NEW YORK STATE DEPARTMENT of TAXATION & FINANCE OFFICE of 2021

Understanding the New York State Enhanced Star Program

The New York State Enhanced Star Program provides property tax relief to eligible homeowners, particularly seniors. This program is an extension of the basic School Tax Relief (STAR) exemption, designed to assist those who meet specific income criteria. Homeowners must apply through the New York State Department of Taxation and Finance and meet the necessary qualifications to benefit from this exemption.

Eligibility Criteria for the Enhanced Star Program

To qualify for the Enhanced Star Program, applicants must meet several criteria:

- Homeowners must be at least sixty-five years old by December thirty-first of the tax year.

- The total income of all owners must not exceed the threshold set by the state, which is adjusted annually.

- Applicants must occupy the property as their primary residence.

- Only one Enhanced Star exemption is allowed per household.

Application Process for the Enhanced Star Program

The application process for the Enhanced Star Program involves several steps:

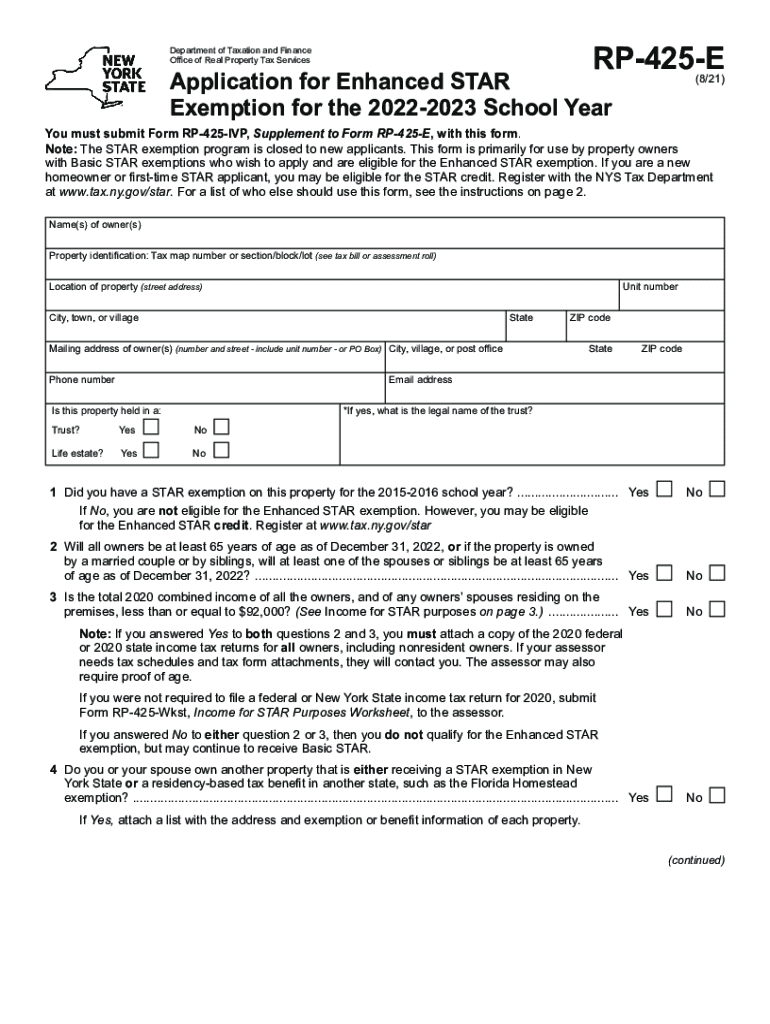

- Complete the Enhanced Star application form, known as RP-425. This form can be obtained from the New York State Department of Taxation and Finance website.

- Gather required documentation, such as proof of age and income verification.

- Submit the completed application form and documentation to your local assessor's office by the specified deadline, typically by March first of the tax year.

Required Documents for Application

When applying for the Enhanced Star Program, homeowners need to provide specific documents, including:

- A completed RP-425 application form.

- Proof of age, such as a driver's license or birth certificate.

- Income documentation, which may include tax returns or other financial statements to verify total household income.

Form Submission Methods

Homeowners can submit their Enhanced Star application in several ways:

- Online through the New York State Department of Taxation and Finance portal, if available.

- By mail, sending the completed application form to the local assessor's office.

- In-person at the local assessor's office, where staff can assist with the application process.

Legal Use of the Enhanced Star Program

The Enhanced Star Program is governed by specific legal guidelines that ensure its proper implementation. Homeowners must comply with the eligibility requirements and provide accurate information when applying. Any discrepancies or false information may lead to penalties, including the potential loss of the exemption.

Quick guide on how to complete new york state department of taxation ampamp finance office of

Prepare NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE OFFICE OF effortlessly on any gadget

Digital document management has become prevalent among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE OFFICE OF on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The simplest way to modify and eSign NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE OFFICE OF without hassle

- Find NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE OFFICE OF and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to secure your modifications.

- Select how you wish to share your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE OFFICE OF and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york state department of taxation ampamp finance office of

Create this form in 5 minutes!

How to create an eSignature for the new york state department of taxation ampamp finance office of

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the NYS Enhanced Star Program?

The NYS Enhanced Star Program is a property tax reduction initiative for qualifying New York State residents. This program offers additional property tax exemptions for seniors and people with disabilities, signNowly lowering their annual tax burdens. By participating in this program, eligible homeowners can make substantial savings on their property taxes.

-

How do I apply for the NYS Enhanced Star Program?

To apply for the NYS Enhanced Star Program, homeowners must complete the appropriate application form available through their local assessor’s office or the New York State Department of Taxation and Finance. The application requires documentation that confirms eligibility, including income details and proof of residency. It is essential to submit the application by the deadline to receive the tax benefits.

-

What are the eligibility requirements for the NYS Enhanced Star Program?

Eligibility for the NYS Enhanced Star Program generally includes being a homeowner aged 65 or older with a qualifying income threshold. Additionally, applicants must use the property as their primary residence and meet any local criteria set forth by their respective tax assessor’s office. It's advisable to check specific local requirements as they can vary.

-

Can the NYS Enhanced Star Program be combined with other tax benefits?

Yes, homeowners can often combine the NYS Enhanced Star Program with other property tax benefits, depending on local regulations. This may include exemptions like the Veteran's exemption or other local initiatives. Homeowners are encouraged to review their eligibility and consult their local assessor for the best approach to maximize savings.

-

What documents do I need for the NYS Enhanced Star Program application?

When applying for the NYS Enhanced Star Program, you will typically need to provide proof of age, proof of income, and verification of residency. This might include tax returns, Social Security statements, or other financial documents that affirm your eligibility. Ensuring all required documents are incorporated can expedite the application process.

-

Is there a deadline to apply for the NYS Enhanced Star Program?

Yes, there is a specific deadline for applying for the NYS Enhanced Star Program, which varies by locality. Generally, applications must be submitted by a certain date in the year before the tax assessment. Homeowners should check with their local tax office to ensure they meet the necessary deadlines to take advantage of the program.

-

How does the NYS Enhanced Star Program impact my property taxes?

The NYS Enhanced Star Program signNowly decreases property taxes by providing exemptions that lower the assessed value of a home. As a result, eligible homeowners can enjoy considerable annual tax savings, making home ownership more affordable. This initiative not only eases financial burdens but also aims to support the economic stability of seniors and those with disabilities.

Get more for NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE OFFICE OF

- Employment employee personnel file package arkansas form

- Assignment of mortgage package arkansas form

- Assignment of lease package arkansas form

- Lease purchase agreements package arkansas form

- Satisfaction cancellation or release of mortgage package arkansas form

- Premarital agreements package arkansas form

- Painting contractor package arkansas form

- Framing contractor package arkansas form

Find out other NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE OFFICE OF

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF