February S 211 Wisconsin Sales and Use Tax Exemption Certificate Fillable 2021

Understanding the February S-211 Wisconsin Sales and Use Tax Exemption Certificate

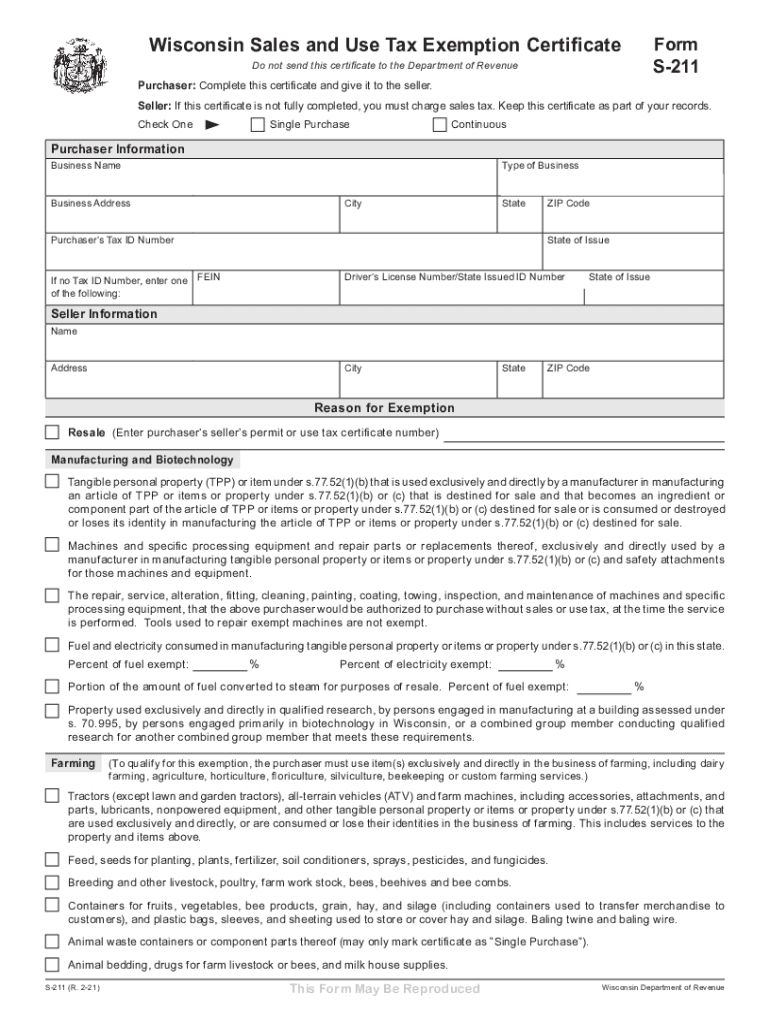

The February S-211 Wisconsin Sales and Use Tax Exemption Certificate is a crucial document that allows eligible buyers to make purchases exempt from sales tax. This certificate is specifically designed for businesses and individuals who qualify under certain conditions, such as reselling goods or using them in manufacturing. Understanding its purpose and requirements is essential for compliance with Wisconsin tax laws.

Steps to Complete the February S-211 Wisconsin Sales and Use Tax Exemption Certificate

Completing the February S-211 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business name, address, and tax identification number. Next, indicate the reason for the exemption, which may include resale or manufacturing purposes. Carefully fill out each section of the form, ensuring that all details are correct. Finally, sign and date the certificate to validate it. Keep a copy for your records, as it may be required for future reference.

Legal Use of the February S-211 Wisconsin Sales and Use Tax Exemption Certificate

The legal use of the February S-211 certificate is governed by Wisconsin state tax regulations. To be valid, the form must be completed accurately and used only for qualifying purchases. Misuse of the exemption certificate can result in penalties, including back taxes and fines. It is important to understand the legal ramifications and ensure that the certificate is used in accordance with state laws to avoid any compliance issues.

Eligibility Criteria for the February S-211 Wisconsin Sales and Use Tax Exemption Certificate

Eligibility for the February S-211 certificate is primarily based on the buyer's intended use of the purchased goods. Businesses that plan to resell items or use them in manufacturing processes typically qualify for the exemption. Additionally, certain nonprofit organizations may also be eligible. It is essential to review the specific criteria outlined by the Wisconsin Department of Revenue to confirm eligibility before applying for the exemption.

Obtaining the February S-211 Wisconsin Sales and Use Tax Exemption Certificate

To obtain the February S-211 Wisconsin Sales and Use Tax Exemption Certificate, individuals and businesses can download the form directly from the Wisconsin Department of Revenue website. The form is available in a fillable format, making it easy to complete electronically. After filling out the necessary information, the certificate can be printed and signed. Ensure that you have the most current version of the form to comply with any updates in tax regulations.

Examples of Using the February S-211 Wisconsin Sales and Use Tax Exemption Certificate

There are various scenarios in which the February S-211 certificate can be utilized. For instance, a retailer purchasing inventory for resale can present this certificate to suppliers to avoid paying sales tax. Similarly, a manufacturer acquiring raw materials intended for production may also use the exemption certificate. Understanding these examples helps clarify the practical applications of the form and reinforces its importance in business operations.

Quick guide on how to complete february 2021 s 211 wisconsin sales and use tax exemption certificate fillable

Complete February S 211 Wisconsin Sales And Use Tax Exemption Certificate fillable effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage February S 211 Wisconsin Sales And Use Tax Exemption Certificate fillable on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign February S 211 Wisconsin Sales And Use Tax Exemption Certificate fillable with ease

- Obtain February S 211 Wisconsin Sales And Use Tax Exemption Certificate fillable and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to share your form: via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign February S 211 Wisconsin Sales And Use Tax Exemption Certificate fillable to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct february 2021 s 211 wisconsin sales and use tax exemption certificate fillable

Create this form in 5 minutes!

How to create an eSignature for the february 2021 s 211 wisconsin sales and use tax exemption certificate fillable

The best way to create an e-signature for a PDF online

The best way to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

The way to generate an e-signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

How can airSlate SignNow help improve my business's revenue wi?

airSlate SignNow streamlines the document signing process, allowing your business to close deals faster and enhance customer satisfaction. By reducing the time spent on paperwork, you can focus on more strategic activities that directly contribute to increasing your revenue wi.

-

What pricing plans does airSlate SignNow offer to support my revenue wi?

airSlate SignNow provides flexible pricing plans to accommodate businesses of all sizes. Whether you're a small startup or a large corporation, there’s a plan that fits your needs, ensuring that investing in your document management system will positively impact your revenue wi.

-

What features does airSlate SignNow have that can boost my revenue wi?

Key features of airSlate SignNow include customizable templates, real-time tracking, and secure eSignature capabilities. These tools enhance efficiency and productivity, ultimately supporting your goal to increase revenue wi by streamlining operations and improving customer interactions.

-

Are there integrations with other tools that can help elevate my revenue wi?

Yes, airSlate SignNow seamlessly integrates with popular platforms such as Salesforce, Google Drive, and Zapier. This interoperability allows you to synchronize your workflow across applications, thereby optimizing processes that will help in increasing your revenue wi.

-

How does airSlate SignNow ensure document security while increasing revenue wi?

airSlate SignNow implements advanced encryption and secure storage solutions to safeguard your documents. By ensuring that your sensitive data is protected, the platform helps maintain client trust and fosters better long-term relationships that can enhance your revenue wi.

-

Can airSlate SignNow accommodate businesses in various industries to boost revenue wi?

Absolutely! airSlate SignNow is versatile and can cater to multiple industries, including finance, healthcare, and real estate. This adaptability allows businesses from various sectors to utilize the platform to enhance their operations and drive their revenue wi.

-

What is the onboarding process like for airSlate SignNow, and how does it affect revenue wi?

The onboarding process for airSlate SignNow is user-friendly and typically takes only a few minutes. A quick implementation means that your team can start benefiting from improved workflows immediately, which in turn can lead to a quicker boost in your revenue wi.

Get more for February S 211 Wisconsin Sales And Use Tax Exemption Certificate fillable

- Injury workers compensation form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration arizona form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497297143 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement arizona form

- Letter tenant change form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants arizona form

- Utility notice form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat arizona form

Find out other February S 211 Wisconsin Sales And Use Tax Exemption Certificate fillable

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement