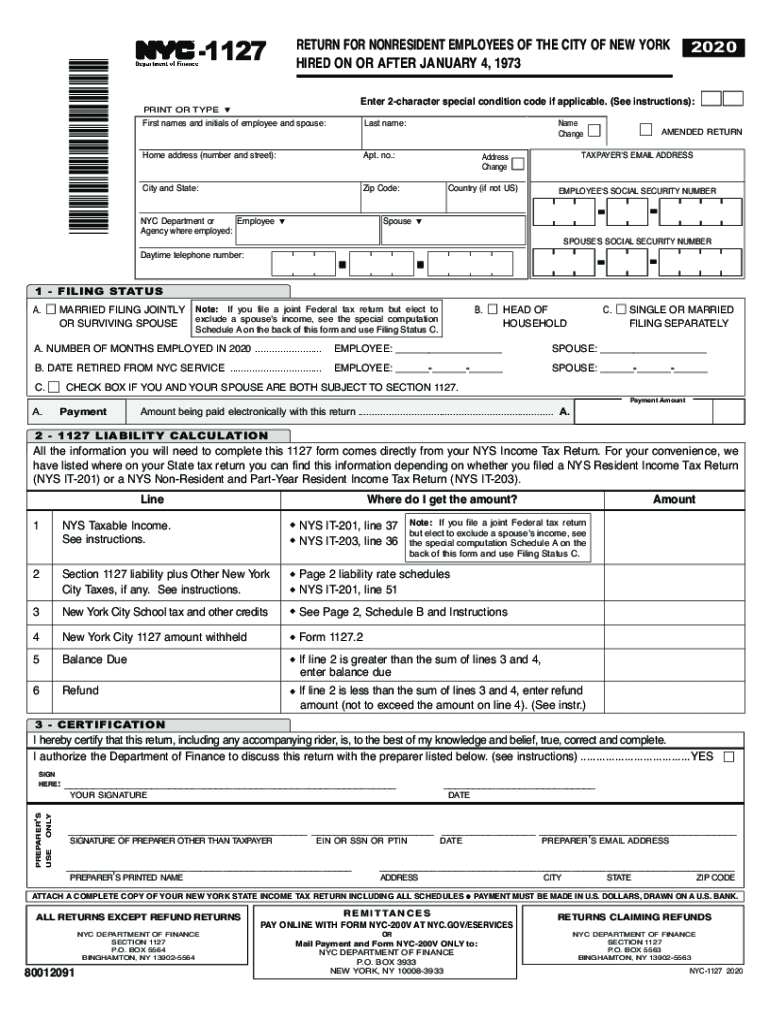

Schedule a on the Back of This Form and Use Filing Status C 2020

What is the Schedule A on the Back of the NYC 1127 Tax Form?

The Schedule A on the back of the NYC 1127 tax form is a critical component used for itemizing deductions related to certain taxes and expenses. This schedule allows taxpayers to detail specific deductions that may reduce their overall tax liability. It is essential for individuals who opt to itemize rather than take the standard deduction, as it provides a structured format to report various eligible expenses.

Common deductions that may be reported on Schedule A include state and local taxes, mortgage interest, and certain medical expenses. Understanding how to accurately fill out this schedule can significantly impact the amount of tax owed or the refund received.

Steps to Complete the Schedule A on the NYC 1127 Tax Form

Completing Schedule A requires careful attention to detail. Here are the steps to follow:

- Gather all relevant documentation, including receipts and statements for deductible expenses.

- Start by entering your total state and local taxes paid in the designated section.

- Next, list any mortgage interest paid during the tax year, ensuring you have Form 1098 from your lender.

- Document any qualifying medical expenses, keeping in mind that only expenses exceeding a certain percentage of your adjusted gross income may be deductible.

- Review all entries for accuracy before transferring the total deductions to the main NYC 1127 tax form.

IRS Guidelines for Completing the NYC 1127 Tax Form

The IRS provides specific guidelines that must be followed when completing the NYC 1127 tax form and its associated schedules. Taxpayers should refer to the IRS instructions for the 1127 form, which outline eligibility criteria, required documentation, and filing procedures. It is crucial to adhere to these guidelines to ensure compliance and avoid penalties.

Additionally, the IRS updates these guidelines periodically, so it is advisable to check for any changes that may affect the current tax year. Familiarity with these regulations can help taxpayers maximize their deductions and ensure accurate reporting.

Filing Deadlines for the NYC 1127 Tax Form

Timely filing of the NYC 1127 tax form is essential to avoid penalties and interest. The typical deadline for submitting this form is April fifteenth of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day.

Taxpayers should also be aware of any extensions that may be available, which can provide additional time to file. It is important to note that an extension to file does not extend the deadline for payment of any taxes owed.

Form Submission Methods for the NYC 1127 Tax Form

Taxpayers have several options for submitting the NYC 1127 tax form. The form can be filed electronically through approved e-filing services, which can expedite processing and reduce the likelihood of errors. Alternatively, taxpayers may choose to mail a paper copy of the form to the appropriate tax authority.

For in-person submissions, local tax offices may accept the form directly, allowing for immediate confirmation of receipt. Regardless of the method chosen, it is advisable to keep copies of all submitted documents for personal records.

Eligibility Criteria for the NYC 1127 Tax Form

To qualify for the NYC 1127 tax form, individuals must meet specific eligibility criteria set forth by the New York City Department of Finance. Generally, this form is intended for residents who have incurred certain tax liabilities that may be eligible for deductions.

Eligibility may depend on factors such as income level, residency status, and the nature of the expenses being claimed. Taxpayers should review the criteria carefully to ensure they qualify before completing the form.

Quick guide on how to complete schedule a on the back of this form and use filing status c

Manage Schedule A On The Back Of This Form And Use Filing Status C effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, since you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle Schedule A On The Back Of This Form And Use Filing Status C on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Schedule A On The Back Of This Form And Use Filing Status C with ease

- Obtain Schedule A On The Back Of This Form And Use Filing Status C and select Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or redact sensitive details using the specific tools provided by airSlate SignNow.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet signature.

- Review the information and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and eSign Schedule A On The Back Of This Form And Use Filing Status C to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule a on the back of this form and use filing status c

Create this form in 5 minutes!

How to create an eSignature for the schedule a on the back of this form and use filing status c

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is the NYC 1127 tax form 2019?

The NYC 1127 tax form 2019 is a form used for reporting certain income, expenses, and deductions for businesses operating in New York City. This form is crucial for ensuring compliance with local tax regulations and accurate reporting of tax liability. By completing the NYC 1127 tax form 2019, businesses can effectively manage their tax obligations.

-

How can I access the NYC 1127 tax form 2019?

The NYC 1127 tax form 2019 can be accessed through the official New York City Department of Finance website or directly from tax filing software that includes New York City tax forms. Additionally, airSlate SignNow offers features that allow users to easily upload and manage tax documents like the NYC 1127 tax form 2019.

-

What are the benefits of using airSlate SignNow for the NYC 1127 tax form 2019?

Using airSlate SignNow for the NYC 1127 tax form 2019 streamlines the document signing process, making it faster and more efficient. Our platform allows users to eSign documents securely, ensuring that all signatures are legally binding. This feature helps businesses save time and reduces the hassle associated with traditional paper-based tax filing.

-

Is there a cost associated with using airSlate SignNow for the NYC 1127 tax form 2019?

Yes, airSlate SignNow offers various pricing plans depending on your business needs, including options for individuals and larger teams. The cost provides access to a comprehensive digital signing solution, enabling you to handle the NYC 1127 tax form 2019 and other documents at a fraction of traditional costs. There are also free trials available to test the platform.

-

Can I integrate airSlate SignNow with other tax software for the NYC 1127 tax form 2019?

Yes, airSlate SignNow integrates seamlessly with many popular tax software solutions, making it easy to file the NYC 1127 tax form 2019. These integrations help streamline your workflow by allowing you to send documents for eSignatures directly from your tax software. This integration improves efficiency and ensures you can manage your tax filings without hassle.

-

What features does airSlate SignNow provide for tax document management, including the NYC 1127 tax form 2019?

airSlate SignNow provides a variety of features for effective tax document management, including customizable templates, reminders, and audit trails. For the NYC 1127 tax form 2019, you can create reusable templates to simplify the process in future tax years. The platform also ensures that your documents are stored securely and compliant with regulations.

-

How secure is my information when using airSlate SignNow for the NYC 1127 tax form 2019?

Security is a top priority for airSlate SignNow; we use advanced encryption methods to protect all documents, including the NYC 1127 tax form 2019. Our platform complies with industry standards for data protection to ensure your sensitive information remains confidential throughout the entire signing process. You can confidently manage your tax documents without worrying about data bsignNowes.

Get more for Schedule A On The Back Of This Form And Use Filing Status C

- Vermont will form

- Vt will 497429156 form

- Legal last will and testament form for married person with adult and minor children from prior marriage vermont

- Legal last will and testament form for civil union partner with adult and minor children from prior marriage vermont

- Legal last will and testament form for married person with adult and minor children vermont

- Legal last will and testament form for civil union partner with adult and minor children vermont

- Mutual wills package with last wills and testaments for married couple with adult and minor children vermont form

- Legal last will and testament form for a widow or widower with adult children vermont

Find out other Schedule A On The Back Of This Form And Use Filing Status C

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online