Forms in GovDownloadIndiana Part Year or Full Year Nonresident it 40PNR 2021

What is the Indiana IT-40PNR Form?

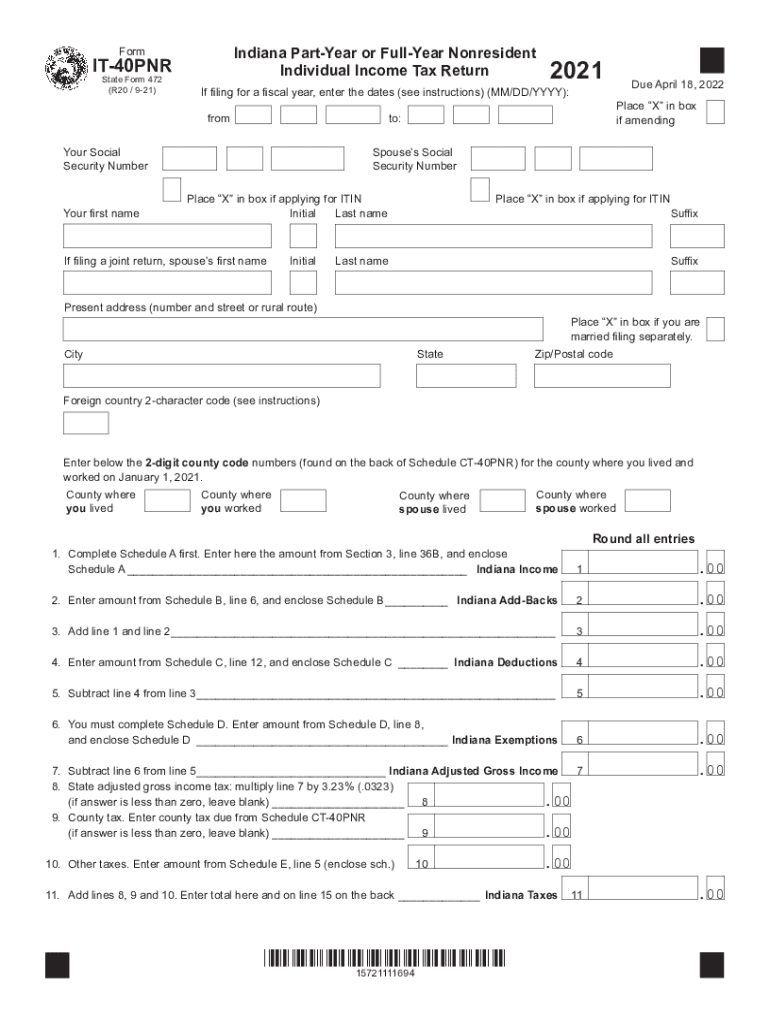

The Indiana IT-40PNR form is a tax document specifically designed for part-year or full-year nonresidents of Indiana. This form allows individuals who have earned income in Indiana but reside in another state to report their income accurately. It is essential for ensuring compliance with Indiana tax laws and for determining the correct amount of tax owed to the state. The IT-40PNR form captures various income sources, deductions, and credits applicable to nonresidents, making it a vital tool for tax reporting.

Steps to Complete the Indiana IT-40PNR Form

Completing the Indiana IT-40PNR form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out personal information such as your name, address, and Social Security number. Then, report your Indiana-source income, which includes wages, business income, and any other earnings derived from Indiana. After calculating your total income, apply any eligible deductions and credits specific to nonresidents. Finally, review your completed form for accuracy before submitting it to the Indiana Department of Revenue.

Legal Use of the Indiana IT-40PNR Form

The Indiana IT-40PNR form is legally recognized for tax purposes when completed and submitted according to state regulations. To ensure its validity, filers must adhere to the guidelines set forth by the Indiana Department of Revenue, including compliance with eSignature laws if submitting electronically. The form must be signed and dated, and any required documentation should accompany it. Proper use of the IT-40PNR form helps prevent issues with tax compliance and potential penalties.

Filing Deadlines for the Indiana IT-40PNR Form

It is crucial to be aware of the filing deadlines for the Indiana IT-40PNR form to avoid penalties. Generally, the form must be submitted by the same deadline as federal tax returns, which is typically April fifteenth. However, if you are unable to meet this deadline, you may be eligible for an extension. It is important to check the Indiana Department of Revenue's website for any updates or changes to deadlines, especially in light of unforeseen circumstances that may affect tax filing.

Required Documents for the Indiana IT-40PNR Form

When completing the Indiana IT-40PNR form, several documents are necessary to ensure accurate reporting. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Proof of residency in another state

- Any additional income statements relevant to Indiana earnings

Having these documents on hand will facilitate a smoother and more accurate filing process.

Examples of Using the Indiana IT-40PNR Form

The Indiana IT-40PNR form is applicable in various scenarios. For instance, a person who lives in Ohio but works in Indiana would need to file this form to report their Indiana earnings. Similarly, a student attending a university in Indiana while maintaining residency in another state would also use the IT-40PNR to report any income earned during their time in Indiana. Each of these examples highlights the importance of the form for nonresidents who engage in economic activities within the state.

Quick guide on how to complete formsingovdownloadindiana part year or full year nonresident it 40pnr

Prepare Forms in govDownloadIndiana Part Year Or Full Year Nonresident IT 40PNR effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, since you can locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly and efficiently. Manage Forms in govDownloadIndiana Part Year Or Full Year Nonresident IT 40PNR on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and eSign Forms in govDownloadIndiana Part Year Or Full Year Nonresident IT 40PNR with ease

- Obtain Forms in govDownloadIndiana Part Year Or Full Year Nonresident IT 40PNR and then click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal standing as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for sharing your form: by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Forms in govDownloadIndiana Part Year Or Full Year Nonresident IT 40PNR to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct formsingovdownloadindiana part year or full year nonresident it 40pnr

Create this form in 5 minutes!

How to create an eSignature for the formsingovdownloadindiana part year or full year nonresident it 40pnr

How to generate an e-signature for a PDF online

How to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The way to make an e-signature right from your smartphone

The best way to create an e-signature for a PDF on iOS

The way to make an e-signature for a PDF on Android

People also ask

-

What is the it40pnr plan in airSlate SignNow?

The it40pnr plan offered by airSlate SignNow is designed to provide users with an affordable solution for sending and eSigning documents. This plan includes essential features tailored for businesses of all sizes, ensuring that you can efficiently manage your document workflows while keeping costs low.

-

How does it40pnr improve document signing efficiency?

With the it40pnr plan, airSlate SignNow accelerates the document signing process by allowing users to send, receive, and manage eSignatures seamlessly. This efficiency helps businesses save time and enhance productivity, making it easier to close deals and complete transactions.

-

What features are included in the it40pnr subscription?

The it40pnr subscription includes robust features such as unlimited document signing, mobile compatibility, customizable templates, and audit trails. These features provide comprehensive solutions for managing your documentation needs effectively.

-

Is there a free trial available for the it40pnr plan?

Yes, airSlate SignNow offers a trial period for the it40pnr plan, allowing prospective users to explore its features at no cost. This trial gives you the opportunity to experience how it40pnr can transform your document signing process before committing to a subscription.

-

Can it40pnr integrate with other software tools?

Absolutely! The it40pnr plan supports integrations with various popular applications, making it easier to incorporate airSlate SignNow into your existing workflows. This flexibility helps streamline processes across platforms, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow’s it40pnr plan?

Using the it40pnr plan, businesses benefit from an intuitive user interface, savings on printing and mailing costs, and enhanced compliance with electronic signature laws. This combination of benefits makes it an appealing choice for those looking to optimize their document management.

-

How secure is the it40pnr document signing process?

The it40pnr plan emphasizes security, utilizing industry-standard encryption to protect your documents and signatures. airSlate SignNow also provides compliance with regulations such as eIDAS and ESIGN, ensuring that your transactions are safe and legal.

Get more for Forms in govDownloadIndiana Part Year Or Full Year Nonresident IT 40PNR

- Postnuptial agreement form 497296745

- Letters of recommendation package arkansas form

- Ar mechanics lien form

- Arkansas construction or mechanics lien package corporation arkansas form

- Arkansas business form

- Child care services package arkansas form

- Special or limited power of attorney for real estate sales transaction by seller arkansas form

- Special or limited power of attorney for real estate purchase transaction by purchaser arkansas form

Find out other Forms in govDownloadIndiana Part Year Or Full Year Nonresident IT 40PNR

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document