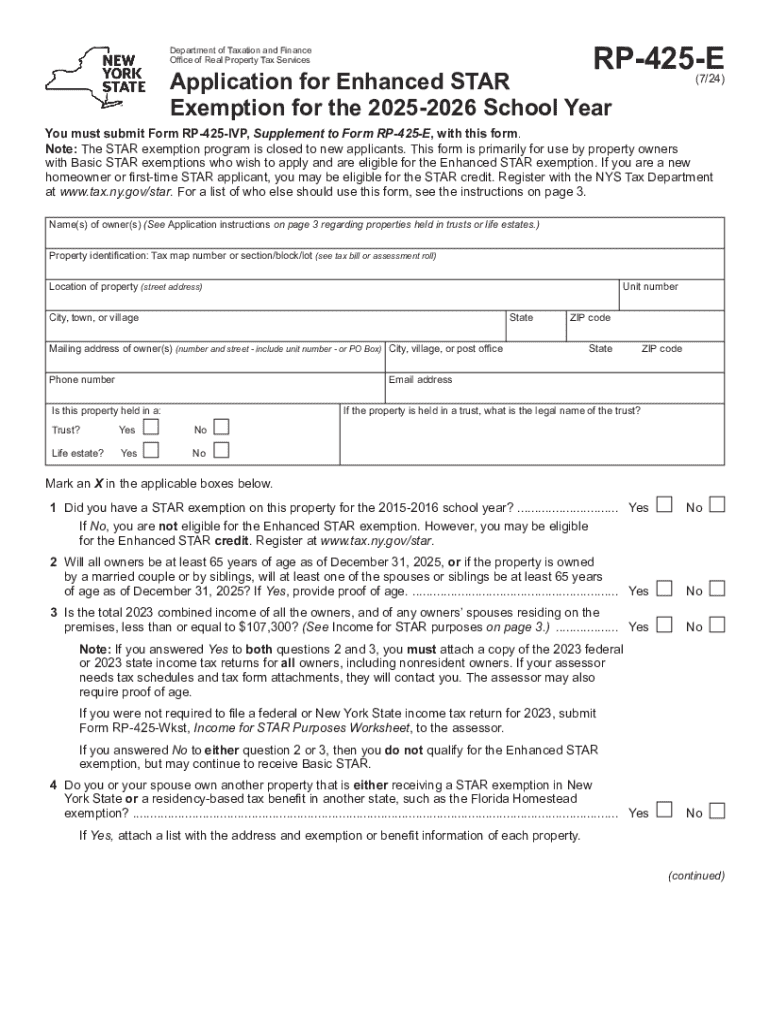

Form RP 425 E Application for Enhanced STAR Exemption for the 2025 2026 School Year Revised 724 2024-2026

What is the RP-425 E Application for Enhanced STAR Exemption?

The RP-425 E Application for Enhanced STAR Exemption is a form used in New York State for homeowners to apply for the Enhanced School Tax Relief (STAR) exemption. This program provides eligible property owners with a reduction in their school property taxes. The Enhanced STAR exemption is specifically designed for senior citizens aged sixty-five and older, who meet certain income requirements. The application is revised periodically, and the version for the 2 school year is essential for those looking to benefit from this financial relief.

Eligibility Criteria for the Enhanced STAR Program

To qualify for the Enhanced STAR exemption, applicants must meet specific criteria:

- Applicants must be at least sixty-five years old by December thirty-first of the application year.

- The total income of all owners must not exceed the specified limit, which is updated annually.

- The property must be the primary residence of the applicant.

- Homeowners must have applied for and received the basic STAR exemption to be eligible for the Enhanced version.

Steps to Complete the RP-425 E Application

Completing the RP-425 E Application for Enhanced STAR Exemption involves several steps:

- Gather necessary documents, including proof of age and income documentation.

- Obtain the RP-425 E application form from your local assessor's office or download it from the New York State Department of Taxation and Finance website.

- Fill out the application form accurately, ensuring all required fields are completed.

- Submit the completed application to your local assessor's office by the designated deadline.

Required Documents for Submission

When submitting the RP-425 E Application, applicants must provide several documents to support their eligibility:

- Proof of age, such as a birth certificate or driver's license.

- Income verification documents, including tax returns or Social Security statements.

- Documentation proving ownership of the property, such as a deed or mortgage statement.

Form Submission Methods

The RP-425 E Application can be submitted through various methods:

- Online submission through the New York State Department of Taxation and Finance website, if available.

- Mailing the completed application to your local assessor's office.

- In-person submission at the local assessor's office during business hours.

Filing Deadlines for the Enhanced STAR Application

It is crucial for applicants to be aware of the filing deadlines to ensure their application is processed in time. Typically, the application must be submitted by March first of the year for which the exemption is being requested. Late applications may not be considered, so timely submission is essential for receiving the Enhanced STAR exemption.

Handy tips for filling out Form RP 425 E Application For Enhanced STAR Exemption For The 2025 2026 School Year Revised 724 online

Quick steps to complete and e-sign Form RP 425 E Application For Enhanced STAR Exemption For The 2025 2026 School Year Revised 724 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Get access to a GDPR and HIPAA compliant platform for maximum simplicity. Use signNow to electronically sign and send out Form RP 425 E Application For Enhanced STAR Exemption For The 2025 2026 School Year Revised 724 for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form rp 425 e application for enhanced star exemption for the 2025 2026 school year revised 724

Create this form in 5 minutes!

How to create an eSignature for the form rp 425 e application for enhanced star exemption for the 2025 2026 school year revised 724

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the application for enhanced star?

The application for enhanced star is a powerful tool designed to streamline the document signing process for businesses. It allows users to send, sign, and manage documents electronically, ensuring efficiency and security in transactions.

-

How much does the application for enhanced star cost?

The pricing for the application for enhanced star varies based on the plan you choose. We offer flexible pricing options to accommodate businesses of all sizes, ensuring you get the best value for your investment.

-

What features does the application for enhanced star offer?

The application for enhanced star includes features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to enhance your document management experience and improve workflow efficiency.

-

Is the application for enhanced star easy to use?

Yes, the application for enhanced star is designed with user-friendliness in mind. Its intuitive interface allows users to easily navigate through the signing process, making it accessible for everyone, regardless of technical expertise.

-

Can the application for enhanced star integrate with other software?

Absolutely! The application for enhanced star offers seamless integrations with various third-party applications, including CRM and project management tools. This ensures that you can incorporate it into your existing workflow without any hassle.

-

What are the benefits of using the application for enhanced star?

Using the application for enhanced star provides numerous benefits, including reduced turnaround times for document signing and improved security. It helps businesses save time and resources while ensuring compliance with legal standards.

-

Is there a mobile version of the application for enhanced star?

Yes, the application for enhanced star is available on mobile devices, allowing users to sign documents on the go. This flexibility ensures that you can manage your documents anytime, anywhere, enhancing productivity.

Get more for Form RP 425 E Application For Enhanced STAR Exemption For The 2025 2026 School Year Revised 724

Find out other Form RP 425 E Application For Enhanced STAR Exemption For The 2025 2026 School Year Revised 724

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself