Printable Indiana it 40PNR Form Part Year or Full Year Nonresident Individual Income Tax Return 2020

What is the Printable Indiana IT 40PNR Form Part Year Or Full Year Nonresident Individual Income Tax Return

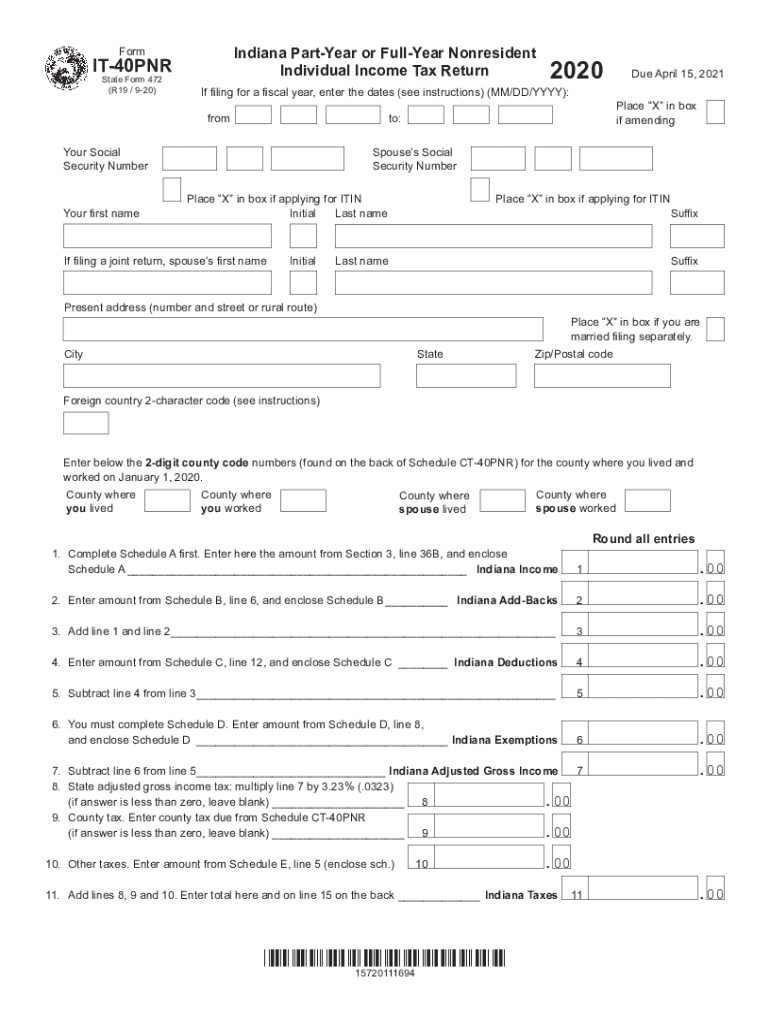

The Indiana IT 40PNR form is specifically designed for individuals who are nonresidents or part-year residents of Indiana. This form allows these taxpayers to report their income earned within the state and calculate the corresponding tax liability. It is essential for those who have lived in Indiana for only part of the year or who earn income from Indiana sources while residing in another state. Completing this form accurately ensures compliance with Indiana tax laws and helps avoid potential penalties.

Steps to complete the Printable Indiana IT 40PNR Form Part Year Or Full Year Nonresident Individual Income Tax Return

Filling out the Indiana IT 40PNR form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your residency status for the tax year to establish if you are a part-year resident or a nonresident.

- Complete the personal information section, ensuring all details are accurate.

- Report your Indiana income, which includes wages, salaries, and any other income sourced from Indiana.

- Calculate your tax liability based on the income reported and any applicable deductions or credits.

- Review the form for accuracy before submitting it.

Legal use of the Printable Indiana IT 40PNR Form Part Year Or Full Year Nonresident Individual Income Tax Return

The Indiana IT 40PNR form is legally recognized for filing taxes in the state of Indiana. To be considered valid, the form must be filled out completely and accurately. It is important to adhere to all state guidelines and regulations when completing this form. Utilizing a reliable digital solution can enhance the legal standing of the document by ensuring that all signatures are compliant with eSignature laws, such as ESIGN and UETA.

Filing Deadlines / Important Dates

For the tax year 2020, the filing deadline for the Indiana IT 40PNR form typically aligns with the federal tax deadline. Taxpayers should ensure they file their returns by the designated date to avoid penalties. It is advisable to check for any extensions or changes to the deadline that may apply, particularly in light of any special circumstances or government announcements.

Form Submission Methods (Online / Mail / In-Person)

The Indiana IT 40PNR form can be submitted through various methods to accommodate different preferences:

- Online: Taxpayers can file electronically using approved software that supports Indiana tax forms.

- Mail: Completed forms can be sent to the Indiana Department of Revenue at the designated address for tax returns.

- In-Person: Taxpayers may also choose to deliver their forms directly to local tax offices, although this method may vary by location.

Required Documents

When completing the Indiana IT 40PNR form, several documents are necessary to ensure accurate reporting:

- W-2 forms from employers for income earned.

- 1099 forms for other income sources, such as freelance work or interest.

- Records of any deductions or credits that may apply.

- Proof of residency status, if applicable.

Quick guide on how to complete printable 2020 indiana it 40pnr form part year or full year nonresident individual income tax return

Complete Printable Indiana IT 40PNR Form Part Year Or Full Year Nonresident Individual Income Tax Return effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Printable Indiana IT 40PNR Form Part Year Or Full Year Nonresident Individual Income Tax Return on any device using airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to modify and electronically sign Printable Indiana IT 40PNR Form Part Year Or Full Year Nonresident Individual Income Tax Return with ease

- Acquire Printable Indiana IT 40PNR Form Part Year Or Full Year Nonresident Individual Income Tax Return and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you would like to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about missing or lost files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Printable Indiana IT 40PNR Form Part Year Or Full Year Nonresident Individual Income Tax Return and ensure seamless communication at every stage of the form development process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 indiana it 40pnr form part year or full year nonresident individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 indiana it 40pnr form part year or full year nonresident individual income tax return

The best way to create an eSignature for your PDF document in the online mode

The best way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What are the 2020 tax forms state of Indiana that I need to file?

In Indiana, the primary 2020 tax forms include the IT-40 for individual income tax and the IT-40PNR for part-year residents. These forms must be completed and submitted to ensure compliance with state tax regulations. For specific circumstances, you may also need additional forms, like schedules or credits related to your deductions.

-

Where can I find the 2020 tax forms state of Indiana?

The 2020 tax forms state of Indiana are available on the Indiana Department of Revenue's website. You can download and print them easily or use online tax software that facilitates e-filing. This accessibility makes it convenient for taxpayers to ensure they have the correct forms for filing.

-

How can airSlate SignNow help me with my 2020 tax forms state of Indiana?

airSlate SignNow provides an efficient way to electronically sign and send your 2020 tax forms state of Indiana. This tool simplifies the process of obtaining signatures from all necessary parties, allowing for a quicker submission. With its user-friendly interface, you can expedite your tax-related tasks.

-

Is there a cost associated with using airSlate SignNow for my 2020 tax forms state of Indiana?

airSlate SignNow offers various pricing plans to suit individual and business needs. It's a cost-effective solution that can save you time and enhance the accuracy of your filings for the 2020 tax forms state of Indiana. Check their website for detailed pricing options that fit your requirements.

-

Can I integrate airSlate SignNow with other applications for my 2020 tax forms state of Indiana?

Yes, airSlate SignNow integrates seamlessly with many applications to enhance your filing experience for the 2020 tax forms state of Indiana. Whether you're using accounting software or document management systems, these integrations help streamline processes. This flexibility can signNowly boost your productivity.

-

What features does airSlate SignNow offer for handling 2020 tax forms state of Indiana?

airSlate SignNow includes features like customizable templates, secure storage, and real-time tracking for your documents. These tools are invaluable for managing your 2020 tax forms state of Indiana effectively. You can ensure compliance and avoid common filing errors with these robust features.

-

How fast can I eSign my 2020 tax forms state of Indiana using airSlate SignNow?

eSigning your 2020 tax forms state of Indiana using airSlate SignNow can be done in just a few minutes. The platform allows for quick access to documents and speedy signatures from all parties involved. This rapid turnaround minimizes delays in your tax filing process.

Get more for Printable Indiana IT 40PNR Form Part Year Or Full Year Nonresident Individual Income Tax Return

- Rights of survivorship ownership agreement for a vessel andor outboard motor pwd 790 form

- Huntland drive suite 380 form

- Logistics form

- Texas dwi education program online form

- City of plano contractor registration form

- Stan stanart form

- Famspermit jacksonville form

- Texas hazlewood act exemption application for continued enrollment tvc texas form

Find out other Printable Indiana IT 40PNR Form Part Year Or Full Year Nonresident Individual Income Tax Return

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure