Www Taxformfinder Orgforms2019Form Indiana Department of Revenue Estimated Tax Payment

Understanding the Indiana 46005 Tax Form

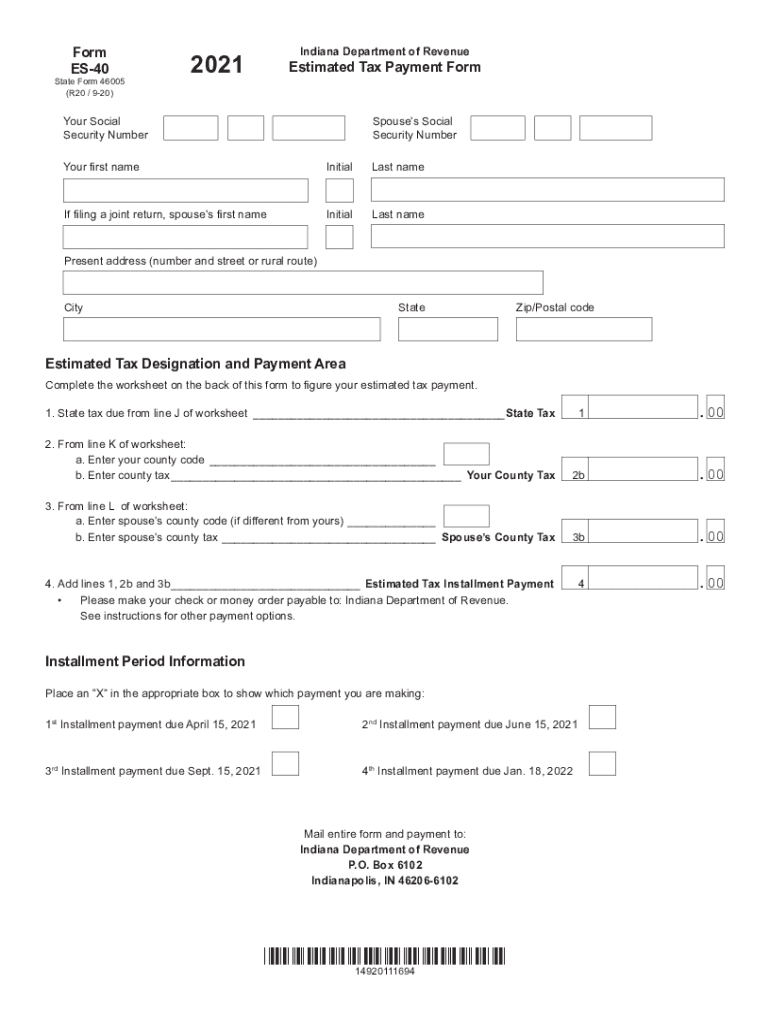

The Indiana 46005 tax form, also known as the Indiana 1040 ES tax form, is designed for individuals who need to make estimated tax payments to the state. This form is essential for taxpayers who expect to owe tax of $1,000 or more when they file their annual return. It allows individuals to pay their estimated tax liabilities in a structured manner, helping to avoid penalties associated with underpayment.

Steps to Complete the Indiana 46005 Tax Form

Completing the Indiana 46005 tax form involves several key steps:

- Gather Necessary Information: Collect your income details, deductions, and any credits you may qualify for.

- Calculate Your Estimated Tax: Use the information gathered to estimate your tax liability for the year. This includes considering your income, deductions, and applicable tax rates.

- Fill Out the Form: Input your estimated tax amounts into the appropriate sections of the 46005 form. Ensure accuracy to prevent issues later.

- Review and Sign: Double-check your entries for any errors, then sign the form to validate it.

- Submit the Form: Choose your submission method, whether online, by mail, or in person, and ensure it is sent by the due date.

Key Elements of the Indiana 46005 Tax Form

The Indiana 46005 tax form includes several important sections that taxpayers must complete:

- Taxpayer Information: This section requires your name, address, and Social Security number.

- Estimated Payments: Here, you will list your estimated tax payments for the year, broken down by quarter.

- Signature: A signature is required to validate the form and confirm that the information provided is accurate.

Filing Deadlines for the Indiana 46005 Tax Form

Timely submission of the Indiana 46005 tax form is crucial to avoid penalties. The estimated tax payments are typically due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Form Submission Methods

Taxpayers have multiple options for submitting the Indiana 46005 tax form:

- Online: Many taxpayers prefer to submit their forms electronically for convenience and speed.

- By Mail: You can print the completed form and send it to the Indiana Department of Revenue via postal service.

- In-Person: For those who prefer face-to-face interaction, submitting the form in person at a local revenue office is an option.

Penalties for Non-Compliance

Failing to file the Indiana 46005 tax form or underpaying your estimated taxes can lead to penalties. The Indiana Department of Revenue may impose fines based on the amount owed and the duration of the non-compliance. It is essential to stay informed about your tax obligations to avoid these consequences.

Quick guide on how to complete wwwtaxformfinderorgforms2019form 2020 indiana department of revenue estimated tax payment

Complete Www taxformfinder orgforms2019Form Indiana Department Of Revenue Estimated Tax Payment effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly and efficiently. Handle Www taxformfinder orgforms2019Form Indiana Department Of Revenue Estimated Tax Payment on any device using the airSlate SignNow Android or iOS apps and enhance any document-centric task today.

The easiest way to edit and eSign Www taxformfinder orgforms2019Form Indiana Department Of Revenue Estimated Tax Payment with minimal effort

- Locate Www taxformfinder orgforms2019Form Indiana Department Of Revenue Estimated Tax Payment and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose offered by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your alterations.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Www taxformfinder orgforms2019Form Indiana Department Of Revenue Estimated Tax Payment and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wwwtaxformfinderorgforms2019form 2020 indiana department of revenue estimated tax payment

How to generate an electronic signature for your PDF in the online mode

How to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the 46005 tax and how does it affect eSigning documents?

The 46005 tax is a specific tax identifier that may impact your business's document workflows. Understanding its implications can help you prepare accurate documents for eSigning through platforms like airSlate SignNow. Using SignNow ensures that your documents comply with the relevant tax regulations.

-

How does airSlate SignNow simplify the process of managing the 46005 tax?

airSlate SignNow simplifies document management by providing customizable templates that can incorporate 46005 tax details. This not only streamlines the eSigning process but helps in ensuring that all necessary tax information is accurately reflected in your documents.

-

What pricing plans does airSlate SignNow offer that include features for handling 46005 tax?

airSlate SignNow offers several pricing plans that cater to different business needs when managing tax-related documents, including those impacted by the 46005 tax. Each plan includes features like templates, integrations, and secure eSigning, making it an affordable solution for businesses of all sizes.

-

Can airSlate SignNow be integrated with accounting software for managing the 46005 tax?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions to help manage the 46005 tax. This integration allows for easier data transfer and ensures that your eSigned documents are compliant with accounting requirements, simplifying tax reporting and documentation.

-

What are the key benefits of using airSlate SignNow for handling 46005 tax documents?

Using airSlate SignNow for 46005 tax documents provides numerous benefits, including increased efficiency in document processing and a reduced risk of errors. Additionally, the easy-to-use eSigning features streamline collaboration, enabling businesses to stay compliant while saving time and resources.

-

Is the airSlate SignNow platform secure for handling sensitive 46005 tax information?

Absolutely, airSlate SignNow employs top-of-the-line security measures to protect sensitive 46005 tax information. With advanced encryption and compliance with data protection regulations, you can trust that your documents are secure while being eSigned and stored in the platform.

-

How can I get support for my 46005 tax-related queries while using airSlate SignNow?

AirSlate SignNow offers comprehensive support to address your 46005 tax-related queries. You can access a dedicated support team through various channels, including live chat and email, ensuring that your questions regarding document management and eSigning are promptly answered.

Get more for Www taxformfinder orgforms2019Form Indiana Department Of Revenue Estimated Tax Payment

- Foundation contractor package arkansas form

- Plumbing contractor package arkansas form

- Brick mason contractor package arkansas form

- Roofing contractor package arkansas form

- Electrical contractor package arkansas form

- Sheetrock drywall contractor package arkansas form

- Flooring contractor package arkansas form

- Trim carpentry contractor package arkansas form

Find out other Www taxformfinder orgforms2019Form Indiana Department Of Revenue Estimated Tax Payment

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement