Forms in GovDownloadForm BT 1C Indiana Department of Revenue Application for 2021-2026

Understanding the Indiana BT-1 Form

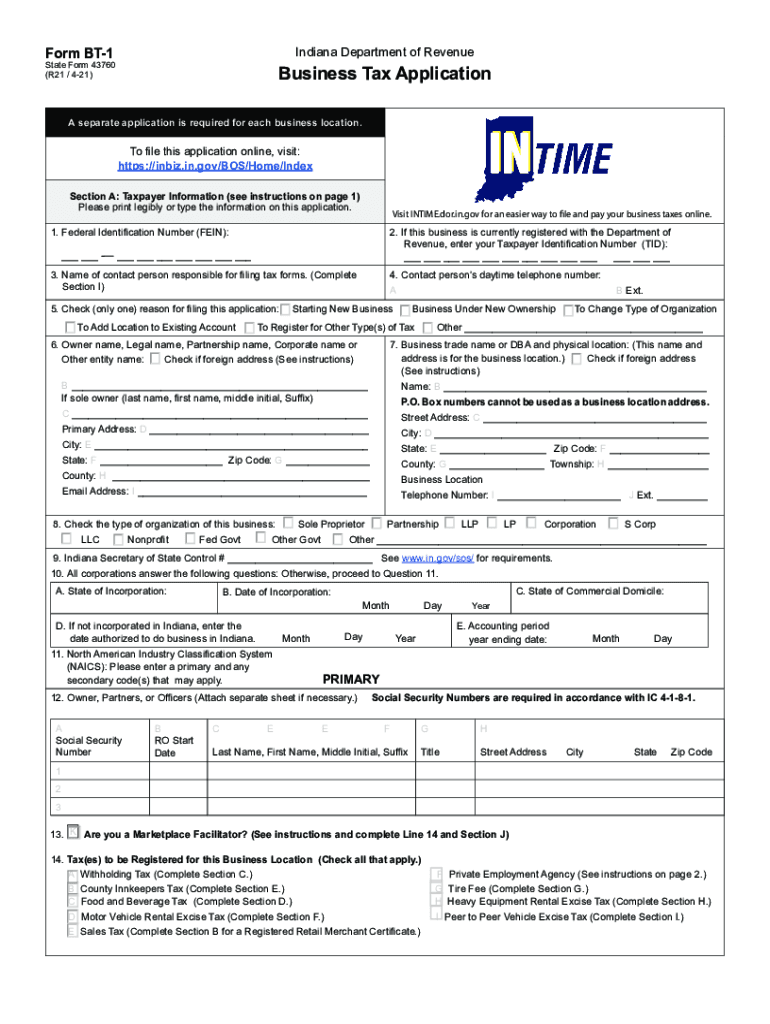

The Indiana BT-1 form is a crucial document used by businesses to apply for a Business Tax Identification Number. This form is essential for various tax-related processes, including filing state taxes and ensuring compliance with state regulations. It is specifically designed for businesses operating within Indiana and provides the necessary information to the Indiana Department of Revenue.

Steps to Complete the Indiana BT-1 Form

Completing the Indiana BT-1 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your business name, address, and federal Employer Identification Number (EIN). Next, fill out the form with precise details regarding your business structure, such as whether you are a corporation, partnership, or sole proprietorship. After completing the form, review it carefully for any errors before submission. This thorough review helps prevent delays in processing.

Required Documents for the Indiana BT-1 Form

When submitting the Indiana BT-1 form, certain documents are required to support your application. These typically include:

- Your federal Employer Identification Number (EIN)

- Business formation documents, if applicable

- Proof of business address, such as a utility bill or lease agreement

Having these documents ready will streamline the application process and ensure that your submission is complete.

Form Submission Methods for the Indiana BT-1

The Indiana BT-1 form can be submitted through various methods to accommodate different preferences. You can choose to file the form online through the Indiana Department of Revenue's website, which offers a convenient and efficient way to complete your application. Alternatively, you may also print the form and submit it via mail or in person at your local Department of Revenue office. Each method has its own processing times, so consider your timeline when deciding how to submit.

Legal Use of the Indiana BT-1 Form

The Indiana BT-1 form is legally binding once submitted and accepted by the Indiana Department of Revenue. It is important to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or delays in processing. Understanding the legal implications of this form helps businesses maintain compliance with state tax laws and regulations.

Eligibility Criteria for the Indiana BT-1 Form

To be eligible for the Indiana BT-1 form, businesses must operate within the state of Indiana and meet specific criteria. This includes having a physical presence in the state or conducting business activities that generate taxable income. Additionally, businesses must provide accurate information regarding their structure and ownership to ensure proper classification for tax purposes.

Quick guide on how to complete formsingovdownloadform bt 1c indiana department of revenue application for

Effortlessly Prepare Forms in govDownloadForm BT 1C Indiana Department Of Revenue Application For on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hold-ups. Manage Forms in govDownloadForm BT 1C Indiana Department Of Revenue Application For on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign Forms in govDownloadForm BT 1C Indiana Department Of Revenue Application For

- Find Forms in govDownloadForm BT 1C Indiana Department Of Revenue Application For and click on Get Form to begin.

- Use the tools provided to fill out your form.

- Mark important sections of your documents or redact sensitive information with the tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Forms in govDownloadForm BT 1C Indiana Department Of Revenue Application For and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct formsingovdownloadform bt 1c indiana department of revenue application for

Create this form in 5 minutes!

How to create an eSignature for the formsingovdownloadform bt 1c indiana department of revenue application for

How to create an e-signature for your PDF document online

How to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to generate an e-signature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The way to generate an e-signature for a PDF file on Android OS

People also ask

-

What is a bt form business and how can it benefit my company?

A bt form business refers to a business transaction form that streamlines the process of managing contracts and agreements. By utilizing a bt form business, companies can enhance efficiency in their workflows, reduce paperwork, and ensure compliance. This ultimately leads to faster turnaround times and increased productivity.

-

How does airSlate SignNow facilitate the bt form business process?

airSlate SignNow offers a user-friendly platform that simplifies the creation, sharing, and signing of bt form business documents. With its intuitive interface, businesses can easily customize forms and manage digital signatures in one place. This streamlines the overall process and enhances collaboration among teams.

-

What pricing options are available for airSlate SignNow's bt form business solutions?

airSlate SignNow provides flexible pricing plans tailored to fit various business needs, including options for small businesses and enterprises. These plans include features designed specifically for managing a bt form business, ensuring you pay only for what you require. Customers can choose from monthly or annual subscriptions to suit their budget.

-

Can I integrate airSlate SignNow with other applications for my bt form business?

Yes, airSlate SignNow offers seamless integrations with popular business applications such as Google Workspace, Salesforce, and Microsoft 365. This makes it easier to incorporate your bt form business processes into your existing workflows. With these integrations, you can automate tasks and improve efficiency across tools.

-

What security measures does airSlate SignNow have for handling bt form business documents?

Security is a top priority for airSlate SignNow, especially when it comes to bt form business documents. The platform employs advanced encryption, secure data storage, and multi-factor authentication to protect sensitive information. This ensures that your documents are safe, compliant, and accessible only to authorized users.

-

Are there templates available for creating bt form business documents?

Absolutely! airSlate SignNow provides a variety of customizable templates for different bt form business needs. These templates allow users to quickly create professional documents tailored to their specifications, saving time and effort in the process.

-

Is there customer support available for airSlate SignNow users managing bt form business?

Yes, airSlate SignNow offers comprehensive customer support to assist users with any questions or issues related to their bt form business processes. Customers can access resources such as live chat, email support, and a detailed knowledge base. This ensures that every user can maximize their experience with the platform.

Get more for Forms in govDownloadForm BT 1C Indiana Department Of Revenue Application For

Find out other Forms in govDownloadForm BT 1C Indiana Department Of Revenue Application For

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later