Indiana Bt Form 2011

What is the Indiana BT Form

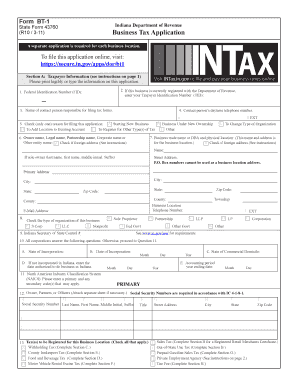

The Indiana BT form, officially known as the BT-1 form, is a business tax application required for various business entities operating within Indiana. This form is crucial for businesses to report their tax obligations accurately. It is primarily used for determining the business's tax liability based on its income, deductions, and credits. Understanding the Indiana BT form is essential for compliance with state tax laws and ensuring that your business meets its financial responsibilities.

How to Use the Indiana BT Form

Using the Indiana BT form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form with the required information, ensuring that all figures are accurate and reflect your business's financial situation. Once completed, review the form for any errors before submitting it to the appropriate state department. Utilizing electronic tools can streamline this process, making it easier to manage and submit your application securely.

Steps to Complete the Indiana BT Form

Completing the Indiana BT form involves a systematic approach to ensure all information is accurately reported. Follow these steps:

- Gather all financial records, including revenue, expenses, and previous tax filings.

- Download the BT-1 form from the Indiana Department of Revenue website or access it through a digital platform.

- Fill in the required fields, including business name, address, and tax identification number.

- Calculate your taxable income based on the provided guidelines.

- Review the form for accuracy and completeness.

- Submit the completed form electronically or via mail, following the submission guidelines.

Legal Use of the Indiana BT Form

The Indiana BT form is legally binding when completed correctly and submitted to the state. To ensure its legal validity, the form must adhere to the regulations set forth by the Indiana Department of Revenue. This includes providing accurate information and ensuring compliance with state tax laws. Utilizing a reliable eSignature solution can enhance the legal standing of the document, ensuring that it meets all necessary requirements for electronic submissions.

Filing Deadlines / Important Dates

Filing deadlines for the Indiana BT form are critical for compliance. Typically, the form must be submitted by the due date specified by the Indiana Department of Revenue, which may vary based on the business's tax year. It is essential to stay informed about these deadlines to avoid penalties. Mark your calendar with important dates related to tax filings, including extensions and any changes in state regulations that may affect submission timelines.

Required Documents

When completing the Indiana BT form, several documents are required to support your application. These may include:

- Previous tax returns for your business.

- Financial statements, including profit and loss statements.

- Documentation of any deductions or credits claimed.

- Business identification documents, such as your EIN.

Having these documents ready will facilitate a smoother completion process and ensure that your form is accurate and complete.

Quick guide on how to complete indiana bt form

Easily Prepare Indiana Bt Form on Any Device

Online document management has become increasingly favored by businesses and individuals. It provides an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents quickly without delays. Manage Indiana Bt Form on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related processes today.

How to Edit and eSign Indiana Bt Form Effortlessly

- Find Indiana Bt Form and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious searching for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Indiana Bt Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana bt form

Create this form in 5 minutes!

How to create an eSignature for the indiana bt form

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the Indiana BT form, and how can airSlate SignNow assist with it?

The Indiana BT form is a document used for business transactions in the state of Indiana. airSlate SignNow provides an easy-to-use platform that allows you to fill out, sign, and send the Indiana BT form electronically, streamlining the process and ensuring compliance.

-

Is there a cost associated with using airSlate SignNow for the Indiana BT form?

Yes, there is a cost to use airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Pricing plans vary, but they provide unlimited access to features that include easy handling of documents like the Indiana BT form.

-

What features does airSlate SignNow offer for managing the Indiana BT form?

airSlate SignNow offers several features tailored to the Indiana BT form, such as document templates, eSigning, and real-time collaboration. These features enhance efficiency by enabling users to complete and manage the form seamlessly.

-

How does airSlate SignNow improve the signing process for the Indiana BT form?

With airSlate SignNow, the signing process for the Indiana BT form is simplified and expedited. Users can sign documents from any device, ensuring that all signatures are collected quickly and securely, which is essential for timely business transactions.

-

Can I integrate airSlate SignNow with other applications to manage the Indiana BT form?

Yes, airSlate SignNow offers integrations with various applications, which allows for a more streamlined workflow when handling the Indiana BT form. Popular integrations with tools such as Google Drive and Salesforce enable seamless document management.

-

What are the benefits of eSigning the Indiana BT form with airSlate SignNow?

eSigning the Indiana BT form with airSlate SignNow offers several benefits, including increased security and reduced turnaround time. Additionally, it eliminates the need for printing and scanning, making the process eco-friendly and efficient.

-

Is airSlate SignNow compliant with state regulations regarding the Indiana BT form?

Absolutely, airSlate SignNow is compliant with state regulations, ensuring that all electronic signatures on the Indiana BT form are legally binding. This compliance gives businesses peace of mind when submitting important documents.

Get more for Indiana Bt Form

- Washington child services form

- Ju 050200 notice of hearing on child in need of services petition washington form

- Ju 050300 order on child in need of services petition washington form

- Washington ju 497430084 form

- Ju 050500 order on review hearing washington form

- Petition risk youth form

- Ju 050650 notice of hearing on at risk youth petition washington form

- Risk youth petition form

Find out other Indiana Bt Form

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free