Sales and Use Tax ExemptionsWashington Department of Revenue 2022-2026

Understanding the Wisconsin Sales and Use Tax Exemption

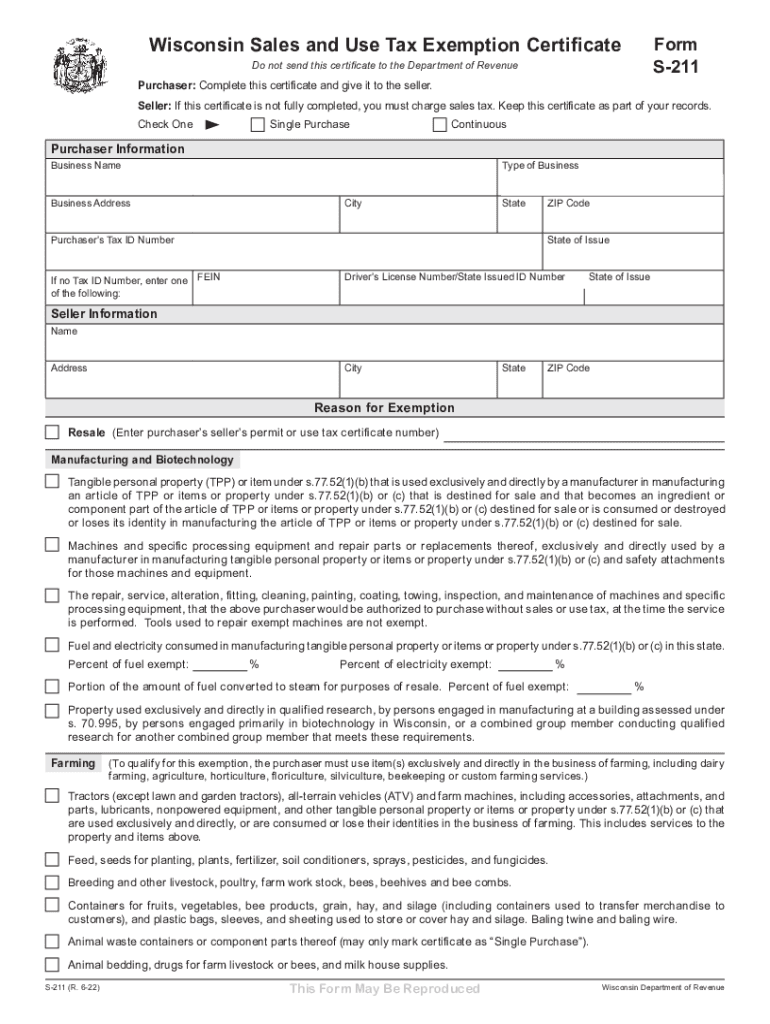

The Wisconsin form S 211 is a vital document for businesses seeking sales and use tax exemptions. This form allows eligible purchasers to claim exemptions on specific purchases, ensuring compliance with state tax regulations. The exemptions can apply to various categories, including manufacturing equipment, certain services, and more. Understanding the nuances of this form is essential for any business operating in Wisconsin.

Steps to Complete the Wisconsin Form S 211

Completing the S 211 form requires careful attention to detail. Here are the steps to ensure accurate submission:

- Gather necessary information, including your business name, address, and tax identification number.

- Identify the specific purchases for which you are claiming an exemption.

- Fill out the form completely, ensuring all required fields are addressed.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the vendor or seller from whom you are purchasing the exempt items.

Eligibility Criteria for Using Form S 211

To qualify for the sales and use tax exemption in Wisconsin, certain criteria must be met. Generally, the purchaser must be a registered business entity in Wisconsin. Additionally, the items purchased must fall under the categories eligible for exemption, such as manufacturing equipment or items for resale. It is crucial to review the specific guidelines provided by the Wisconsin Department of Revenue to ensure compliance.

Legal Use of the Wisconsin Form S 211

The legal use of the S 211 form is governed by Wisconsin tax laws. Businesses must ensure that they are using the form correctly to avoid penalties. Misuse of the exemption can lead to liability for unpaid taxes, interest, and penalties. Therefore, it is essential to maintain accurate records and only claim exemptions for eligible purchases.

Required Documents for Filing Form S 211

When filing the Wisconsin form S 211, certain documents may be required to support your exemption claim. These may include:

- Proof of business registration in Wisconsin.

- Documentation of the specific items being purchased.

- Any relevant tax identification numbers.

Having these documents ready can facilitate a smoother filing process and help substantiate your claims if needed.

Penalties for Non-Compliance with Form S 211

Failure to comply with the requirements associated with the Wisconsin form S 211 can result in significant penalties. Businesses may face back taxes, interest on unpaid amounts, and additional fines. It is essential to understand the implications of non-compliance and to ensure that all claims for exemptions are valid and well-documented.

Quick guide on how to complete sales and use tax exemptionswashington department of revenue

Complete Sales And Use Tax ExemptionsWashington Department Of Revenue effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage Sales And Use Tax ExemptionsWashington Department Of Revenue on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to edit and electronically sign Sales And Use Tax ExemptionsWashington Department Of Revenue effortlessly

- Find Sales And Use Tax ExemptionsWashington Department Of Revenue and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Sales And Use Tax ExemptionsWashington Department Of Revenue to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sales and use tax exemptionswashington department of revenue

Create this form in 5 minutes!

People also ask

-

What is the form s 211, and why is it important?

The form s 211 is a crucial document used for various compliance and reporting needs in businesses. It ensures that organizations remain in line with regulatory requirements and maintain accurate records. Understanding the form s 211 is key to efficient document management and eSigning processes.

-

How can airSlate SignNow help with completing the form s 211?

airSlate SignNow offers an intuitive platform that simplifies the process of completing the form s 211. With customizable templates and eSignature capabilities, you can easily fill out, send, and securely sign the form s 211 from any device. This streamlines your workflow and ensures compliance.

-

What pricing options are available for airSlate SignNow when using form s 211?

AirSlate SignNow provides flexible pricing plans tailored to meet the needs of businesses using form s 211. Whether you're a startup or a larger enterprise, you can find a plan that fits your budget and requirements, ensuring cost-effective eSigning solutions for your documentation.

-

Are there any special features for managing the form s 211 with airSlate SignNow?

Yes, airSlate SignNow includes specialized features for managing the form s 211, such as customizable templates, automated workflows, and advanced security measures. These tools help ensure that your form s 211 is handled efficiently and securely, enhancing productivity across your organization.

-

Can I integrate airSlate SignNow with other applications for handling form s 211?

Absolutely! airSlate SignNow offers seamless integrations with popular business applications, allowing you to manage the form s 211 alongside other crucial tasks. This interoperable approach makes it easy to incorporate eSigning and document management into your existing workflow.

-

What are the benefits of using airSlate SignNow for form s 211?

Using airSlate SignNow for the form s 211 enhances efficiency and clarity in your documentation process. You save time with electronic signatures, reduce paperwork errors, and ensure compliance with industry standards. These benefits signNowly improve overall business operations.

-

Is airSlate SignNow user-friendly for submitting form s 211?

Yes, airSlate SignNow is designed with user experience in mind, making it extremely user-friendly for submitting the form s 211. The platform offers a straightforward interface that individuals and businesses can navigate easily, ensuring a smooth eSigning experience.

Get more for Sales And Use Tax ExemptionsWashington Department Of Revenue

- North dakota trust 497317446 form

- North dakota mineral deed form

- Nd form 497317448

- Warranty deed from two co trustees to an individual north dakota form

- Discovery interrogatories from plaintiff to defendant with production requests north dakota form

- Discovery interrogatories from defendant to plaintiff with production requests north dakota form

- Discovery interrogatories for divorce proceeding for either plaintiff or defendant north dakota form

- Mineral deed form 497317453

Find out other Sales And Use Tax ExemptionsWashington Department Of Revenue

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free