Instructions for Form NYC 1 New York City 2020-2026

What is the betax dof service fee?

The betax dof service fee is a charge associated with the processing and handling of the New York City Department of Finance's (NYC DOF) tax forms, specifically the betax dof form. This fee is applied to ensure that the necessary administrative tasks are completed efficiently and accurately. Understanding this fee is essential for individuals and businesses who need to comply with local tax regulations. It is important to note that the fee structure may vary based on the specifics of the form being submitted and the nature of the transaction.

Key elements of the betax dof service fee

Several key elements define the betax dof service fee, including:

- Fee Structure: The fee may vary depending on the type of service required or the complexity of the submission.

- Payment Methods: Payments can typically be made online, by mail, or in person, depending on the preferences of the filer.

- Compliance Requirements: It is crucial to ensure that all fees are paid in accordance with the deadlines set forth by the NYC DOF to avoid penalties.

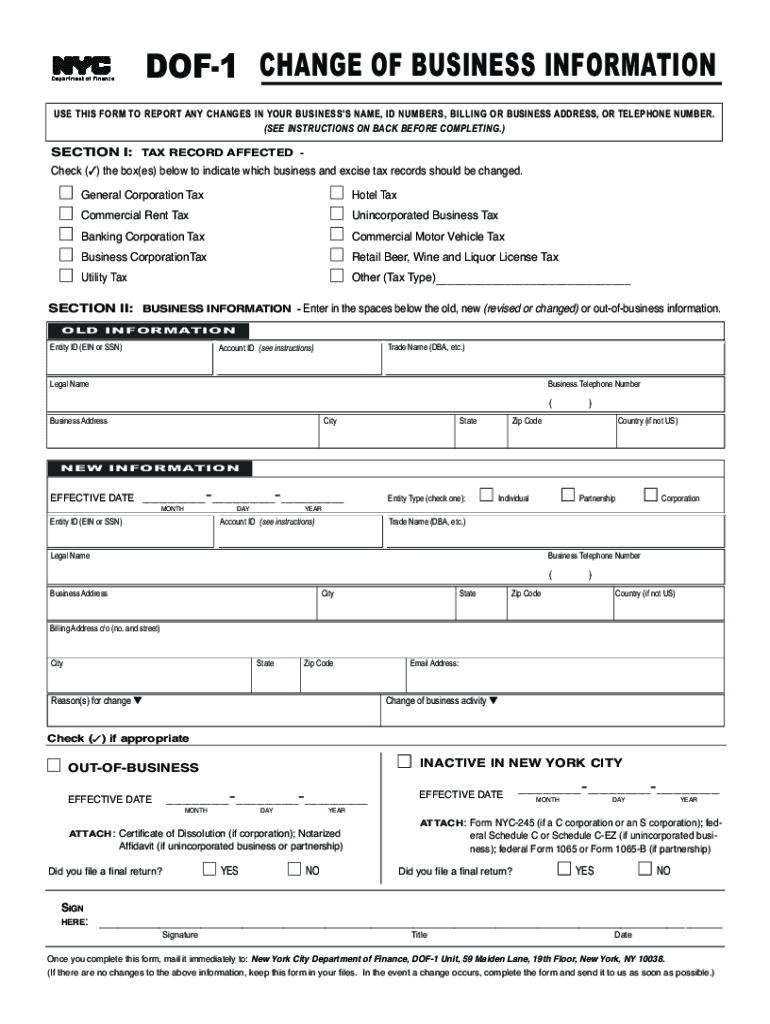

Steps to complete the betax dof form

Completing the betax dof form involves several important steps:

- Gather Required Information: Collect all necessary documents and data required to fill out the form accurately.

- Fill Out the Form: Carefully complete each section of the betax dof form, ensuring all information is correct and complete.

- Calculate the Service Fee: Determine the applicable service fee based on the instructions provided by the NYC DOF.

- Submit the Form: Choose your preferred submission method, ensuring that you include the service fee payment if applicable.

Legal use of the betax dof form

The betax dof form is legally recognized in New York City for various tax-related purposes. To ensure its legal standing, it must be completed accurately and submitted in compliance with NYC regulations. The form serves as an official record of the information provided, and any discrepancies can lead to legal implications. Therefore, it is essential to understand the legal requirements surrounding the form and the associated service fee.

Filing deadlines for the betax dof form

Filing deadlines for the betax dof form are critical to avoid penalties and ensure compliance. These deadlines can vary depending on the specific tax year and the type of transaction involved. It is advisable to check the NYC DOF website or contact their office for the most current information regarding filing deadlines. Meeting these deadlines helps maintain good standing with local tax authorities.

Who issues the betax dof form?

The betax dof form is issued by the New York City Department of Finance. This department is responsible for managing the city's tax collection and ensuring compliance with local tax laws. The NYC DOF provides guidance and resources for individuals and businesses to navigate the tax filing process, including the issuance of necessary forms and information about associated fees.

Quick guide on how to complete instructions for form nyc 1 new york city

Effortlessly Create Instructions For Form NYC 1 New York City on Any Device

Managing documents online has become increasingly favored by both companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to generate, modify, and electronically sign your documents swiftly and without complications. Handle Instructions For Form NYC 1 New York City on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to adjust and electronically sign Instructions For Form NYC 1 New York City with ease

- Obtain Instructions For Form NYC 1 New York City and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Mark important sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature with the Sign tool, a process that takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method of sending the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Instructions For Form NYC 1 New York City to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form nyc 1 new york city

Create this form in 5 minutes!

How to create an eSignature for the instructions for form nyc 1 new york city

How to generate an e-signature for a PDF file in the online mode

How to generate an e-signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to make an e-signature from your smartphone

The best way to create an e-signature for a PDF file on iOS devices

The way to make an e-signature for a PDF file on Android

People also ask

-

What is the betax dof service fee?

The betax dof service fee is a charge associated with processing documents through our platform. This fee ensures that all eSigning and document handling is secure and efficient. By incorporating the betax dof service fee, airSlate SignNow provides a comprehensive service that enhances your business workflow.

-

How does the betax dof service fee fit into the pricing plans?

The betax dof service fee is included in our competitive pricing plans, designed to offer maximum value for your investment. Depending on the plan you choose, this fee varies but always reflects the high-quality service you receive. Our pricing transparency ensures you know exactly what you're paying for.

-

Are there any benefits to using airSlate SignNow despite the betax dof service fee?

Yes, the betax dof service fee is a small price to pay for the extensive features and benefits provided by airSlate SignNow. Users enjoy seamless document management, secure eSignatures, and robust integrations with various applications. This fee facilitates a service that ultimately saves time and enhances productivity.

-

Does the betax dof service fee apply to all document types?

Yes, the betax dof service fee applies to all document types processed through airSlate SignNow. Whether you're dealing with contracts, agreements, or other important documents, this fee supports our commitment to secure and fast eSigning. Every document is treated with the highest level of service.

-

Can I avoid the betax dof service fee with a certain subscription?

Unfortunately, the betax dof service fee is mandatory for all our subscriptions as it ensures every transaction is handled efficiently. However, our pricing plans offer different tiers, allowing you to choose an option that aligns with your business needs. The investment contributes to a reliable and user-friendly service.

-

What features are included that justify the betax dof service fee?

The betax dof service fee provides access to a suite of features including customizable templates, real-time tracking of documents, and advanced security protocols. These tools not only improve your efficiency but also ensure that your documents are legally binding and tamper-proof. The fee supports continuous updates and customer support.

-

Is the betax dof service fee charged per document or per transaction?

The betax dof service fee is typically charged per transaction, which consolidates multiple document processing into one fee. This approach helps simplify billing while ensuring that you pay only for what you use. It's designed for businesses of all sizes looking to optimize their document management costs.

Get more for Instructions For Form NYC 1 New York City

- Partial release of property from mortgage for corporation arkansas form

- Partial release of property from mortgage by individual holder arkansas form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy arkansas form

- Warranty deed for parents to child with reservation of life estate arkansas form

- Warranty deed for separate or joint property to joint tenancy arkansas form

- Warranty deed to separate property of one spouse to both as joint tenants or as community property with right of survivorship 497296774 form

- Ar deed fiduciary form

- Warranty deed from limited partnership or llc is the grantor or grantee arkansas form

Find out other Instructions For Form NYC 1 New York City

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement