 1127 Form

It is important to be aware of the filing deadlines for the 2020 NYC 1127 form. Typically, the form must be submitted by April fifteenth of the following tax year. However, if you are unable to meet this deadline, you may request an extension. Ensure that you check for any updates or changes to deadlines that may occur.

Required Documents for the 2020 NYC 1127 Form

When preparing to file the 2020 NYC 1127 form, certain documents are essential:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources.

- Documentation of deductions or credits you plan to claim.

Penalties for Non-Compliance with the 2020 NYC 1127 Form

Failing to file the 2020 NYC 1127 form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to file on time and ensure the accuracy of your information to avoid these consequences.

Quick guide on how to complete instructions for form it 196 taxnygov 627253592

Complete Instructions For Form IT 196 Tax NY gov effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Instructions For Form IT 196 Tax NY gov on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to alter and eSign Instructions For Form IT 196 Tax NY gov with ease

- Find Instructions For Form IT 196 Tax NY gov and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you prefer to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, and mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Instructions For Form IT 196 Tax NY gov and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 196 taxnygov 627253592

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 196 taxnygov 627253592

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 2020 nyc 1127?

airSlate SignNow is a versatile eSignature platform that allows businesses to send and electronically sign documents with ease. The reference to '2020 nyc 1127' underscores specific regulatory compliance or documents that may be prevalent in that region, enhancing your workflow in New York City.

-

What are the pricing options for airSlate SignNow for those interested in 2020 nyc 1127?

airSlate SignNow offers competitive pricing plans that cater to different business needs, including options for teams or enterprises working with documents related to 2020 nyc 1127. Potential customers can choose a plan that fits their budget while ensuring they have access to all essential features.

-

What features does airSlate SignNow provide for managing 2020 nyc 1127-related documents?

airSlate SignNow includes robust features like templates, reusable fields, and automated workflows, which are particularly beneficial when managing documents associated with the 2020 nyc 1127 context. These tools enhance efficiency and accuracy, streamlining your document management processes.

-

How does airSlate SignNow improve document security for 2020 nyc 1127 transactions?

Security is a top priority at airSlate SignNow, with features such as encryption and secure cloud storage designed to safeguard your documents, including those referencing 2020 nyc 1127. This ensures that your sensitive information remains protected throughout the signing process.

-

Can airSlate SignNow integrate with other tools relevant to 2020 nyc 1127?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications that can enhance your workflow for handling 2020 nyc 1127 documentation. This allows you to streamline processes and maintain productivity by connecting your favorite tools directly.

-

What benefits does airSlate SignNow offer for small businesses dealing with 2020 nyc 1127?

For small businesses in New York City, airSlate SignNow provides a cost-effective solution to eSigning and document management, especially regarding compliance with 2020 nyc 1127 regulations. This allows businesses to save time and resources while ensuring legality and professionalism in their operations.

-

How user-friendly is airSlate SignNow for those unfamiliar with 2020 nyc 1127 compliance?

airSlate SignNow is designed with user experience in mind, making it accessible even for those unfamiliar with complex compliance requirements like 2020 nyc 1127. Its intuitive interface guides users through the document preparation and signing process, lowering the learning curve signNowly.

Get more for Instructions For Form IT 196 Tax NY gov

- Texas lead based paint addendum form

- Letter tenant rental 497327573 form

- Texas affidavit form blank

- Letter from landlord to tenant as notice to remove unauthorized inhabitants texas form

- Tenant shut off form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat texas form

- Assignment of deed of trust by individual mortgage holder texas form

- Texas holder 497327581 form

Find out other Instructions For Form IT 196 Tax NY gov

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document