Form RP 425 E Application for Enhanced STAR Exemption for the 2023 2024 School Year Revised 722 2022

Understanding the Form RP-425 E for Enhanced STAR Exemption

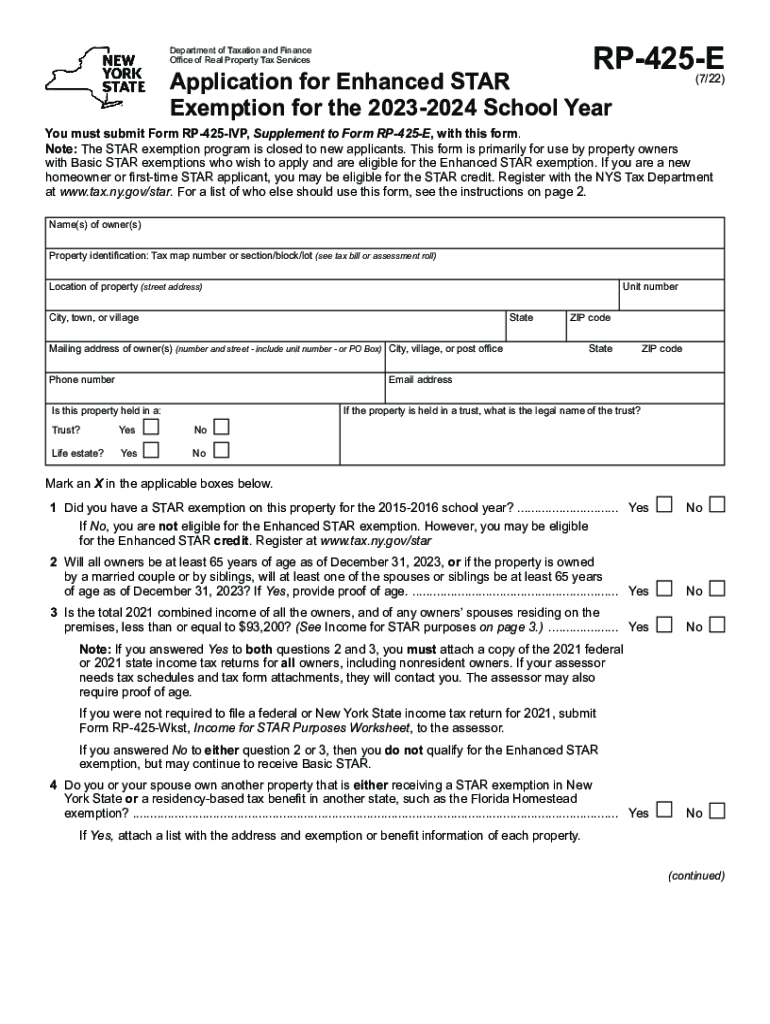

The Form RP-425 E is the official application for the Enhanced STAR exemption in New York State for the 2 school year. This form is specifically designed for homeowners who meet certain eligibility criteria, primarily aimed at seniors and disabled individuals. It allows qualifying applicants to receive a reduction in their school property taxes, making home ownership more affordable. Understanding the details of this form is essential for ensuring compliance and maximizing benefits.

Steps to Complete the Form RP-425 E Application

Completing the Form RP-425 E involves several key steps to ensure accuracy and compliance with New York State regulations. Start by gathering necessary documentation, including proof of age or disability, and income information. Next, fill out the form with precise details, ensuring that all sections are completed. It is important to double-check for any errors before submission. Once completed, submit the form to your local assessor's office by the specified deadline to ensure your application is processed in a timely manner.

Eligibility Criteria for the Enhanced STAR Program

To qualify for the Enhanced STAR exemption, applicants must meet specific eligibility criteria. Generally, the applicant must be a homeowner who is at least sixty-five years old, or who has a disability, and their income must fall below a certain threshold set by the state. Additionally, applicants must reside in the property for which they are applying and must not have previously received the Enhanced STAR exemption. It is essential to review the current income limits and other requirements to confirm eligibility.

Required Documents for the Application Process

When applying for the Enhanced STAR exemption using Form RP-425 E, several documents are required to support your application. These typically include proof of age, such as a birth certificate or driver's license, and documentation of income, such as tax returns or Social Security statements. If applicable, additional proof of disability may also be required. Having these documents ready will streamline the application process and help avoid delays.

Form Submission Methods for Enhanced STAR Application

The Form RP-425 E can be submitted through various methods to accommodate applicants' preferences. Homeowners may choose to submit the form online through their local assessor's office website, mail it directly to the office, or deliver it in person. Each method has its own advantages, such as immediate confirmation of receipt when submitted in person or the convenience of online submission. It is advisable to check with your local office for specific submission guidelines and options.

Important Filing Deadlines for the Enhanced STAR Program

Filing deadlines for the Enhanced STAR exemption application are crucial to ensure timely processing. Typically, applications must be submitted by a specific date each year, often in March. It is important to stay informed about these deadlines to avoid missing out on potential tax savings. Checking with your local assessor's office for the exact date and any potential extensions is recommended.

Quick guide on how to complete form rp 425 e application for enhanced star exemption for the 2023 2024 school year revised 722

Complete Form RP 425 E Application For Enhanced STAR Exemption For The 2023 2024 School Year Revised 722 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily access the right form and securely store it online. airSlate SignNow offers you all the necessary tools to create, edit, and eSign your documents quickly and without interruptions. Handle Form RP 425 E Application For Enhanced STAR Exemption For The 2023 2024 School Year Revised 722 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to edit and eSign Form RP 425 E Application For Enhanced STAR Exemption For The 2023 2024 School Year Revised 722 with ease

- Obtain Form RP 425 E Application For Enhanced STAR Exemption For The 2023 2024 School Year Revised 722 and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to share your form—via email, text message (SMS), or invite link, or download it to your computer.

Put an end to missing or lost files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form RP 425 E Application For Enhanced STAR Exemption For The 2023 2024 School Year Revised 722 and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form rp 425 e application for enhanced star exemption for the 2023 2024 school year revised 722

Create this form in 5 minutes!

People also ask

-

What is the enhanced star program offered by airSlate SignNow?

The enhanced star program is an initiative designed by airSlate SignNow to provide extra value to our customers through advanced features and benefits. This program simplifies the document signing process while ensuring compliance and security. By enrolling in the enhanced star program, users can unlock tools that enhance their productivity and overall experience.

-

How does the enhanced star program benefit businesses?

Businesses that participate in the enhanced star program can enjoy streamlined workflows, quicker turnaround times, and improved document management. This program also allows users to access superior customer support, ensuring that any issues are resolved promptly. Overall, it enhances operational efficiency and contributes to better business outcomes.

-

What features are included in the enhanced star program?

The enhanced star program includes a variety of features such as advanced eSignature tools, customizable document workflows, and enhanced security options. Users also benefit from integrations with popular applications, making it easier to manage documents across platforms. These features collectively boost the effectiveness of the document signing process.

-

Is there a cost associated with the enhanced star program?

Yes, the enhanced star program is available with a subscription model that varies based on the selected features and the size of your business. However, the cost is competitive and designed to provide signNow ROI through improved efficiency and reduced administrative overhead. Interested customers should signNow out to airSlate SignNow for detailed pricing information.

-

Can the enhanced star program integrate with other software solutions?

Absolutely! The enhanced star program is designed to integrate seamlessly with a wide range of software solutions including CRM systems, cloud storage services, and productivity tools. This integration capability ensures that teams can maintain their existing workflows while benefiting from advanced eSigning features.

-

Who should consider enrolling in the enhanced star program?

The enhanced star program is ideal for businesses of all sizes that require efficient document management and eSignature solutions. It's particularly useful for organizations with high-volume signing needs or those looking to streamline their operations. If you're seeking enhanced productivity and compliance, this program is a valuable option.

-

What support options are available for enhanced star program users?

Users of the enhanced star program have access to dedicated customer support, which includes priority assistance through various channels such as chat, email, and phone. Additionally, users can access a wealth of online resources and tutorials to maximize their use of the program. Our support team is committed to ensuring a smooth experience for all customers.

Get more for Form RP 425 E Application For Enhanced STAR Exemption For The 2023 2024 School Year Revised 722

Find out other Form RP 425 E Application For Enhanced STAR Exemption For The 2023 2024 School Year Revised 722

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple