Form Y 206 Yonkers Nonresident Fiduciary Earnings Tax 2022-2026

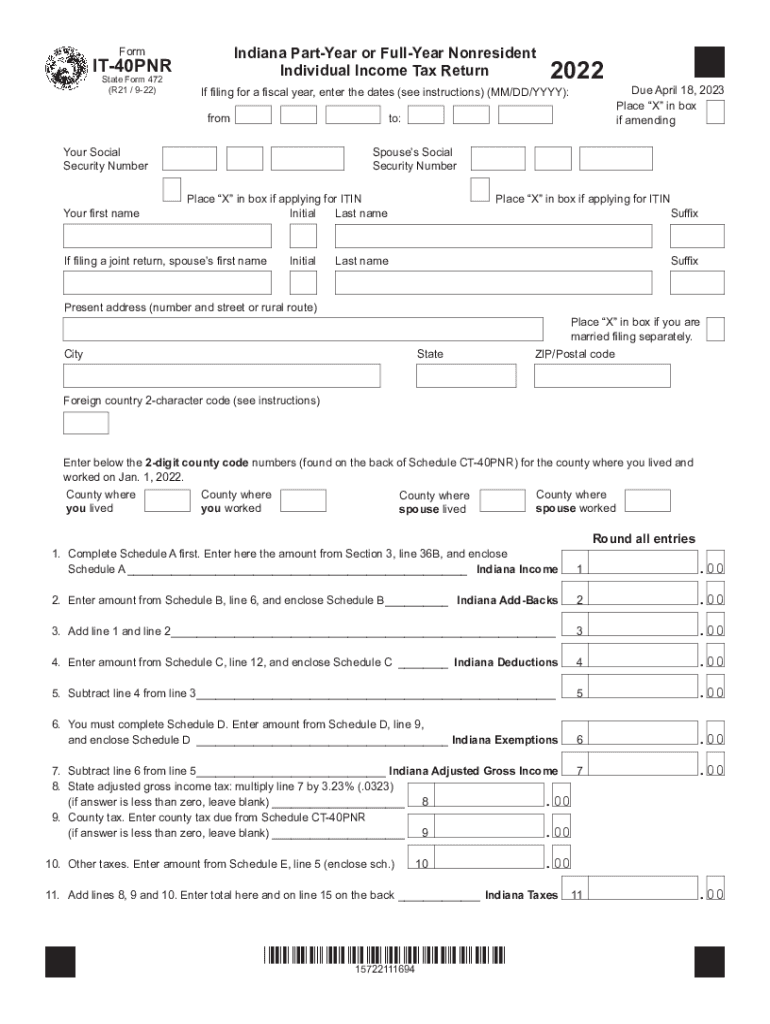

What is the Indiana State Tax Form?

The Indiana State Tax Form, specifically the IT-40PNR, is designed for residents who earn income outside of Indiana. This form allows taxpayers to report their income accurately while ensuring compliance with state tax laws. It is essential for individuals who have income from sources such as employment, business activities, or investments outside the state boundaries. Understanding the purpose of this form helps taxpayers navigate their obligations effectively.

Steps to Complete the Indiana IT-40PNR Form

Completing the Indiana IT-40PNR form involves several key steps. First, gather all necessary documentation, including W-2s, 1099s, and any other income statements. Next, accurately report your income, deductions, and credits on the form. It is crucial to ensure that all figures are correct to avoid potential issues with the Indiana Department of Revenue. After filling out the form, review it thoroughly for accuracy before submitting it.

Filing Deadlines for the Indiana Tax Forms

Filing deadlines for the Indiana IT-40PNR form typically align with federal tax deadlines. For most taxpayers, the deadline is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these deadlines to avoid penalties and interest on late submissions.

Required Documents for the Indiana IT-40PNR Form

When completing the Indiana IT-40PNR form, certain documents are required to support your income claims. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any other income, such as rental income or dividends

- Documentation for deductions and credits claimed

Having these documents ready will streamline the process and help ensure accuracy when filing.

Digital vs. Paper Version of the Indiana IT-40PNR Form

The Indiana IT-40PNR form can be completed and submitted either digitally or on paper. The digital version offers convenience, allowing taxpayers to fill out the form online and e-file it directly with the Indiana Department of Revenue. This method often results in faster processing times. Conversely, the paper version requires mailing the completed form, which may take longer to process. Choosing between these options depends on individual preferences and circumstances.

Penalties for Non-Compliance with Indiana Tax Laws

Failure to comply with Indiana tax laws when filing the IT-40PNR form can result in significant penalties. Common penalties include:

- Late filing penalties, which can accumulate over time

- Interest on unpaid taxes, calculated from the due date

- Potential audits or additional scrutiny from the Indiana Department of Revenue

Understanding these consequences emphasizes the importance of timely and accurate filing.

Quick guide on how to complete form y 206 yonkers nonresident fiduciary earnings tax

Complete Form Y 206 Yonkers Nonresident Fiduciary Earnings Tax effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals alike. It serves as a perfect environmentally friendly substitute for conventional printed and signed documents, allowing you to access the proper form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents rapidly without interruptions. Manage Form Y 206 Yonkers Nonresident Fiduciary Earnings Tax on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Form Y 206 Yonkers Nonresident Fiduciary Earnings Tax with ease

- Find Form Y 206 Yonkers Nonresident Fiduciary Earnings Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Craft your signature with the Sign tool, which only takes seconds and holds the same legal value as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form Y 206 Yonkers Nonresident Fiduciary Earnings Tax and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form y 206 yonkers nonresident fiduciary earnings tax

Create this form in 5 minutes!

How to create an eSignature for the form y 206 yonkers nonresident fiduciary earnings tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the indiana it40pnr?

The indiana it40pnr is a specialized form for businesses in Indiana to report employee withholding information. This form is crucial for ensuring compliance with state tax regulations, making it essential for payroll processing in the state.

-

How can airSlate SignNow help with the indiana it40pnr?

airSlate SignNow provides a cost-effective solution for businesses to create, send, and eSign the indiana it40pnr. By using our platform, you can streamline the submission process and ensure that all signatures are gathered securely and efficiently.

-

Is the indiana it40pnr easy to eSign with airSlate SignNow?

Yes, eSigning the indiana it40pnr with airSlate SignNow is incredibly easy. Our user-friendly interface allows you to fill out and sign the form digitally, saving you time and reducing paper usage.

-

What are the pricing options for airSlate SignNow's services related to the indiana it40pnr?

airSlate SignNow offers flexible pricing plans that are designed to fit various business needs. Each plan provides essential features for managing documents like the indiana it40pnr, with no hidden fees or long-term contracts.

-

Can I integrate airSlate SignNow with other software for managing the indiana it40pnr?

Absolutely! airSlate SignNow seamlessly integrates with a variety of third-party applications. This allows your team to combine the management of the indiana it40pnr with other business processes, enhancing productivity and efficiency.

-

What features make airSlate SignNow the best choice for handling the indiana it40pnr?

airSlate SignNow includes advanced features like automated workflows, templates, and real-time tracking specifically for the indiana it40pnr. These features ensure that your team can complete necessary documentation quickly while maintaining compliance.

-

How does using airSlate SignNow for the indiana it40pnr benefit my business?

Using airSlate SignNow for the indiana it40pnr can greatly enhance your operational efficiency. By digitizing the signing process, you reduce administrative burdens, ensure many documents are processed without delays, and improve overall turnaround time.

Get more for Form Y 206 Yonkers Nonresident Fiduciary Earnings Tax

- Letter lease nonrenewal 497326778 form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497326779 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement tennessee form

- Tenant landlord rental form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants tennessee form

- Tn tenant form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat tennessee form

- Notice nonpayment tennessee form

Find out other Form Y 206 Yonkers Nonresident Fiduciary Earnings Tax

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement