for Faster Processing, File and Pay Fuel Tax and Petroleum Distributor Licensing Fee Return through 2021-2026

Understanding the vt tax distributor return blank

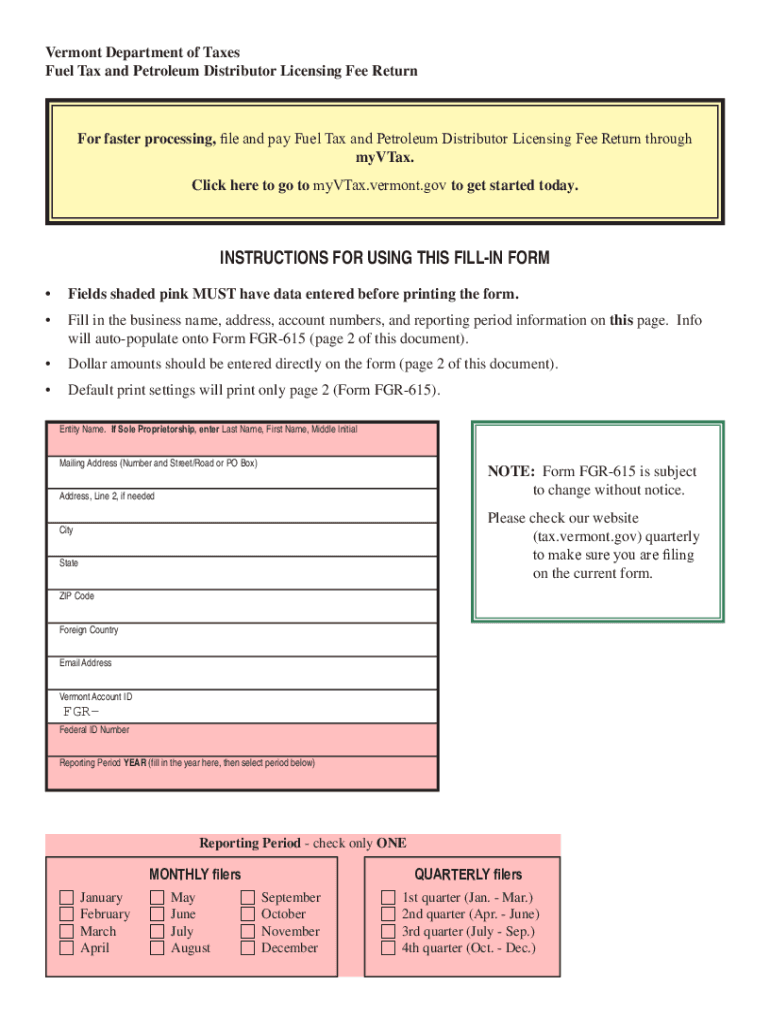

The vt tax distributor return blank is a crucial document for businesses involved in the distribution of fuel in Vermont. This form is used to report the amount of fuel distributed and the associated taxes owed to the state. It is essential for compliance with state regulations and helps ensure that businesses fulfill their tax obligations accurately. Understanding the specifics of this form can help distributors avoid penalties and maintain good standing with the Vermont Department of Taxes.

Steps to complete the vt tax distributor return blank

Filling out the vt tax distributor return blank involves several key steps:

- Gather necessary information: Collect data on the total gallons of fuel distributed, tax rates, and any exemptions that may apply.

- Complete the form: Accurately fill in all required fields, ensuring that figures are precise and reflective of actual distributions.

- Review for accuracy: Double-check all entries to avoid errors that could lead to compliance issues.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in-person, ensuring it is sent before the deadline.

Legal use of the vt tax distributor return blank

The legal use of the vt tax distributor return blank is governed by state tax laws. Submitting this form accurately is not only a legal requirement but also a means of maintaining transparency in business operations. Failure to file or inaccuracies in reporting can lead to penalties, including fines or audits. Businesses should ensure they understand their legal obligations surrounding the completion and submission of this form.

Required documents for filing the vt tax distributor return blank

When preparing to file the vt tax distributor return blank, certain documents are necessary:

- Records of fuel purchases and sales, including invoices and receipts.

- Previous tax returns, which can provide a reference for current filings.

- Any documentation supporting exemptions or deductions claimed on the form.

Having these documents on hand will facilitate a smoother filing process and help ensure compliance with state regulations.

Filing deadlines for the vt tax distributor return blank

Timely submission of the vt tax distributor return blank is crucial to avoid penalties. The filing deadlines typically align with quarterly tax periods, requiring businesses to submit their returns by the end of the month following the close of each quarter. For example, the deadline for the first quarter would be April 30. It is advisable to check the Vermont Department of Taxes website for specific dates and any updates regarding changes to deadlines.

Form submission methods for the vt tax distributor return blank

Businesses have several options for submitting the vt tax distributor return blank:

- Online submission: Many businesses prefer to file electronically for convenience and speed.

- Mail: Completed forms can be sent to the Vermont Department of Taxes via postal service.

- In-person: Some may choose to deliver their returns directly to a tax office for immediate processing.

Each method has its advantages, and businesses should choose the one that best suits their needs while ensuring compliance with submission guidelines.

Quick guide on how to complete for faster processing file and pay fuel tax and petroleum distributor licensing fee return through

Complete For Faster Processing, File And Pay Fuel Tax And Petroleum Distributor Licensing Fee Return Through seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage For Faster Processing, File And Pay Fuel Tax And Petroleum Distributor Licensing Fee Return Through on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign For Faster Processing, File And Pay Fuel Tax And Petroleum Distributor Licensing Fee Return Through effortlessly

- Find For Faster Processing, File And Pay Fuel Tax And Petroleum Distributor Licensing Fee Return Through and then click Get Form to begin.

- Make use of the tools provided to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically available on airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign For Faster Processing, File And Pay Fuel Tax And Petroleum Distributor Licensing Fee Return Through and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for faster processing file and pay fuel tax and petroleum distributor licensing fee return through

Create this form in 5 minutes!

How to create an eSignature for the for faster processing file and pay fuel tax and petroleum distributor licensing fee return through

How to create an electronic signature for your PDF file in the online mode

How to create an electronic signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is a VT tax distributor return blank?

A VT tax distributor return blank is a specific form used by distributors in Vermont to report their sales and tax activities. This document ensures compliance with state laws and helps businesses accurately fulfill their tax obligations. Understanding how to fill out this form correctly is crucial for avoiding potential penalties.

-

How can airSlate SignNow help with the VT tax distributor return blank?

airSlate SignNow simplifies the process of completing and signing your VT tax distributor return blank. Our platform allows users to fill out forms electronically, ensuring that all information is accurately captured. This not only saves time but also helps eliminate errors commonly associated with manual entry.

-

Is airSlate SignNow cost-effective for businesses preparing a VT tax distributor return blank?

Yes, airSlate SignNow offers a cost-effective solution for businesses of all sizes looking to prepare a VT tax distributor return blank. Our pricing plans are designed to fit various budgets while providing essential features like eSigning and document management. Investing in our services can ultimately save you money by preventing costly tax errors.

-

What features does airSlate SignNow provide for VT tax distributor return blanks?

airSlate SignNow comes with robust features such as template creation, cloud storage, and customizable fields specifically designed for the VT tax distributor return blank. Users can easily create reusable templates that streamline the completion of these forms. Additionally, our secure eSignature feature ensures that your documents are legally binding and compliant.

-

Can I integrate airSlate SignNow with other software to manage my VT tax distributor return blank?

Yes, airSlate SignNow offers numerous integrations with popular business software, enhancing your ability to manage the VT tax distributor return blank seamlessly. Integrations with accounting and CRM platforms allow users to sync their data and automate workflows. This ensures a smoother process for tax preparation.

-

What are the benefits of using airSlate SignNow for my tax documents, including the VT tax distributor return blank?

Using airSlate SignNow for your tax documents brings numerous benefits, including enhanced efficiency and reduced paperwork. With our platform, you can complete the VT tax distributor return blank faster and with fewer errors, ensuring timely submissions. Additionally, our secure storage means your files are protected, providing peace of mind.

-

Is support available if I have questions about the VT tax distributor return blank process?

Absolutely! airSlate SignNow provides excellent customer support to assist users navigating the VT tax distributor return blank process. Our knowledgeable team can help answer questions regarding form completion, eSigning, and any other inquiries. You can signNow out through live chat, email, or phone for prompt assistance.

Get more for For Faster Processing, File And Pay Fuel Tax And Petroleum Distributor Licensing Fee Return Through

- Tenant consent to background and reference check arkansas form

- Residential lease or rental agreement for month to month arkansas form

- Residential rental lease agreement arkansas form

- Tenant welcome letter arkansas form

- Warning of default on commercial lease arkansas form

- Warning of default on residential lease arkansas form

- Landlord tenant closing statement to reconcile security deposit arkansas form

- Arkansas name change form

Find out other For Faster Processing, File And Pay Fuel Tax And Petroleum Distributor Licensing Fee Return Through

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT